Introduction

Image: www.pinterest.com

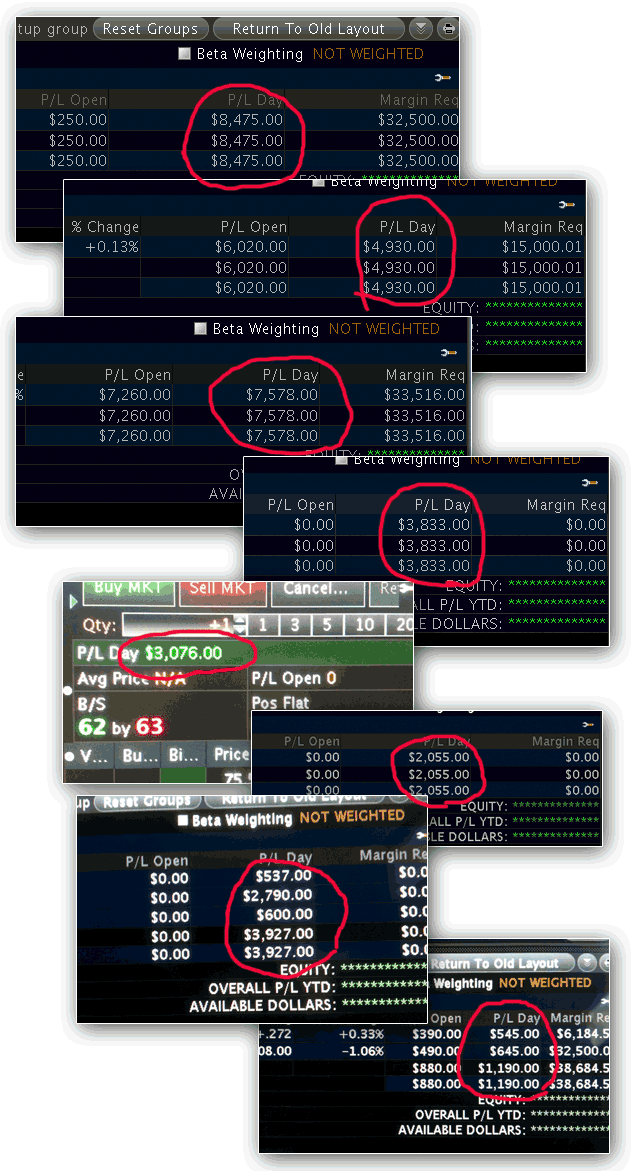

In the ever-evolving world of financial markets, options trading stands out as a powerful instrument for savvy investors seeking to secure substantial returns. However, mastering this intricate art demands a deep understanding of strategies, risk management techniques, and a winning trading system that can consistently outpace the market.

Unveiling Options Trading

Options contracts, derived from the underlying assets, provide investors with the right (but not the obligation) to buy (call options) or sell (put options) a specific asset at a set price within a defined timeframe. This flexibility empowers traders with unique opportunities to capitalize on market fluctuations, hedge against risks, and enhance portfolio returns.

Constructing a Winning System

The foundation of a successful options trading system lies in identifying a set of rules and parameters that guide entry and exit strategies for various market conditions. These rules may encompass technical indicators, fundamental analysis, and volatility assessments. By developing a comprehensive system tailored to individual risk tolerance and investment goals, traders can establish a disciplined approach to the markets.

Technical Cornerstones

Technical analysis plays a pivotal role in options trading, providing insights into market trends and potential future price movements. Key indicators such as moving averages, chart patterns, and support and resistance levels offer valuable clues for identifying trading opportunities. By deciphering these technical signals, traders can anticipate market reversals and execute profitable trades.

Understanding Fundamentals

While technical analysis holds immense value, considering the fundamental factors that drive asset prices is equally crucial. Economic data, corporate earnings, and political events can profoundly impact the volatility and direction of markets. By staying abreast of these fundamental developments, traders can make informed decisions that align with the long-term market outlook.

Mastering Volatilities

Volatility, or the rate of price change, presents both opportunities and challenges in options trading. High volatility creates wider trading ranges, expanding potential profits but also elevating risks. Traders who can skillfully navigate volatility using options strategies, such as straddles or strangles, can harness its power to their advantage.

Leveraging Leverage

Options provide inherent leverage, allowing traders to control a larger position with a relatively small capital outlay. This feature multiplies potential returns, but it also magnifies losses if trades go against the predicted direction. Risk management tools like stop-loss orders and appropriate position sizing are essential to mitigate these risks.

Trading Psychology

Beyond technical prowess and market knowledge, emotional discipline plays a critical role in options trading. The relentless nature of the markets can test even the most seasoned traders. Maintaining objectivity, managing emotions under stress, and adhering to defined trading rules can help navigate the psychological challenges inherent in this high-stakes arena.

Conclusion

Mastering options trading is a journey that demands patience, persistence, and continuous learning. By constructing a winning system that encompasses technical analysis, fundamental understanding, volatility management, and sound trading psychology, investors can unlock the full potential of this powerful financial instrument. Embrace the challenge, equip yourself with knowledge, and embark on a path to consistent market success through the world of options trading.

Image: stock.tradingninja.com

Winning Options Trading System

Image: www.youtube.com