Capture Attention:

In the realm of financial investments, gold has long held a prominent position, captivating investors with its intrinsic value and potential for wealth creation. Amidst the vast array of gold trading avenues, options trading has emerged as a powerful tool, offering traders the ability to seize profitable market opportunities while mitigating risk. In this comprehensive guide, we delve into the world of gold options trading in Australia, equipping you with the knowledge and insights you need to navigate this lucrative market successfully.

Image: news.goldseek.com

Introduction

Gold options trading involves the buying and selling of contracts that confer the right (but not the obligation) to buy or sell gold at a specific price on a future date. These contracts offer a unique blend of flexibility and leverage, allowing traders to capitalize on price fluctuations without the need for outright ownership of the underlying asset. Understanding the mechanics of gold options trading is essential, as it opens up a world of possibilities for enhancing returns and navigating market volatility.

Basic Concepts: Options Jargon Demystified

At the core of gold options trading lies a few fundamental concepts:

-

Call option: A contract giving the buyer the right to purchase a specified quantity of gold at a predetermined price (strike price) on or before the expiration date.

-

Put option: A contract giving the buyer the right to sell a specified quantity of gold at a predetermined price on or before the expiration date.

-

Premium: The price paid by the buyer to acquire the option contract.

-

Expiration date: The date by which the option contract must be exercised or expires.

Understanding Gold Options Trading Strategies

The beauty of gold options trading lies in the multitude of strategies available to traders. Whether you’re a beginner or a seasoned veteran, there’s a strategy tailored to your risk appetite and market outlook:

-

Bull call spread: A strategy designed to benefit from a bullish market outlook, involving the purchase of a call option and the sale of a call option with a higher strike price.

-

Bear put spread: A strategy designed to benefit from a bearish market outlook, involving the purchase of a put option and the sale of a put option with a lower strike price.

-

Covered call: A strategy utilizing an existing holding of physical gold, involving the sale of a call option against the owned gold.

Image: australiayourway.com

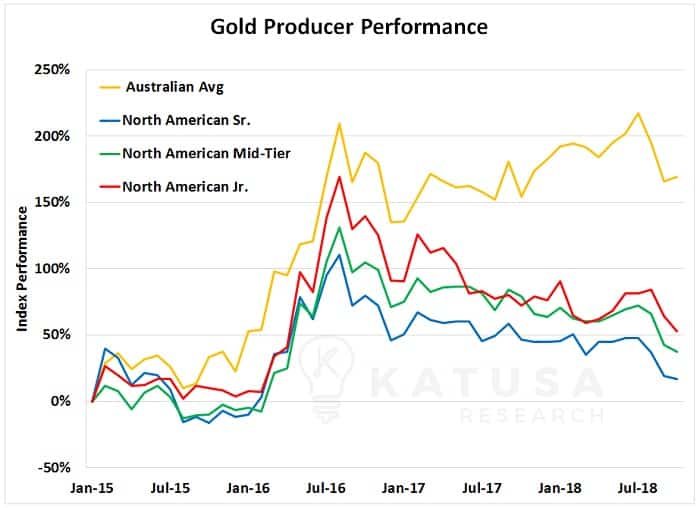

Market Trends and Analysis: Staying Ahead of the Curve

Staying abreast of market trends and conducting thorough analysis is crucial for successful gold options trading. Key factors to consider include economic conditions, interest rates, supply and demand dynamics, and global events that may impact gold prices. By leveraging technical analysis tools, fundamental research, and market sentiment indicators, traders can increase their chances of making informed trading decisions.

Role of Technology in Gold Options Trading

In the modern era, technology plays a pivotal role in gold options trading. Electronic trading platforms and mobile applications provide real-time data, facilitate order execution, and offer advanced analytical tools. By embracing these technological advancements, traders can stay connected to the markets, respond to price action swiftly, and enhance their trading efficiency.

Gold Options Trading Australia

Image: www.reddit.com

Conclusion: Embracing the Golden Opportunity

Gold options trading in Australia presents a lucrative and versatile avenue for investors seeking to grow their wealth and navigate market uncertainty. By thoroughly understanding the concepts, employing appropriate strategies, and staying abreast of market trends, traders can harness the power of gold options to their advantage. Embrace the golden opportunity that lies within this fascinating market, and embark on a journey of financial empowerment.