Introduction

In the realm of investing, options trading often carries an aura of complexity and uncertainty. However, what if I told you there was a scientific approach to options trading that could potentially enhance your chances of success? Science and trading may seem like an unlikely pair, but when combined, they offer a unique and systematic approach to navigating the market’s fluctuations.

Image: leadsemantics.com

By harnessing the principles of probability, statistical analysis, and mathematical modeling, you can transform options trading from a game of chance into a calculated endeavor. This scientific approach empowers you to make well-informed trading decisions, objectively assess risk, and develop strategies that align with your financial goals.

Understanding Scientific Options Trading

Scientific options trading involves the application of scientific principles to the trading of options contracts. Options are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock or commodity) at a predetermined price (the strike price) on or before a specific date (the expiration date).

The scientific approach to options trading focuses on analyzing historical data, market trends, and various statistical models to predict the potential movement of the underlying asset. By understanding the underlying factors that influence option prices, traders can make educated bets on whether the price will rise or fall, ultimately maximizing their chances of a profitable trade.

The Role of Advanced Mathematics

Advanced mathematics plays a pivotal role in scientific options trading. Through the use of complex mathematical models, traders can assess the probability of different market scenarios and calculate the expected value of each trade. These models take into account a wide range of variables, including the volatility of the underlying asset, time to expiration, strike price, and market sentiment.

By leveraging the power of advanced mathematics, traders can make quantitative judgments about the potential profitability of an options trade. This approach reduces the reliance on guesswork and intuition, offering a more objective and data-driven decision-making process.

Tips and Expert Advice

To enhance your success in scientific options trading, consider the following tips from experienced traders:

- Master the Basics: Before attempting scientific options trading, ensure you have a firm understanding of options contracts, trading mechanics, and market dynamics.

- Learn Statistical Modeling: Become proficient in statistical modeling techniques, such as regression analysis and Monte Carlo simulations, which are key tools for analyzing market data and predicting future trends.

- Understand Risk Management: Embrace a disciplined approach to risk management. Set clear trading limits, use stop-loss orders, and manage your position sizes wisely to minimize potential losses.

- Backtest Your Strategies: Before implementing any trading strategy in real-world markets, test it thoroughly using historical data to evaluate its performance and identify any weaknesses.

- Stay Informed: Keep up-to-date with market trends, economic news, and industry developments. Constant learning is crucial for staying ahead of the curve and making informed decisions.

Image: discoverytradinggroup.com

Frequently Asked Questions (FAQs)

Q: Is scientific options trading suitable for beginners?

A: While it requires some level of knowledge and experience, scientific options trading can be accessible to beginners willing to invest time in learning the necessary concepts and practicing with simulated trading.

Q: How do I get started with scientific options trading?

A: Start by acquiring a strong foundation in options trading. Familiarize yourself with statistical modeling techniques and practice using trading simulators to develop your skills.

Q: Can scientific options trading guarantee profits?

A: No trading strategy, including scientific options trading, can guarantee profits. However, it provides a systematic and data-driven approach that aims to enhance your decision-making and increase your chances of success.

Discover Scientific Options Trading

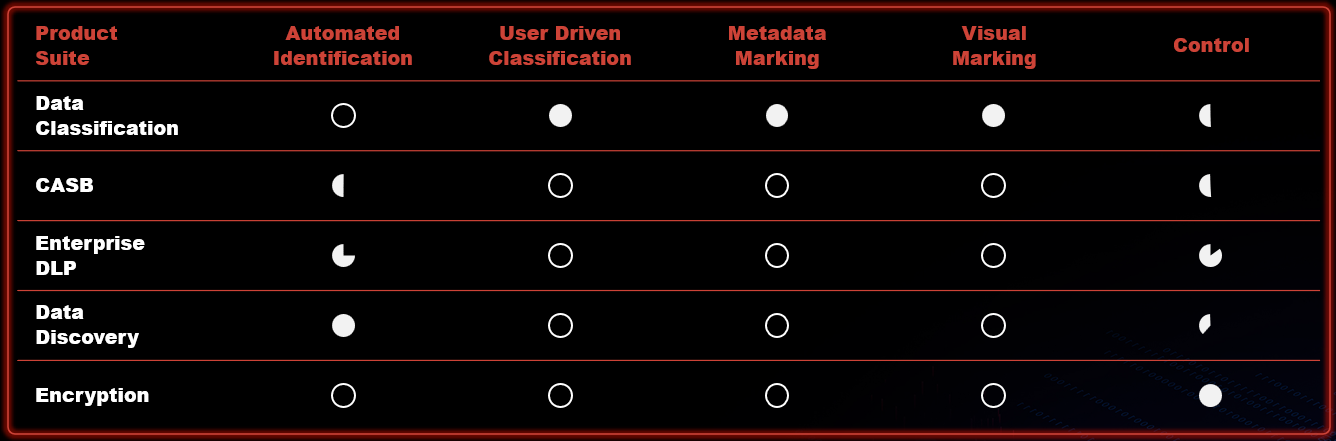

Image: www.dataclassification.com

Conclusion

Unlock the potential of scientific options trading to transform your investment approach. By embracing a data-driven and methodical process, you can overcome the randomness of the markets and increase your opportunities to make profitable trades. Remember, the scientific approach to options trading is not a magic bullet but a powerful tool that, when combined with knowledge, experience, and discipline, can empower you to navigate the complexities of investing.

Are you ready to unlock the scientific approach to options trading and embark on a data-driven investment journey?