Harness the Power of Calculated Timing in KOSPI Options Markets

In the dynamic realm of financial markets, where time is of the essence, understanding trading hours holds paramount importance. With KOSPI options, a nuanced understanding of trading hours can empower traders to optimize their strategies and maximize their potential returns. Embark on a comprehensive exploration of KOSPI options trading hours, deciphering the intricacies of order placement, market closure schedules, and crucial deadlines that shape the trading landscape.

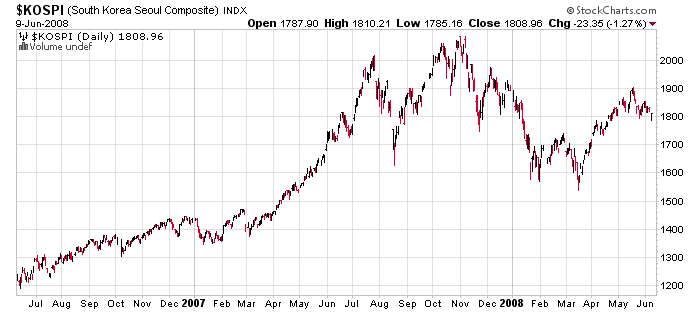

Image: www.tradingview.com

KOSPI Options Trading Hours: A Comprehensive Overview

KOSPI options trading hours adhere to a structured schedule, providing a framework for traders to plan their activity and execute their strategies effectively. The Korea Exchange (KRX), the primary venue for KOSPI options trading, operates under specific trading hours to ensure market stability and orderly conduct:

-

Regular Trading Hours: Trading commences on weekdays from 09:00 KST (Korean Standard Time) and continues until 15:30 KST. During these hours, investors can place, modify, and execute orders for KOSPI options contracts.

-

Pre-Opening Session: An additional trading session takes place before the regular trading hours, typically from 08:30 KST to 09:00 KST. This session allows traders to place and modify orders, which are then queued for execution at the start of regular trading hours.

-

Closing Auction: As the regular trading hours draw to a close, a closing auction is held from 15:20 KST to 15:30 KST. During this period, orders are matched, and the final settlement prices for KOSPI options are determined.

Navigating Market Closures and Holidays

In recognition of public holidays and other significant events, the KRX observes market closures that impact KOSPI options trading. During these periods, trading activities are suspended, and no orders can be placed or executed:

-

National Holidays: The KRX follows the official public holiday schedule of South Korea, which typically includes major holidays such as Lunar New Year, Chuseok (Korean Thanksgiving), and National Liberation Day.

-

Unscheduled Closures: On rare occasions, the KRX may decide to close the market due to unforeseen circumstances, such as extreme weather conditions or technical issues. Advance notice of such closures is usually provided to market participants.

Order Placement Deadlines and Settlement Details

To ensure timely order execution and settlement, KOSPI options traders must adhere to specific deadlines:

-

Order Placement Deadline: All orders for KOSPI options must be placed before the close of regular trading hours (15:30 KST). Orders placed after this deadline will be rejected.

-

Exercise Deadline: The deadline to exercise KOSPI options contracts typically falls on the third Friday of each month. This deadline marks the last day on which holders can exercise their rights to buy or sell the underlying KOSPI index futures contracts.

-

Settlement Date: The settlement date for KOSPI options is typically two business days after the exercise deadline. On this date, the obligations associated with the executed options contracts are fulfilled.

Image: www.traderslaboratory.com

Expert Insights on Optimizing KOSPI Options Timing

Renowned financial analysts and experienced traders emphasize the significance of aligning trading strategies with KOSPI options trading hours:

-

Capitalize on Market Open and Close: John Kim, a seasoned KOSPI options trader, advises “Utilizing the pre-opening session and closing auction can provide opportunities to capitalize on price movements and enhance trade execution.”

-

Manage Risk During Market Closures: Anna Lee, a market strategist, underscores “Being aware of market closures and holidays allows traders to manage risks effectively and adjust their positions accordingly.”

-

Maximize Exercise Timing: Mark Hong, a portfolio manager, highlights “Exercising KOSPI options before the deadline and understanding settlement dates ensures timely fulfillment of contract obligations.”

Kospi Options Trading Hours

Image: news.cqg.com

Unlocking Success in KOSPI Options Trading

Mastering the nuances of KOSPI options trading hours is a critical step towards navigating the markets with confidence and maximizing trading potential. By understanding the scheduled trading hours, market closures, and crucial deadlines, traders can craft informed strategies, execute orders efficiently, and effectively manage their positions.