In the dynamic world of options trading, one crucial aspect that often goes unnoticed but plays a vital role is the cash balance. It’s akin to the fuel that powers your trading engine, enabling you to seize opportunities and manage risks effectively. This comprehensive article will delve into the significance of the cash balance, its impact on options trading strategies, and provide expert insights to help you optimize your trading.

Image: www.youtube.com

The Importance of Cash Balances

Your cash balance is the available funds in your trading account that can be used to purchase and maintain options contracts. It serves as the lifeblood of your trading activities, determining the size and scope of the positions you can take. Without adequate cash, you may find yourself restricted in your ability to capitalize on market opportunities or forced to close positions prematurely.

- Margin Maintenance: Stock Exchange requires traders to maintain a certain amount of cash in their account, known as margin, to cover potential losses on open positions. If your cash balance falls below the required margin, you may receive a margin call, forcing you to deposit additional funds or liquidate positions.

- Option Purchases: The purchase of options requires upfront premium payments, which are deducted from your cash balance. The cost of the premium varies depending on the underlying asset, volatility, and time to expiration. Therefore, it’s essential to have sufficient cash to cover these premium payments.

- Exercise and Assignment: If you hold a call option that is “in the money” (meaning the underlying asset’s price is above the strike price), you may choose to exercise it. This will require you to pay the strike price and take ownership of the underlying asset, which can significantly impact your cash balance. Similarly, if you hold a put option that is”in the money,” you may be assigned the obligation to sell the underlying asset at the strike price, which also requires sufficient cash.

Tips and Expert Advice

Optimizing your cash balance is crucial for erfolgreiches Trading. Here are some tips and expert advice to help you manage your cash effectively:

- Plan Your Trades: Before entering any option trade, make sure you have a clear understanding of the potential cash requirements. Consider the premium costs, margin requirements, and the impact of potential exercises or assignments.

- Use Margin Wisely: Leverage can be a powerful tool, but it also amplifies both profits and losses. Avoid overleveraging your account, and always ensure you have sufficient cash to meet margin requirements.

- Manage Your Positions: Monitor your open positions regularly and adjust them as needed. Closing losing positions promptly can help conserve cash and minimize losses.

- Diversify Your Cash Sources: Don’t rely solely on trading profits to fund your trading account. Consider additional sources of income, such as regular deposits or other investments, to maintain a healthy cash balance.

FAQs

Here are answers to some common questions about cash balances in options trading:

Q: What happens if my cash balance falls below the required margin?

A: You will receive a margin call, which requires you to deposit additional funds or liquidate positions to meet the margin requirements.

Q: Can I trade options if I don’t have enough cash to cover the premium?

A: No, you can only trade options if you have sufficient cash to cover the upfront premium payments.

Q: How can I estimate the potential cash impact of an options trade?

A: Use an options calculator or consult with a financial professional to estimate the premium costs, margin requirements, and potential gains or losses associated with a particular trade.

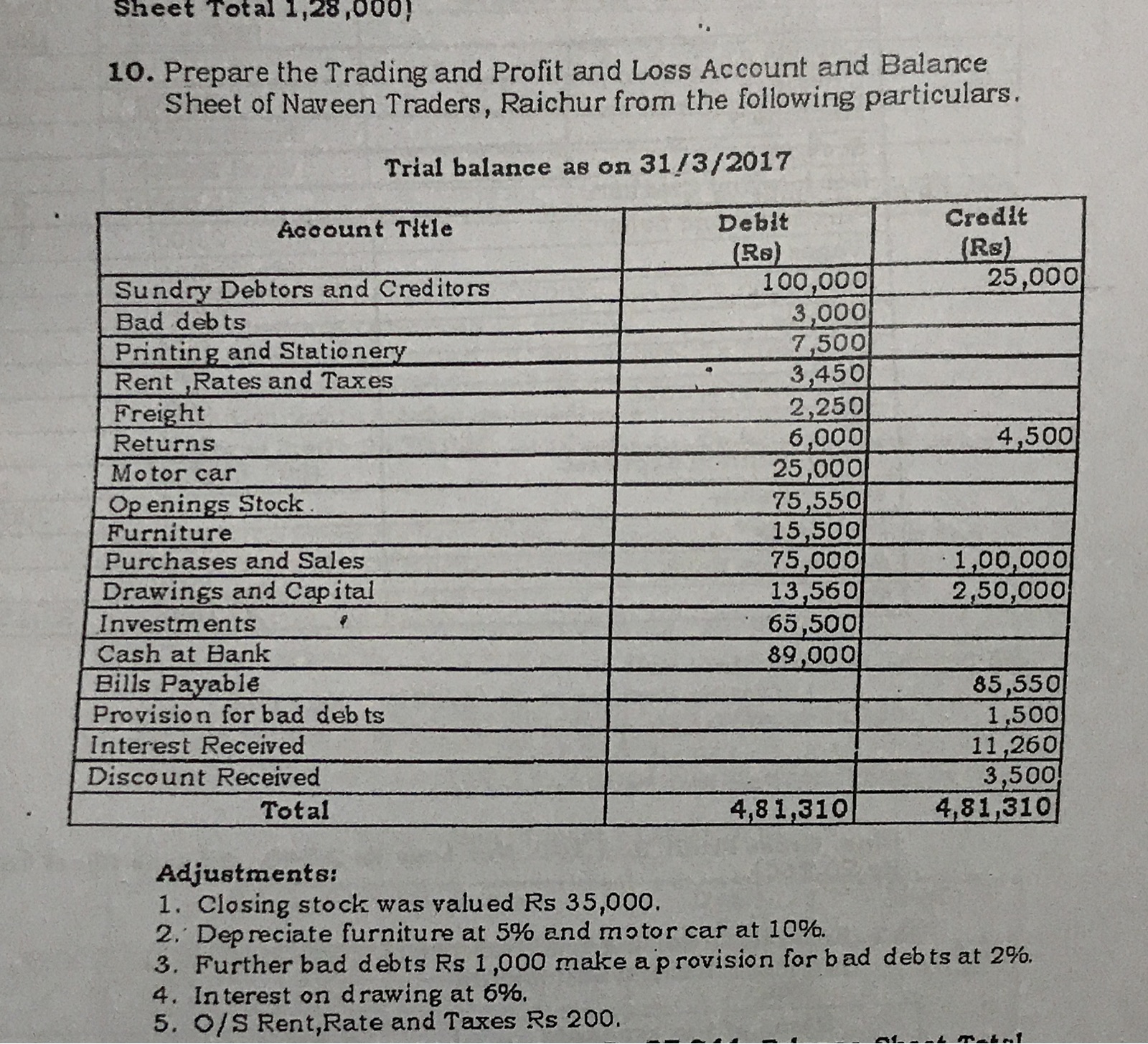

Image: www.toppr.com

Amount Of The Cash Balance Options Trading

Conclusion

Understanding and managing your cash balance is paramount for successful options trading. By maintaining adequate cash, you empower yourself to seize opportunities, minimize risks, and make informed decisions. Remember, trading is a marathon, not a sprint, and a healthy cash balance provides the endurance you need to navigate the ups and downs of the market.

So, are you ready to elevate your options trading with a solid understanding of cash balances? The key is to continually educate yourself, adapt to market conditions, and embrace the power of prudent cash management. By following the tips and advice outlined above, you can optimize your cash balance and pave the way for successful outcomes in the exciting world of options trading.