-

Options trading has emerged as a popular and lucrative investment strategy, but it also comes with inherent risks. To navigate the complex world of options trading successfully, traders need a reliable way to track their performance, identify areas for improvement, and make informed decisions. This article presents an in-depth guide to creating a cheap trading journal and effectively tracking statistics for options trading. By following the steps outlined below, traders can gain valuable insights into their trading behavior and enhance their overall trading performance.

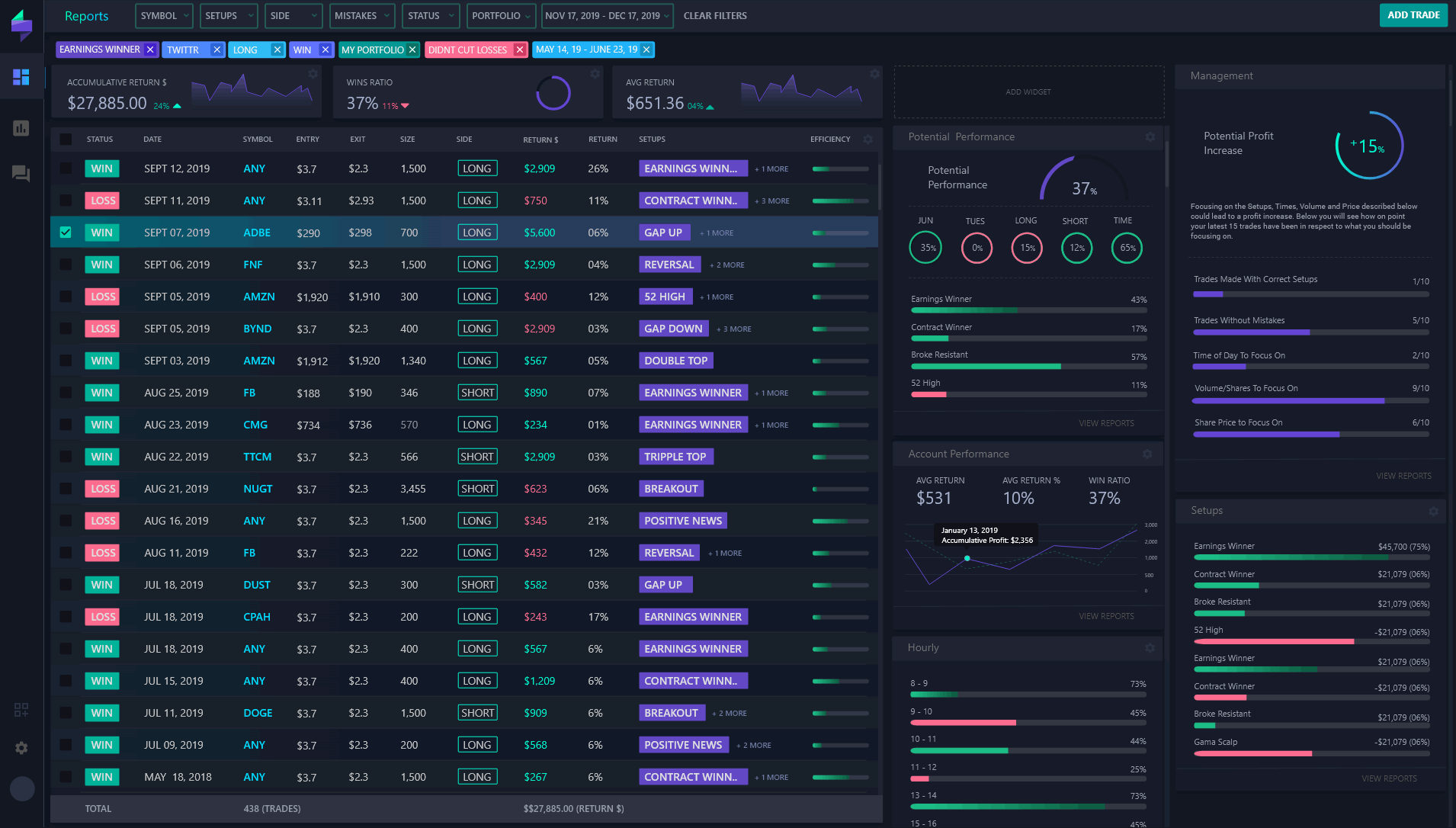

Image: tradersync.com -

The Importance of a Trading Journal and Performance Tracking

A trading journal is an essential tool for any serious options trader. It provides a central repository for recording trades, observations, and analysis, enabling traders to:

- Monitor Performance: By accurately tracking trades, traders can assess their profitability, identify winning and losing strategies, and adjust their approach accordingly.

- Identify Patterns: Reviewing trading records over time allows traders to recognize patterns in their trading behavior. This knowledge can help identify strengths and weaknesses, leading to improved trading decisions.

- Manage Risk: A trading journal helps traders stay disciplined by documenting risk parameters and actual risk exposure. This data enables traders to refine their risk management strategies and avoid costly mistakes.

-

Creating a Cheap Trading Journal

Creating a trading journal doesn’t have to be expensive or time-consuming. Here’s a cost-effective approach:

- Use a Spreadsheet: A simple spreadsheet program like Microsoft Excel or Google Sheets provides a customizable and user-friendly platform for maintaining a trading journal.

- Design a Template: Create a template that includes essential fields such as trade date, symbol, strike price, expiration date, entry and exit prices, profit or loss, and observations.

- Record Every Trade: Consistently record all trades, regardless of size or outcome. The more data collected, the more valuable the journal becomes.

-

Tracking Essential Statistics for Options Trading

Beyond simply recording trades, tracking specific statistics is crucial for options traders:

- Win Rate – The percentage of profitable trades to total trades taken.

- Return on Investment (ROI) – The percentage of net profit earned relative to the initial investment for each trade.

- Sharpe Ratio – A measure of risk-adjusted performance that considers both return and volatility.

- Kelly Criterion – A formula that determines the optimal risk per trade based on win rate, odds, and bankroll.

- Greeks – Sensitivity measures (Delta, Gamma, Theta, Vega) that help traders understand how options prices react to changes in underlying asset price, time to expiration, and volatility.

-

Image: community.ig.comAnalyzing and Using Trading Statistics

To make the most of collected statistics, traders should engage in regular analysis:

- Identify Strengths and Weaknesses: Review statistics to identify areas where trading is profitable and where improvements can be made.

- Test and Refine Strategies: Use statistics to test different trading strategies and pinpoint which ones perform consistently well.

- Manage Risk: Monitor statistics related to risk to ensure compliance with personal risk tolerance levels and make necessary adjustments.

- Set Goals and Track Progress: Establish trading goals and use statistics to track progress towards achieving them.

-

Cheap Trading Journal And Statistics For Options Trading

Image: www.etsy.comConclusion

A well-structured trading journal and a comprehensive performance tracking system are indispensable tools for options traders. By implementing the techniques outlined in this article, traders can gain a deeper understanding of their trading behavior, optimize strategies, manage risk effectively, and ultimately enhance their profitability in the challenging world of options trading.