In the fast-paced and ever-evolving landscape of financial markets, success often hinges upon the ability to adapt and outmaneuver the competition. Dynamic trading strategies offer a powerful solution to navigate market uncertainties, empowering traders with the flexibility to respond swiftly to shifting market conditions. Let’s delve into the multifaceted world of dynamic trading strategy options, exploring their intricacies, advantages, and potential impact on your trading journey.

Image: www.slideserve.com

Dynamic Trading Strategies: A Primer

Dynamic trading strategies embrace a flexible approach to trading, constantly adjusting their parameters based on real-time market data. Unlike static strategies that adhere to predetermined rules, dynamic strategies adapt to evolving market dynamics, allowing traders to capture fleeting opportunities and mitigate risks more effectively. This adaptability stems from the use of algorithms and technical indicators that monitor market movements, analyzing trends and identifying trading signals.

Types of Dynamic Trading Strategies

The spectrum of dynamic trading strategies encompasses a wide range of methodologies, each tailored to specific market conditions and trader objectives. Some of the most widely recognized dynamic trading strategies include:

- Trend following: This strategy identifies and exploits prevailing market trends, capturing the momentum of upward or downward price movements.

- Range trading: This approach focuses on identifying trading ranges within which price action oscillates, seeking to buy low and sell high within the defined boundaries.

- Breakout trading: This strategy aims to capitalize on price breakouts from predefined support or resistance levels, anticipating a continuation of the trend in the breakout direction.

- Reversal trading: This approach seeks to identify and profit from reversals in market trends, entering trades when the market momentum shifts from bullish to bearish or vice versa.

Benefits of Dynamic Trading Strategies

The adoption of dynamic trading strategies offers traders a multitude of benefits, enhancing their trading prowess in several ways:

- Adaptability: Dynamic strategies provide traders with the agility to respond swiftly to changing market conditions, reducing the risk of missing out on profitable opportunities.

- Reduced risk: By continuously monitoring market movements, dynamic strategies can identify potential risks and adjust positions accordingly, minimizing the potential for significant losses.

- Enhanced decision-making: The use of algorithms and technical indicators in dynamic strategies provides traders with objective data and insights, reducing the reliance on emotions and gut feelings.

- Increased profitability: Dynamic trading strategies can lead to increased profitability by capitalizing on market inefficiencies and exploiting price movements more effectively.

Image: www.forexfactory.com

Challenges and Considerations

While dynamic trading strategies offer substantial advantages, it’s imperative to be aware of the potential challenges and considerations associated with their use:

- Complexity: Dynamic trading strategies can be complex to understand and implement, requiring technical expertise and a deep understanding of market dynamics.

- Emotional discipline: Traders employing dynamic strategies must possess strong emotional discipline to resist the temptation to deviate from the strategy’s parameters.

- Market volatility: Dynamic trading strategies can be adversely affected by periods of high market volatility, as rapid price movements may disrupt the strategy’s signals and lead to false positives.

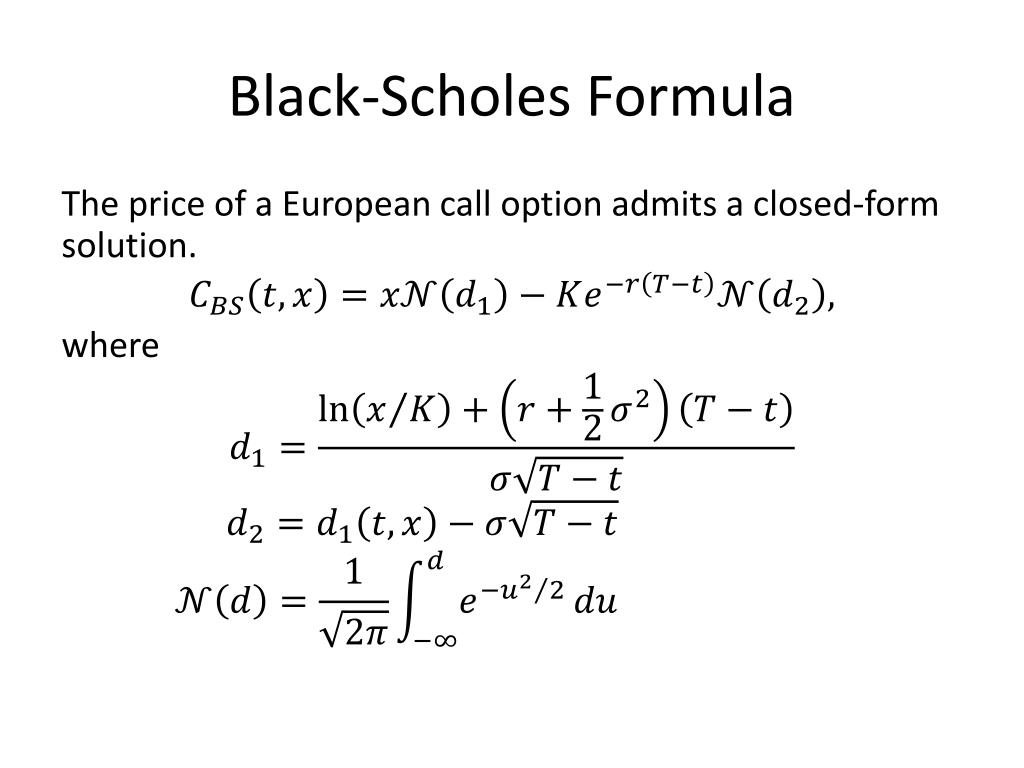

Dynamic Trading Strategy Option

Image: blog.coniectoinvestments.com

Conclusion

Dynamic trading strategy options empower traders with the flexibility and adaptability needed to navigate the ever-changing financial markets. Through their ability to adjust to market dynamics in real-time, dynamic strategies offer traders the potential to enhance their decision-making, reduce risk, and increase profitability. However, embracing dynamic trading strategies requires a thorough understanding of the concepts, strategies, and potential challenges involved. By judiciously applying dynamic trading strategies, traders can unlock market agility and position themselves for greater success in the competitive world of finance.