In the intricate tapestry of financial markets, options trading stands out as a versatile and sophisticated strategy. When the implied volatility (IV) – a measure of expected price fluctuations – is low, it presents a unique landscape for traders seeking both income and protection. This article delves into the world of options trading in low IV environments, exploring its intricacies and unveiling hidden opportunities for savvy investors.

Image: www.youtube.com

Understanding Implied Volatility: A Key to Success

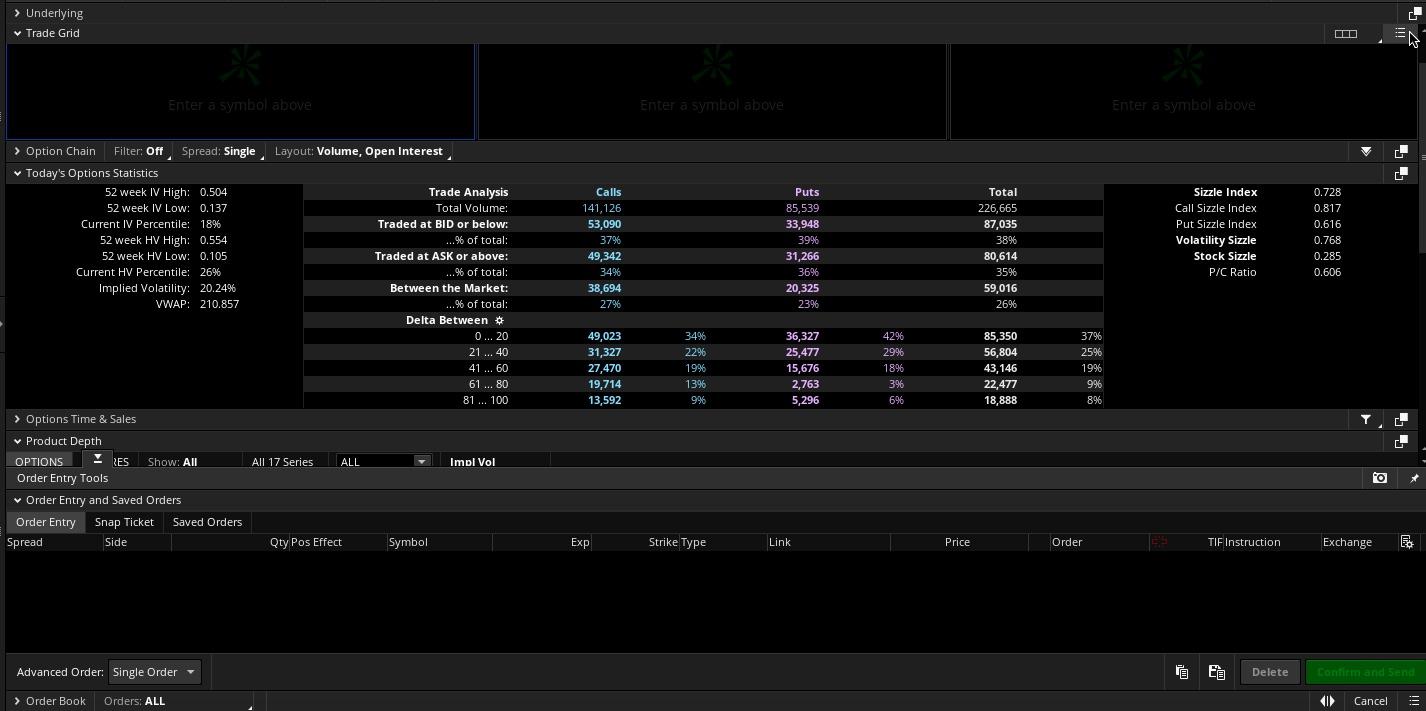

Implied volatility is a crucial concept for options traders. It reflects the market’s expectations of future price movements and influences the premium paid for an option contract. In low IV environments, the market anticipates relatively stable price movements, resulting in lower option premiums. This presents a compelling opportunity for investors to acquire options at more favorable prices.

Strategies for Profiting from Low IV: A Trader’s Guide

Navigating low IV environments requires strategic adaptability. Here are some effective approaches to consider:

-

Selling Options for Income:

When IV is low, selling options can generate a steady stream of income through premiums. By selling covered calls (selling a call option while owning the underlying asset), traders can earn a premium and benefit from potential price appreciation. Conversely, writing cash-secured puts (selling a put option while holding cash) provides downside protection while collecting a premium.

-

Image: tickertape.tdameritrade.comBuying Options for Upside Potential:

Low IV environments can also present opportunities for buying options. When the market underestimates future price volatility, buying calls (the right to buy an asset at a specific price) can offer significant upside potential. However, thorough analysis is crucial to identify undervalued options.

-

Spreading Strategies for Enhanced Returns:

Spread strategies, which involve buying and selling options at different strikes and expirations, can enhance returns while managing risk. For instance, a vertical bull spread involves buying a call option at a lower strike and simultaneously selling a call option at a higher strike with the same expiration. This strategy profits from a limited but desired price increase.

-

Monitoring Volatility: A Trader’s Vigilance

Vigilantly monitoring volatility is essential for successful options trading. Sudden spikes in IV can significantly affect option values, either positively or negatively. Traders should be prepared to adjust their positions or exit trades in response to changing volatility levels.

-

Patience and Discipline: Virtues of the Game

Options trading in low IV environments requires patience and discipline. It’s not always about quick gains but rather about strategizing for long-term, steady returns. By adhering to sound risk management principles and waiting for the right opportunities, traders can harness the potential of low IV markets.

Options Trading In Low Implied Volatility

Image: www.wikifx.com

Conclusion: Expanding Horizons in the World of Options

Options trading in low implied volatility environments offers a unique set of opportunities for income generation and potential growth. By understanding the concept of IV, employing strategic approaches, and maintaining vigilant monitoring, traders can unlock hidden value in the financial markets. Whether seeking steady income streams, seeking protection against market downturns, or pursuing upside potential, low IV environments provide fertile ground for the astute trader.