In today’s fast-paced financial world, options trading has emerged as a versatile investment strategy, offering traders the potential for substantial returns. However, navigating the intricacies of options trading can be daunting, especially for novice traders. This comprehensive guide will demystify the world of cash account option trading, providing you with the knowledge and tools to make informed decisions.

Image: tradingforexguide.com

What is Cash Account Option Trading?

Cash account option trading refers to the trading of options without the use of margin. Unlike margin trading, where traders can borrow funds to increase their buying power, cash account option trading requires traders to use only the funds they have on hand. This limits the potential risk but also restricts the trader’s ability to leverage their positions.

Why Trade Options in a Cash Account?

Trading options in a cash account offers several key benefits:

- Reduced Margin Risk: Cash account option trading eliminates the risk associated with margin trading. If the market moves against your position, you will not be obligated to pay additional funds beyond your initial investment.

- Controlled Trading: Cash account option trading enforces financial discipline by requiring traders to trade within their means. This prevents excessive risk-taking and promotes prudent trading behavior.

- Education and Experience: Cash account option trading provides a suitable platform for beginners to gain practical experience and develop their trading skills before transitioning to margin trading.

Core Concepts of Cash Account Option Trading

Options 101: Options are contracts that provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specific expiration date.

Call Options: Call options confer the right to purchase the underlying asset at the strike price on or before the expiration date. They are typically used when traders anticipate a rise in the asset’s price.

Put Options: Put options grant the right to sell the underlying asset at the strike price on or before the expiration date. They are employed when traders anticipate a decline in the asset’s price.

Premium: The premium represents the value of an option contract and is paid by the option buyer to the option seller. The premium is influenced by various factors, including the strike price, expiration date, and volatility of the underlying asset.

Image: jordship.weebly.com

Mechanics of Cash Account Option Trading

Order Types: Cash account option trading involves two primary order types:

- Market Orders: Market orders execute immediately at the prevailing market price. They are suitable for traders seeking quick trade execution, but they offer no control over the execution price.

- Limit Orders: Limit orders specify a maximum or minimum price at which traders are willing to buy or sell an option contract. They provide greater control over the execution price but may result in delayed or partial execution.

Settlement: Options contracts are settled on a physical basis, which means that the buyer or seller must either deliver or receive the underlying asset upon contract expiration. Cash settlement, where the difference between the strike price and the underlying asset’s price is settled in cash, is not available for cash account option trading.

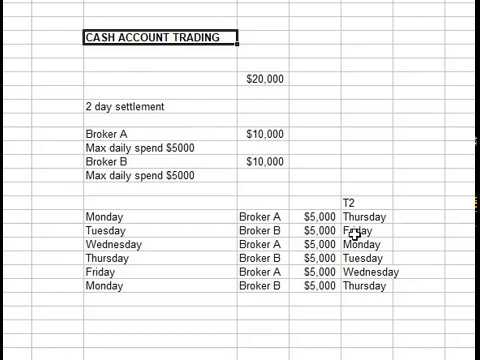

Cash Account Option Trading Tutorial

Image: tradebrains.in

Advanced Strategies for Sophisticated Traders

Once you have mastered the basics, you can explore advanced option trading strategies to enhance your trading potential:

Spreads: Spreads involve simultaneous trading of two or more option contracts with different strike prices and expiration dates. They offer various combinations of risk and reward profiles to suit different trading objectives.

**Theta Sca