In the realm of financial markets, options trading beckons as an exciting and potentially lucrative strategy. Among the various types of options, call price options hold a special allure, offering immense opportunities to navigate market fluctuations and enhance your investment prowess. Join us on this insightful journey as we delve into the intricacies of call price option trading, empowering you with the knowledge and confidence to harness its full potential.

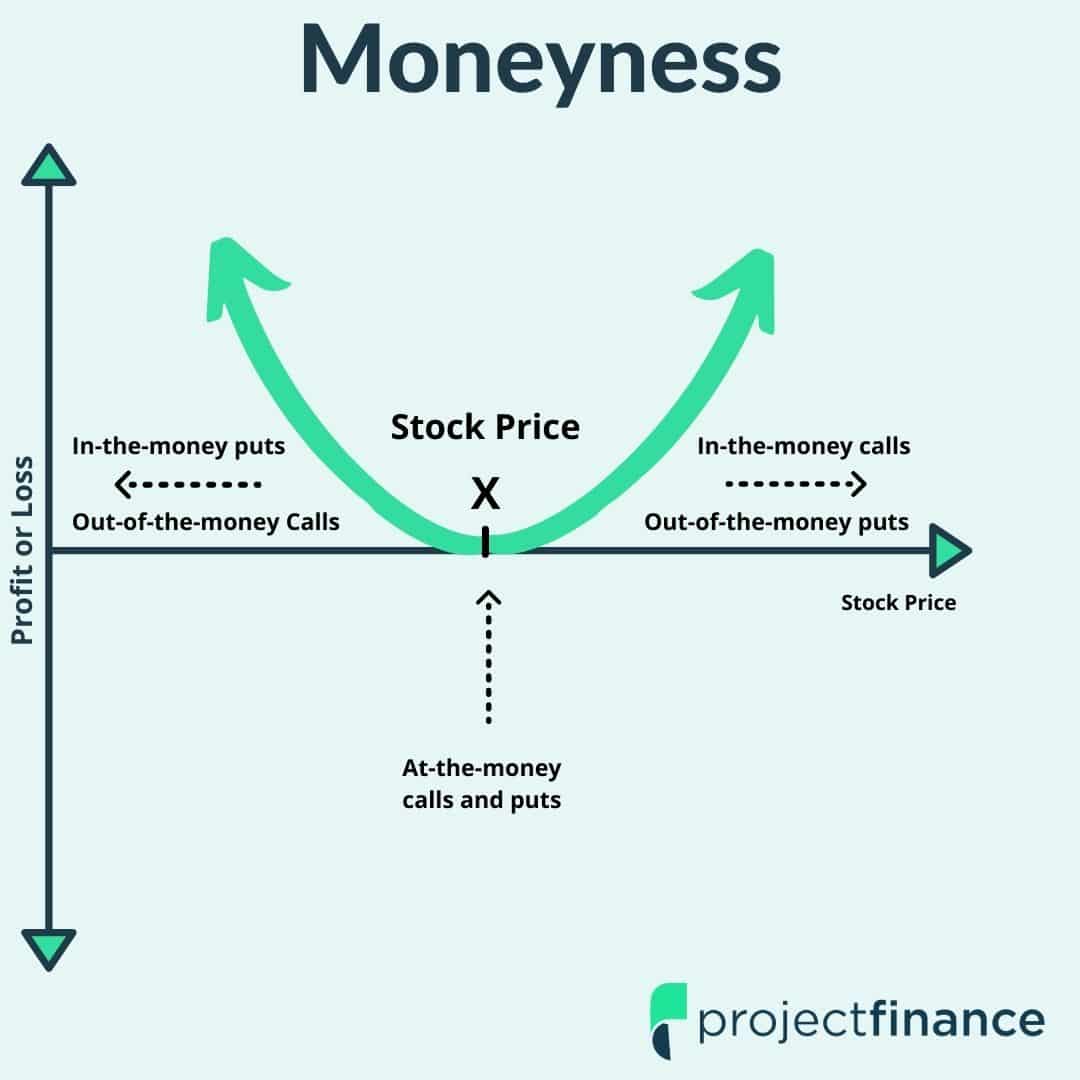

Image: www.projectfinance.com

What are Call Price Options?

A call price option grants you the right, but not the obligation, to buy an underlying asset at a predetermined price, known as the strike price, before or on a certain date, called the expiration date. Essentially, it’s like having a ticket that allows you to purchase the asset at a fixed rate in the future, regardless of market conditions.

By trading call options, you speculate that the price of the underlying asset, such as a stock or commodity, will rise above the strike price before expiration. If your prediction holds true, you can exercise the option and purchase the asset at the advantageous strike price, potentially generating significant profits.

Mechanics of Call Price Option Trading

Understanding the mechanics of call price option trading is crucial for success. Here’s a breakdown of key concepts:

-

Premium: The price you pay to acquire a call option. It represents the cost of the option contract.

-

Strike Price: The predetermined price at which you can buy the underlying asset.

-

Expiration Date: The date on which the option expires, rendering it invalid.

The price of a call option is influenced by factors such as the current price of the underlying asset, the strike price, time to expiration, volatility, and interest rates. Volatility, in particular, plays a significant role, as higher volatility implies a greater chance of price fluctuations, potentially increasing the value of the call option.

Benefits of Call Price Option Trading

Call price option trading offers numerous advantages:

-

Leverage: Options magnify your buying power, allowing you to potentially reap substantial returns with a relatively small investment.

-

Risk Management: By using call options, you limit your potential losses to the premium paid, providing a safety net against downside market movements.

-

Income Generation: Selling covered calls, where you hold the underlying asset, creates income through the premiums received.

-

Flexibility: Call options offer versatility in strategic investing, enabling you to tailor your trades based on market outlook and risk tolerance.

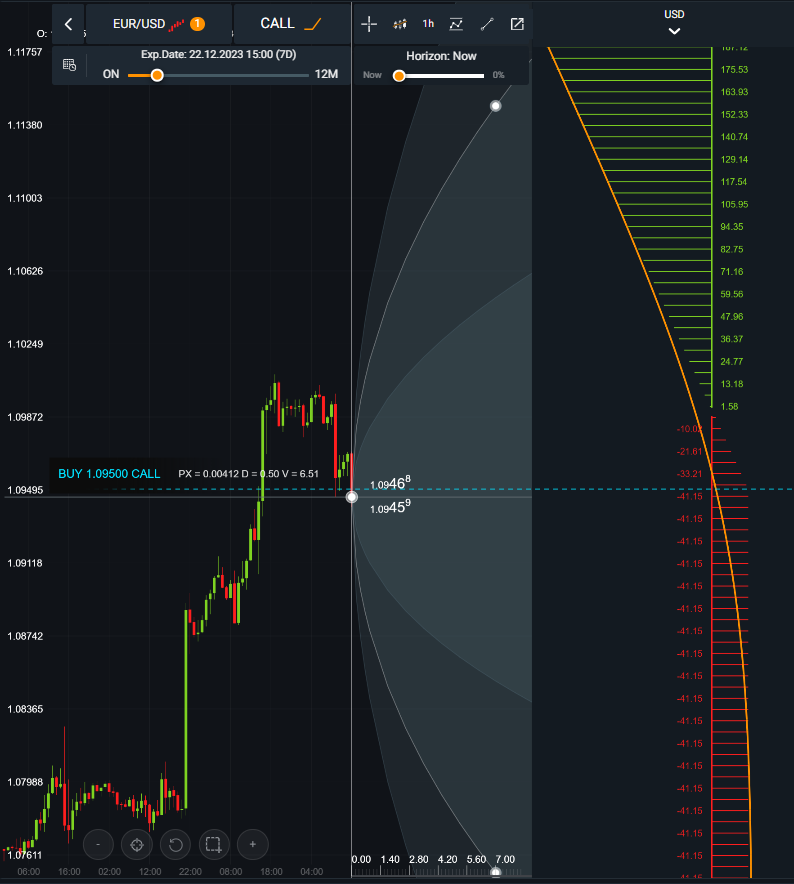

Image: tradersunion.com

Types of Call Price Option Trading Strategies

The beauty of call price option trading lies in the diverse range of strategies it offers, including:

-

Bull Call Spread: Buying a lower-strike call option and selling a higher-strike call option to benefit from modest price increases.

-

Covered Call: Selling a call option against shares of the underlying asset you own, aiming for income generation with limited risk.

-

Call Butterfly Spread: A neutral strategy involving buying one at-the-money call option and selling two out-of-the-money call options with higher and lower strike prices.

How to Get Started with Call Price Option Trading

Embarking on the journey of call price option trading requires these essential steps:

-

Educate Yourself: Thoroughly research the topic, understand the risks involved, and explore different trading strategies.

-

Open a Brokerage Account: Choose a reputable brokerage firm that offers options trading facilities.

-

Choose an Underlying Asset: Select an asset with ample liquidity and volatility, such as stocks, commodities, or indices.

-

Determine a Strategy: Based on your market outlook and risk tolerance, select an appropriate call price option trading strategy.

-

Execute the Trade: Place an order with your brokerage firm, specifying the option type, strike price, expiration date, and quantity.

-

Monitor and Adjust: Regularly track the performance of your option trades and make adjustments as needed based on changing market conditions.

What Is Call Price Option Trading

![[WIP] Enrollment – Options Trading Program | Beyond Insights](https://www.beyondinsights.net/wp-content/uploads/Call-vs-Put-Options.png)

Image: www.beyondinsights.net

Final Thoughts

Call price option trading opens doors to a wealth of opportunities for astute investors and traders. By embracing a strategic approach, harnessing the power of leverage, and implementing sound risk management practices, you can navigate market uncertainties and unlock the potential for financial success. Remember that knowledge is power, and ongoing education is key. Embrace the world of call price option trading with newfound confidence, and may your endeavors bear abundant rewards.