Navigating the complexities of options trading demands a well-structured plan. Creating a customized plan empowers you to identify opportunities, manage risk, and maximize returns consistently. This article will guide you through the essential steps to develop a robust options trading plan that aligns with your individual goals and trading style.

Image: www.pinterest.jp

Options trading, a versatile investment strategy, involves contracts that grant buyers the right to buy or sell an underlying asset at a predetermined price within a specified time frame. Understanding the fundamentals of options trading, including the types of options, pricing models, and risk assessment strategies, forms the foundation of an effective plan.

Defining Your Trading Goals and Strategy

The cornerstone of a successful trading plan lies in defining your goals and devising a tailored strategy to achieve them. Consider your risk tolerance, timeframe horizons, and financial objectives. Are you seeking income generation, capital growth, or hedging strategies? Align your trading strategy with these goals, whether you prefer short-term scalping or long-term investments.

Researching and selecting underlying assets suited to your strategy is crucial. Factors to consider include industry trends, volatility levels, and liquidity. Conducting thorough analysis on potential candidates helps you make informed decisions and identify opportunities that align with your trading objectives and risk appetite.

Technical Analysis and Risk Management

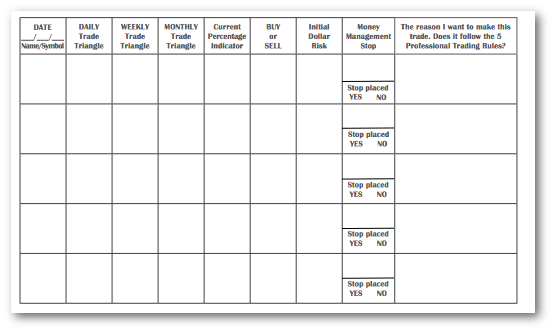

Technical analysis techniques play a pivotal role in options trading. By studying historical price patterns, volume indicators, and chart formations, you can identify potential trading signals and make more informed decisions. Integrating risk management strategies is equally essential to minimize potential losses. Determine appropriate position sizes, set stop-loss orders, and consider hedging strategies to protect your capital.

Understanding the concept of delta hedging, an advanced risk management technique, can significantly enhance your trading strategy. By balancing your portfolio with positions that offset each other’s risk exposure, you can mitigate potential losses and improve the overall performance of your trading plan.

Backtesting and Constant Refinement

Once your trading plan is formulated, backtesting it against historical data is a valuable exercise that allows you to evaluate its effectiveness and identify any areas for improvement. By simulating trades based on your proposed strategy, you gain insights into its strengths and weaknesses, enabling you to fine-tune your approach and optimize performance.

Trading is a dynamic field that constantly evolves. Continuously monitoring your trading performance, assessing market trends, and incorporating new knowledge is essential. Adapting your plan as needed and staying up-to-date with the latest developments in options trading ensures that it remains relevant and effective.

Image: club.ino.com

Expert Advice for Success

- Stay informed: Market news, economic data, and industry trends have a direct impact on options prices. Stay informed through newsletters, financial news outlets, and social media platforms to make well-timed decisions.

- Practice Discipline: Trading involves adhering to your plan and avoiding emotional decision-making. Stick to your trading signals, position sizing, and risk management strategies, even during market fluctuations.

- Seek Knowledge: Continuous learning is key to staying ahead in options trading. Read industry publications, attend webinars, and engage with trading communities to expand your knowledge and improve your skills.

- Manage Emotions: Controlling your emotions is crucial. Avoid chasing losses or letting fear govern your decisions. Remember that market swings are a natural part of trading.

- Start Small: Begin with small trades and gradually increase your position sizes as you gain confidence and experience. This approach allows you to manage risk effectively and preserve capital.

FAQs on Options Trading Plans

Q: How frequently should I review my trading plan?

A: Regularly review and refine your trading plan, especially after significant market changes or shifts in your personal circumstances.

Q: What is the importance of backtesting?

A: Backtesting provides insights into the historical performance of your trading strategy, enabling you to make informed decisions about its effectiveness and potential modifications.

Q: How can I stay updated with the latest options trading developments?

A: Leverage resources such as industry publications, trading forums, and social media platforms to gain insights from experts, analyze market trends, and enhance your trading knowledge.

Create Options Trading Plan

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

Image: www.investopedia.com

Conclusion

Crafting a comprehensive options trading plan is the cornerstone of sustainable success in the financial markets. By following the outlined steps, you can create a customized roadmap that aligns with your trading goals, risk tolerance, and market conditions. Remember, options trading involves continuous learning and refinement. Embrace the challenges, stay dedicated, and consistently enhance your strategies. The journey of an options trader is one of skill, discipline, and unwavering pursuit of knowledge. Are you ready to embark on this rewarding path?