If you’ve ventured into the world of options trading, understanding the impact of fees and commissions on your potential profits (or losses) is crucial. These charges, often overlooked, can significantly influence your trading outcomes and overall profitability.

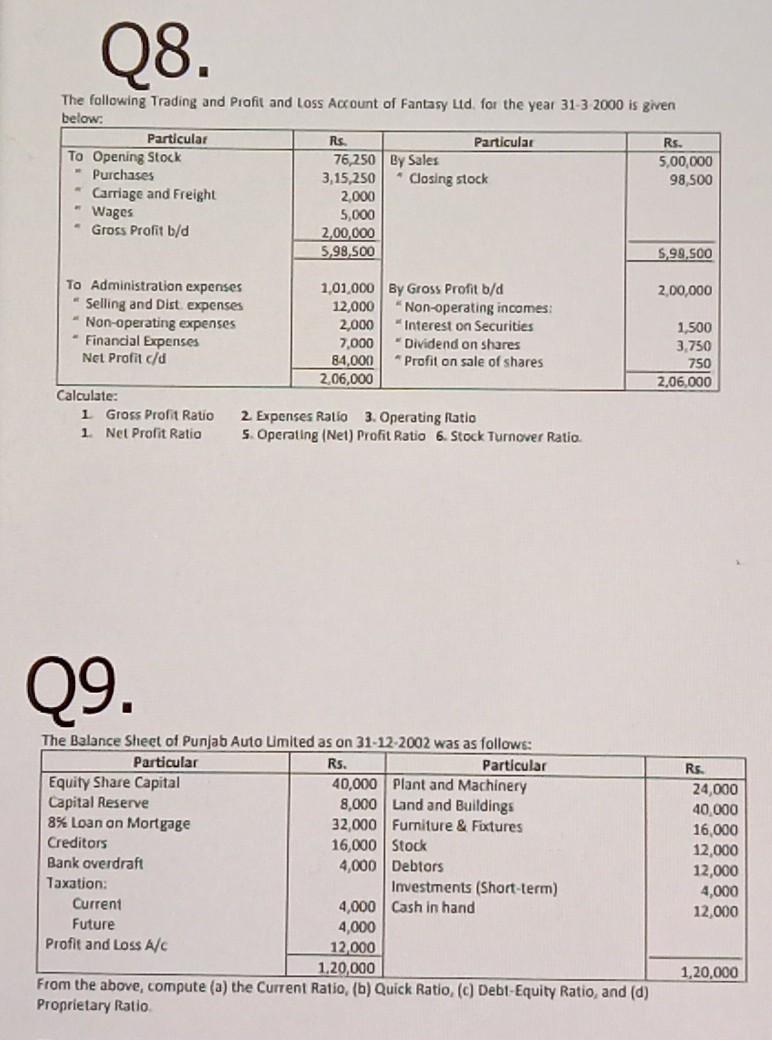

Image: www.chegg.com

In this comprehensive guide, we’ll delve into the intricacies of options trading fees and commissions, exploring how they affect your trading strategies, profit calculations, and overall performance.

Understanding Options Trading Fees

When you trade options contracts, you’ll likely encounter various fees:

- Option Premiums: The price you pay to purchase or sell an options contract, constituting the primary cost in options trading.

- Transaction Fees: Charged by your brokerage firm to facilitate the execution of your trades.

- Regulatory Fees: Imposed by regulatory bodies like the SEC to support market infrastructure and investor protection.

- Exchange Fees: Collected by the stock exchange where your options trades are executed.

These fees can vary among brokerage firms and exchanges, so it’s essential to research and compare their offerings before choosing a trading platform.

Impact on Your Losses

It’s important to note that fees and commissions are not considered part of your capital when determining profit or loss in options trading. These charges are deducted from your trading account before any financial gains or losses are calculated.

For example, let’s say you purchase an options contract with a premium of $200. Additionally, you incur transaction fees of $10. If the contract expires worthless, you would lose the entire $200 premium, plus the $10 transaction fee, resulting in a total loss of $210.

Implications for Profitability

The impact of fees and commissions on your profits can be substantial, especially for short-term or low-volume traders.

Consider a trader who makes a series of trades with small profit margins. Each trade generates a profit of $20, but the trader incurs $5 in transaction fees. Over time, these fees will accumulate, reducing the trader’s overall profitability.

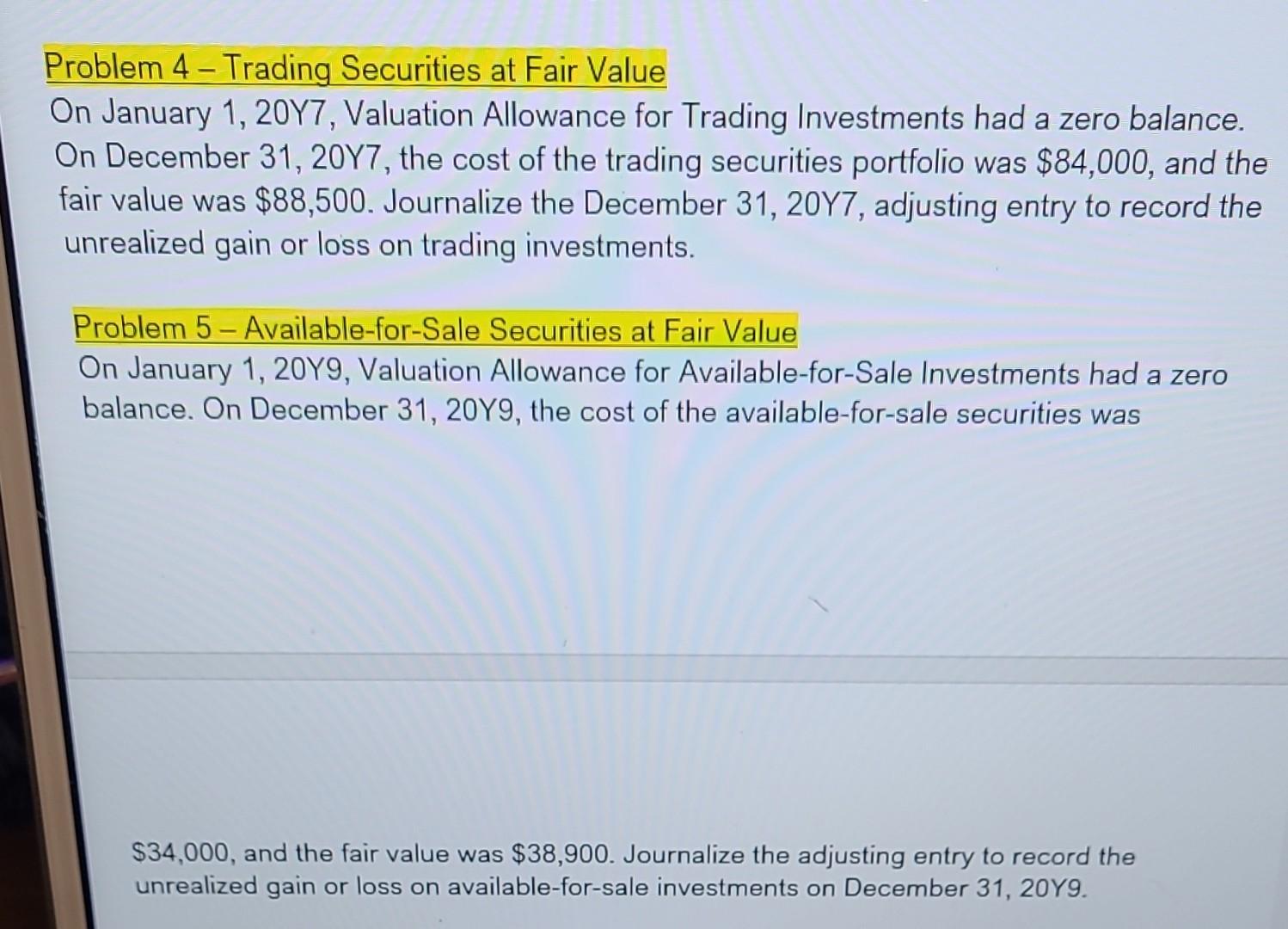

Image: www.chegg.com

Strategies to Minimize Fees

To mitigate the impact of fees and commissions, traders can employ several strategies:

- Negotiating Fees: Some brokerage firms may offer lower fees for high-volume traders or those who commit to trading a certain number of contracts per month.

- Trading During Market Openings/Closings: Transaction fees are often higher during market open and close due to increased trading activity and liquidity. Avoiding trading during these times can save you money.

- Consider Spread Trading: Spread trading involves simultaneously buying and selling options contracts with different strike prices or expiration dates. This strategy can sometimes reduce the overall fees associated with options trading.

Do Fees And Commissions Count In Loss In Options Trading

Image: academy.shrimpy.io

Conclusion

Fees and commissions are an integral part of options trading, and understanding their impact on your profits and losses is crucial for successful trading. By carefully considering the various fees involved and implementing strategies to minimize their effect, you can maximize your profitability and achieve your financial goals in options trading.