Excessive trading in options accounts can jeopardize trading profits and jeopardize investor accounts. Given these significant risks, understanding strategies for identifying excessive trading is critical, and the synthetic valuation approach provides a reliable framework.

Image: www.chegg.com

Identifying Excessive Trading

Excessive trading, often termed “churning,” occurs when excessive transactions are generated in an investment account or options account, frequently without regard to the account owner’s objectives or risk tolerance. Identifying excessive trading can be challenging, but synthetic valuation techniques offer a valuable approach.

Synthetic valuation constructs a simulated portfolio that mirrors the investor’s actual trading activity, using pricing models to approximate the value of the portfolio. By comparing the returns from the synthetic portfolio with passive benchmarks or comparable investment strategies, it’s possible to isolate excessive trading’s impact.

Uncovering Excessive Trading

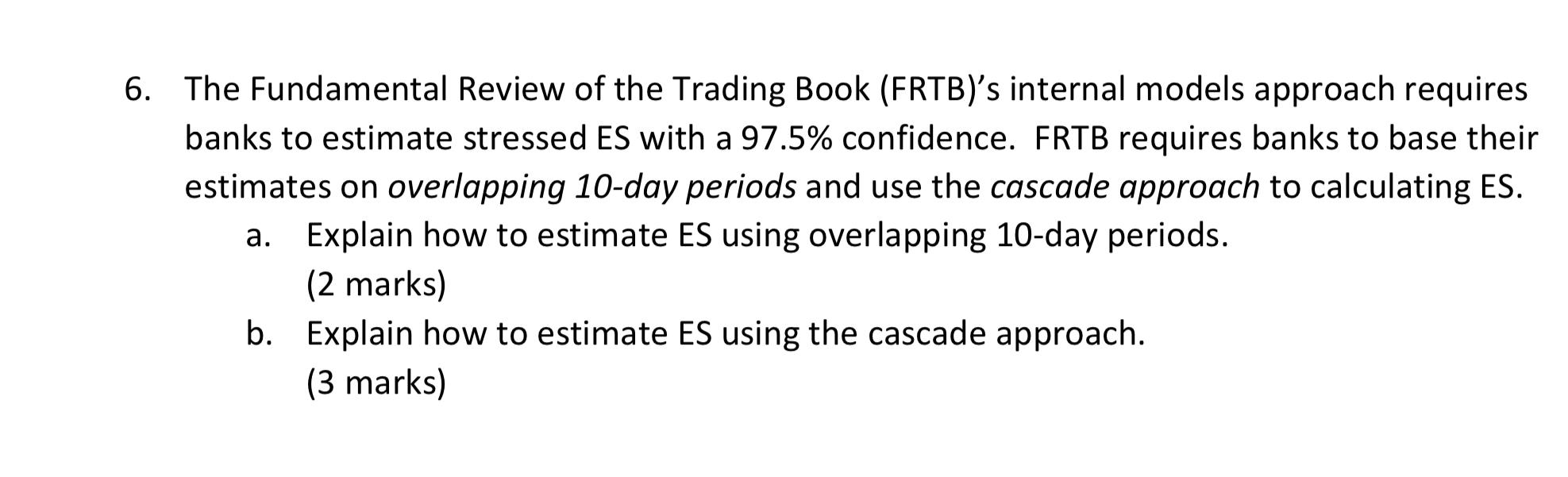

The synthetic valuation approach involves several steps to uncover excessive trading:

- Data Collection: Gather account data, including transaction histories, account statements, and market data.

- Portfolio Construction: Construct a synthetic portfolio that accurately reflects the account’s trading activity, taking into account transaction dates, option strategies, and portfolio composition.

- Pricing and Valuation: Use standard options pricing models (e.g., Black-Scholes) to estimate the value of the synthetic portfolio over the time period.

- Benchmarking: Compare the returns of the synthetic portfolio with a suitable benchmark or comparable investment strategy to identify any significant deviations.

- Analysis: Analyze the deviations to determine whether they stem from excessive trading or other factors (e.g., market conditions, investment strategy).

Tips for Curbing Excessive Trading

Curbing excessive trading requires discipline, vigilance, and sound investment strategies. Consider these expert tips:

- Establish Investment Goals: Clearly define investment objectives, risk tolerance, and time horizon before engaging in any options trading.

- Utilize Risk Management Tools: Implement stop-loss orders, limit orders, and position-sizing strategies to manage risk and prevent exorbitant losses.

- Seek Professional Advice: Consult with experienced financial advisors or investment professionals who can provide guidance and help navigate complex investment decisions.

- Beware of Emotional Trading: Avoid making trading decisions based on emotions or short-term market fluctuations. Instead, rely on analytical research and sound judgment.

Image: www.chegg.com

FAQs on Excessive Trading

Q: What constitutes excessive trading?

A: Excessive trading generally involves significant trading activity, often out of alignment with the investor’s investment objectives and risk tolerance.

Q: Why is excessive trading detrimental?

A: Excessive trading can erode trading profits, incur unnecessary expenses, and potentially jeopardize the investment account.

Q: How can synthetic valuation help identify excessive trading?

A: Synthetic valuation simulates the trading activity in an account, allowing comparison against benchmarks to reveal any significant deviations attributable to excessive trading.

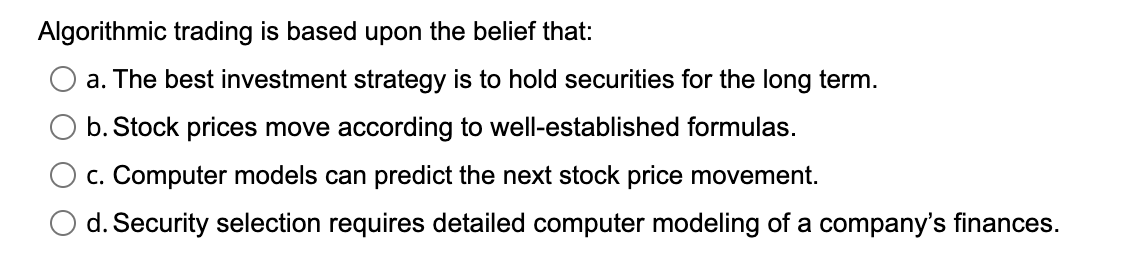

Determining Excessive Trading Options Accounts A Synthetic Valuation Approach

Image: www.chegg.com

Conclusion

Identifying and curbing excessive trading are paramount to safeguarding trading profits and maintaining financial stability. The synthetic valuation approach provides a robust framework for uncovering excessive trading, while expert tips and prudent financial practices offer invaluable guidance. By adhering to sound investment principles and seeking professional advice when necessary, investors can successfully navigate the complexities of options trading and strive towards their financial goals.

Are you concerned about excessive trading in your options account?