In the intricate world of options trading, dynamic profit targets are indispensable tools that empower traders to maximize returns while managing risk. Unlike their static counterparts, dynamic profit targets adjust automatically based on market conditions, adapting to the ebb and flow of asset prices. This article delves into the intricacies of dynamic profit targets, guiding you through their mechanics, advantages, and pitfalls.

Image: tradersoffer.net

Concept of Dynamic Profit Targets

A dynamic profit target is an order placed with the broker that triggers the sale of an option contract when the underlying asset reaches a preset gain threshold. Unlike static profit targets, which remain fixed regardless of market movements, dynamic profit targets track the underlying asset’s price, updating the target price based on a predetermined formula or algorithm. This ensures that traders lock in gains when the market is moving in their favor and prevents them from holding onto losing positions for too long.

Types of Dynamic Profit Targets

Various types of dynamic profit targets exist, each tailored to specific trading strategies.

Trailing Stop Profit Targets: These targets move with the underlying asset’s price, trailing behind by a preset percentage or dollar amount. As the asset gains value, the profit target increases, ensuring that traders capture potential profits.

Parabolic Stop and Reverse Profit Targets: These targets follow a parabolic curve, allowing traders to lock in gains while minimizing drawdowns. When the asset’s price moves parabolically, the profit target accelerates to maximize returns.

Adaptive Profit Targets: These targets use artificial intelligence or machine learning algorithms to adjust based on market volatility and historical data. They dynamically adjust the profit target to optimize returns while mitigating risk.

Advantages of Dynamic Profit Targets

Dynamic profit targets offer numerous advantages for options traders:

Increased Profits: By adjusting the profit target as the asset price moves, traders can capture greater profits than with static targets.

Risk Management: Dynamic profit targets protect traders from unpredictable market movements by selling the option contract automatically when it reaches a certain threshold.

Time Savings: Traders can automate the process of adjusting profit targets, freeing up their time for other tasks.

Improved Trading Psychology: Dynamic profit targets remove the emotional element from trading by automatically locking in gains and exiting losing positions.

Image: 4xdev.com

Pitfalls of Dynamic Profit Targets

Despite their advantages, dynamic profit targets also have potential pitfalls:

False Exits: Market volatility can lead to the profit target being hit prematurely, resulting in missed profit opportunities.

Missed Profits: If the asset’s price continues to rise after the profit target is hit, traders may miss out on additional gains.

Complex Strategies: Some dynamic profit target strategies can be complex and require substantial technical analysis.

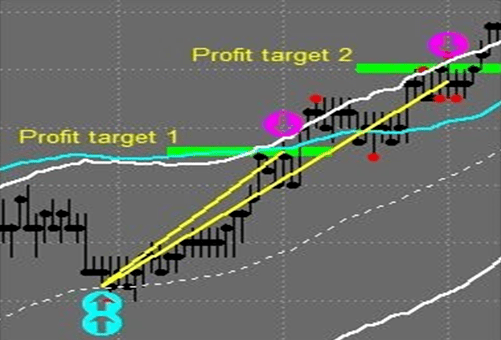

Options Trading Dynamic Profit Targets

Image: www.dolphintrader.com

Conclusion

Dynamic profit targets are powerful tools for options traders seeking to maximize returns while managing risk. By using a variety of dynamic profit target strategies, traders can optimize their trades based on individual trading preferences and market conditions. However, it’s crucial to consider the potential pitfalls associated with these strategies and to approach trading with a well-informed and disciplined mindset.