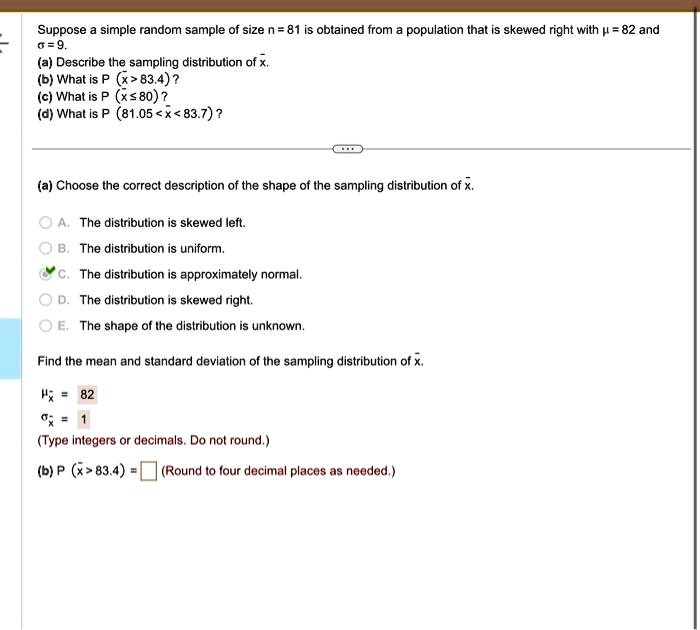

Trading options contracts involves a vast sea of terminology, enough to intimidate even seasoned investors. Among these terms, “placed” and “queued” stand out as particularly crucial, yet often misunderstood. In this comprehensive guide, we will embark on a detailed exploration of these two key concepts, deciphering their intricacies and significance within the realm of options trading.

Image: www.numerade.com

Image: www.numerade.comDefining “Placed” vs. “Queued”

An options order goes through several stages from its inception to execution, each accompanied by its unique lingo. When you submit an order, it is initially considered “entered” or “active.” Once it is received and acknowledged by the exchange, it is designated as “placed.” At this juncture, the order has been successfully transmitted to the trading system, but it has not yet been matched with a counterparty.

The next step in the process is “queuing,” which occurs when your placed order is added to a queue of similar orders. This queue is composed of all active orders at a specific price and time, waiting to be executed. Orders in the queue are matched on a first-in, first-out (FIFO) basis, prioritizing the orders that were placed first. Once your queued order is matched with an opposite order (i.e., a buyer for your sell order or a seller for your buy order), it will be executed.

Navigating Market Volatility and Order Types

The time spent in the queue can vary significantly based on market conditions. In fast-moving markets with high volatility, orders can be executed near-instantaneously. However, during periods of lower volatility or when the market is inactive, it may take a considerably longer time for orders to execute.

Another critical factor influencing order execution times is the type of order placed. Market orders are designed to execute immediately, taking the best available price at the time of placement. Limit orders, on the other hand, specify a particular price and only execute when the market meets or exceeds that price, providing greater price control. Limit orders tend to result in longer execution times, especially in volatile markets, as they are only executed once the designated price threshold is achieved.

Market Depth and Liquidity

Market depth, or the number of outstanding orders at different prices, also plays a vital role in order execution. Liquidity refers to the ease with which orders can be placed and executed without substantially affecting the price. Deep markets with high liquidity typically have more robust order queues and faster execution times, making them more efficient and desirable for trading.

However, in less liquid markets, order queues can be longer and execution times more prolonged. In these scenarios, placing limit orders and exercising patience may be prudent to avoid suboptimal executions, which can erode profits or increase losses.

Image: slideplayer.com

Utilizing Options Trading Tools

To navigate the labyrinth of options trading efficiently, utilizing tools that provide real-time market data and sophisticated order management functionalities is highly recommended. These tools offer valuable insights into order queues, market depth, and liquidity levels, enabling traders to make informed decisions and position themselves strategically.

For instance, options traders might use the “Open Book” to monitor the queue of active orders at various price levels, providing a clear picture of the underlying liquidity and potential execution times. Depth of Market (DOM) charts further enhance this perspective by visually representing the number of orders at each price point, facilitating optimal order placement and risk management.

Additional Tips for Effective Trading

Beyond the technicalities of order flow, there are several additional practices that can significantly enhance the effectiveness of your options trading strategies:

-

Conduct thorough market analysis before placing orders, considering technical indicators, fundamental factors, and market trends.

-

Understand the intricacies of different options contracts, including strike prices, expiration dates, and premium pricing.

-

Exercise discipline and control when placing orders, avoiding emotional decision-making and impulsive trades.

-

Be mindful of bid-ask spreads, commissions, and other costs associated with options trading, optimizing execution times to mitigate their impact.

Dwhat Does Placed And Qued Mean Options Trading

Image: wavebox.io

Conclusion

Successfully navigating the options trading arena necessitates a comprehensive grasp of its terminology and concepts, with “placed” and “queued” serving as essential cornerstones. By leveraging the insights provided in this guide, understanding market volatility, order types, liquidity, and utilizing the appropriate tools, traders can enhance their prospects in this dynamic and complex market. Remember, consistent learning and adaptation are key ingredients for long-term success in options trading, empowering you to make informed decisions, optimize order execution, and ultimately maximize your potential profits.