Options trading, a dynamic arena in finance, has garnered immense attention as investors seek alternative paths to increase their capital. While the potential for substantial gains exists, many wonder about the intricate relationship between options trading and cash. This article delves into the complexities of this subject, exploring the impact of options trading on cash resources.

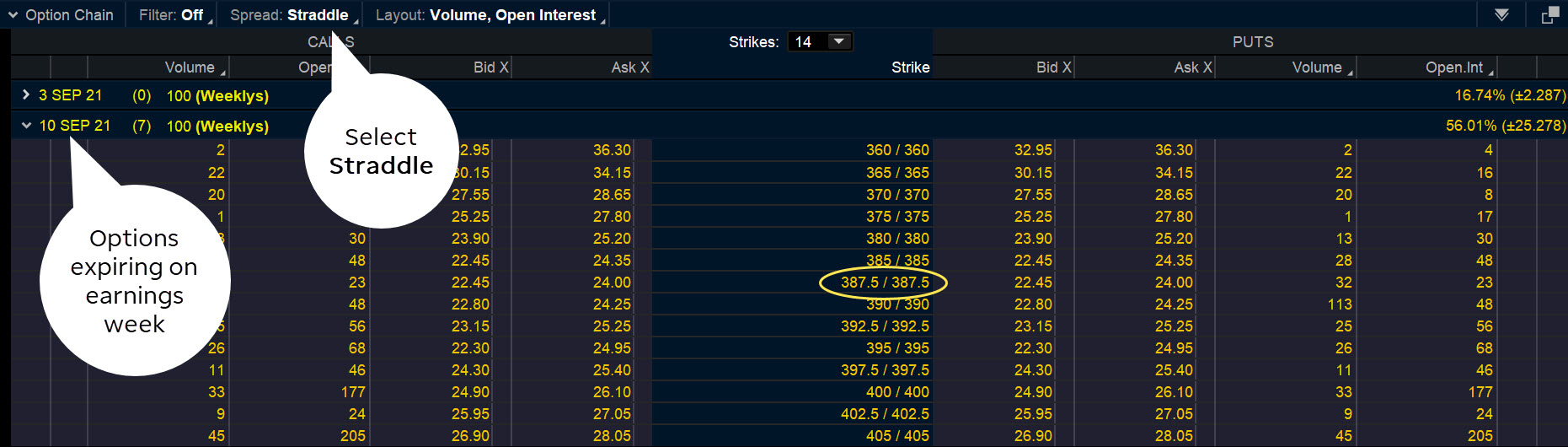

Image: tickertape.tdameritrade.com

Defining Options Trading: A Gateway to Financial Opportunities

Options trading entails the buying and selling of options contracts, which confer the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) by a specified date (expiration date). Options represent a powerful tool for investors to navigate market volatility, hedge risks, or speculate on future price movements.

Unveiling the Impact of Options Trading on Cash Flow

The impact of options trading on cash resources depends on several factors, including the strategy employed, the options contract type, and the market conditions. Options trading typically involves an initial outlay of cash for the purchase of an options contract. This premium represents a non-refundable amount paid to the seller of the option.

When an option is exercised, resulting in the purchase or sale of the underlying asset, the exercise price and any additional transaction costs will be deducted from the trader’s cash resources. Conversely, if an option expires without being exercised, the trader will forfeit the premium paid, incurring a loss of cash.

Exploring Common Options Strategies and Their Cash Implications

Options trading encompasses a wide spectrum of strategies, each tailored to specific investment goals and risk tolerance. Understanding the cash requirements of different strategies is crucial.

-

Buying Call Options: Buying call options provides the right to purchase an underlying asset at a specified strike price. This strategy necessitates the payment of a premium upfront. If the underlying asset’s price rises above the strike price before the expiration date, the trader can potentially exercise the option for a profit. However, if the underlying asset’s price falls below the strike price, the premium will be lost, resulting in a cash outflow.

-

Selling Call Options: Selling call options grants the right to another trader to purchase an underlying asset at a specific strike price. This strategy generates an immediate premium but entails the obligation to sell the asset if the option is exercised. If the underlying asset’s price remains below the strike price, the seller retains the premium, boosting their cash resources. However, if the asset’s price rises above the strike price, the seller may be forced to sell at a loss, depleting their cash.

-

Buying Put Options: Buying put options secures the right to sell an underlying asset at a specific strike price. This strategy is often employed as a protective measure against potential declines in the asset’s value. The premium paid upfront represents the cost of this insurance. If the underlying asset’s price falls below the strike price before expiration, the trader can exercise the option to sell at a profit. If the asset’s price rises above the strike price, the premium will expire without being exercised, leading to a cash outflow.

-

Selling Put Options: Selling put options entails the obligation to purchase an underlying asset at a specified strike price if the option is exercised. This strategy generates an instant premium but involves the potential for unlimited losses if the asset’s price plummets. If the underlying asset’s price remains above the strike price, the seller retains the premium, bolstering their cash resources. However, if the asset’s price falls below the strike price, the seller may be forced to buy at a loss, adversely affecting their cash flow.

Image: traderevenuepro.com

Navigating Market Conditions: A Key Determinant of Cash Impact

Market conditions play a critical role in shaping the impact of options trading on cash resources. In bullish markets characterized by rising prices, call options tend to flourish, while put options may lose value. In bearish markets, where prices decline, put options gain prominence, while call options may suffer losses. Understanding market trends and adapting strategies accordingly can help investors optimize their cash flow through options trading.

Delving into Risk Management: A Path to Cash Preservation

Risk management is paramount in options trading to safeguard cash resources. Employing strategies such as hedging can help mitigate potential losses and protect capital. Hedging involves offsetting the risk of one position with an opposite position in a different market. By implementing sound risk management practices, traders can enhance their chances of preserving cash and mitigating drawdowns.

Does Options Trading Increase Cash

Image: www.binarytradingforbeginners.com

Conclusion: Empowering Investors with Informed Decisions

Options trading offers investors a robust tool to pursue financial gains and manage risks. Understanding the impact of options trading on cash resources is a crucial aspect of navigating this dynamic market. By carefully evaluating different strategies, scrutinizing market conditions, and implementing solid risk management techniques, investors can harness the potential of options trading while protecting their capital.