Option trading, a sophisticated investment strategy, poses unique risks that can lead to hefty losses. Stockholders who dabble in options without thorough preparation often end up filing complaints. Here’s a comprehensive guide to common pitfalls and tips to navigate the treacherous waters of option trading, helping you protect your hard-earned money.

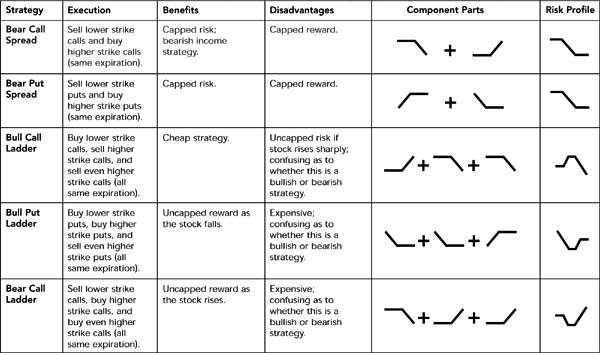

Image: www.oreilly.com

Understanding Option Trading Basics

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on a specific date (expiration date). They differ from stocks in that they don’t convey ownership of the underlying asset.

When purchasing an option, two key factors determine its value: time and volatility. Time decay erodes an option’s worth as it approaches expiration. Volatility, a measure of price fluctuations, influences the option’s premium (purchase price). Higher volatility means more expensive options.

Beware of the High-Risk Nature

Options are not for the faint of heart or novice investors. They are inherently risky due to several factors:

-

Time decay: Options lose value over time, even if the underlying asset remains stable.

-

Volatility: Fluctuations in the underlying asset’s price can significantly affect the value of options.

-

Leverage: Options provide leverage, allowing investors to control a larger position with less capital. This can amplify both gains and losses.

-

Complexity: Options trading involves complex strategies and calculations, which can be overwhelming for non-experts.

Pitfalls to Avoid

The most common complaints against options brokers revolve around these pitfalls:

-

Misrepresentation of Risk: Brokers may downplay the risks associated with options trading, leading investors to believe they are suitable for all levels of experience.

-

Excessive Trading Fees: Some brokers may charge excessive fees for option trades, eroding profits or even leading to losses.

-

Unsuitable Recommendations: Brokers may recommend options strategies that are not aligned with an investor’s experience, risk tolerance, or investment goals.

-

Lack of Transparency: Investors may not fully understand the complex pricing mechanisms and risks associated with options trading.

Image: mobodaily.com

Tips for Smart Option Trading

-

Educate Yourself: Delve into the intricacies of option trading through online courses, books, or seminars before venturing into the market.

-

Choose a Reputable Broker: Select a broker with a strong track record, clear fee structure, and educational resources for traders.

-

Start Small: Begin by trading small amounts of capital until you gain a firm grasp of the mechanics and risks involved.

-

Manage Risk: Employ risk management strategies such as stop-loss orders and position sizing to limit potential losses.

-

Analyze the Underlying Asset: Thoroughly research the underlying asset’s historical performance, industry trends, and economic factors that can influence its price.

-

Monitor Volatility: Keep a close eye on volatility, as it can significantly impact an option’s value. Consider implied volatility and historical volatility when making trading decisions.

-

Seek Professional Advice: If you’re unsure about a particular strategy or the suitability of an option, consult with a financial advisor or experienced trader.

-

File a Complaint: If you believe you’ve been misled or defrauded by an options broker, file a complaint with the appropriate regulatory authority, such as the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA).

Option Trading Tips In Complaints

Image: www.rapidtips.in

Conclusion

Option trading can be a lucrative venture, but it’s essential to approach it with caution and knowledge. By understanding the risks, avoiding common pitfalls, and following these tips, you can navigate the choppy waters of options and increase your chances of success. Remember, the key to success in options trading lies in education, risk management, and a clear understanding of the intricacies of this multifaceted investment strategy.