Introduction: Unleashing the Power of Leveraged Trading

In the realm of day trading, margin options present a potent weapon for both seasoned veterans and aspiring traders alike. These instruments amplify trading potential, but understanding their complexities is paramount for successful navigation. This comprehensive guide delves into day trading margin options, empowering you with the knowledge and strategies needed to harness their power while managing the inherent risks.

Image: yejifumevofyq.web.fc2.com

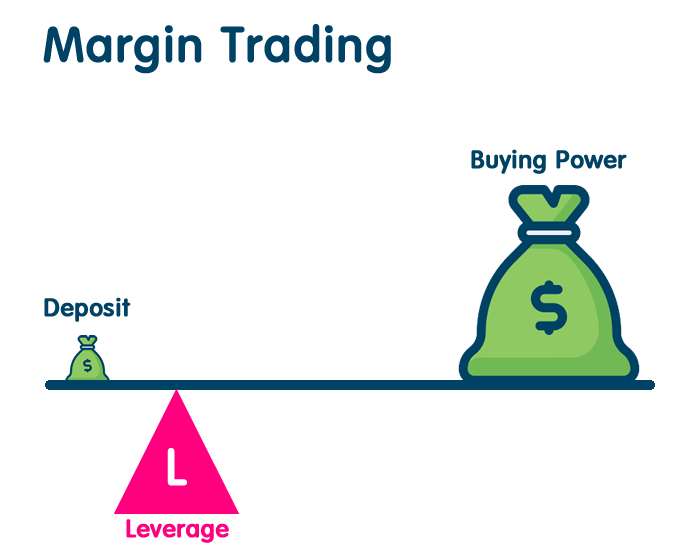

Chapter 1: Delving into Margin Options – Leveraging Beyond Cash

At its core, margin trading involves borrowing funds from a brokerage firm to magnify buying power. This allows traders to trade with larger positions than their available cash balance, potentially amplifying profits. Margin options extend this principle to the world of options trading, where traders gain access to strategies that magnify potential returns.

Chapter 2: The Mechanics of Margin Options – Unraveling the Structure

Margin options encompass both long and short option contracts. Long margin options, akin to traditional long options, grant the buyer the right, but not the obligation, to purchase (for calls) or sell (for puts) the underlying asset at a specified price (strike price) before a designated expiration date. Short margin options, on the other hand, confer the right and obligation to sell (for calls) or purchase (for puts) the underlying asset at the strike price, making them similar to selling uncovered options.

Chapter 3: Trading Margin Options – Employing Effective Strategies

Traders utilize various strategies when trading margin options. Bullish strategies, such as long calls and short puts, exploit expectations of an underlying’s upward movement. Conversely, bearish strategies, such as long puts and short calls, capitalize on anticipated declines. Traders can fine-tune these strategies by tailoring them to specific market conditions and personal risk appetites.

Image: www.trendzzzone.com

Chapter 4: Risks and Considerations – Navigating the Margins of Risk

While margin options can amplify profits, they also elevate risks. Margin calls, forced liquidations of positions to cover losses, can be a harsh reality for traders who overextend their leverage. Additionally, volatility can swiftly erode option premiums, leading to substantial losses. Risk management strategies, such as position sizing, stop-loss orders, and hedging, are crucial for mitigating these risks.

Chapter 5: Managing and Monitoring Margin Accounts – Maintaining Financial Discipline

Maintaining a margin account requires responsible management. Regular monitoring of account balances and equity is essential, ensuring traders avoid breaching margin maintenance requirements. Traders should also be mindful of margin interest charges, which can accumulate over time. Prudent use of margin, combined with a disciplined approach to risk management, is key to minimizing losses and preserving trading capital.

Day Trading Margin Options

Image: www.livingfromtrading.com

Chapter 6: Day Trading Margin Options – Conclusion: Empowering the Trader

Day trading margin options is an advanced technique that can offer lucrative opportunities for skilled traders. However, it requires a thorough understanding of underlying concepts, strategies, and risks. By embracing responsible trading practices and continually honing their knowledge, day traders can harness the power of margin options to enhance their trading arsenals and navigate the dynamic markets.