Imagine this: you’re watching the stock market, and you see two companies locked in a dance of synchronized movement. Their prices rise and fall together, almost as if they’re tethered by an invisible string. This is the heart of pairs trading – a strategy that exploits these correlations to capture profit, even in volatile markets. Now, imagine adding the power of options to this dance.

Image: coinzodiac.com

By combining the intuitive approach of pairs trading with the leverage and flexibility of options, you unlock a whole new dimension of trading opportunities that can help you manage risk and potentially generate substantial profits. This article will be your guide to navigating this exciting world, exploring the core concepts, strategies, and insights that will help you unlock the potential of pairs trading with options.

Unraveling the Mystery: Understanding Pairs Trading with Options

Pairs trading is a relative value strategy centered on identifying two assets (often stocks) that share a strong historical correlation. The idea is simple: when one asset deviates from its expected relationship with the other, there’s a chance to profit by exploiting this temporary imbalance. You essentially bet on the price difference between the two assets converging back to its historical norm.

Options, on the other hand, offer a powerful tool for controlling risk and maximizing potential profits. By purchasing options contracts, you gain the right (but not the obligation) to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). This empowers you to craft sophisticated strategies that can amplify your potential gains while managing your risk profile.

Building Your Trading Arsenal: Key Concepts and Strategies

Before diving into the exciting strategies, let’s equip ourselves with some key concepts that are crucial for navigating this world:

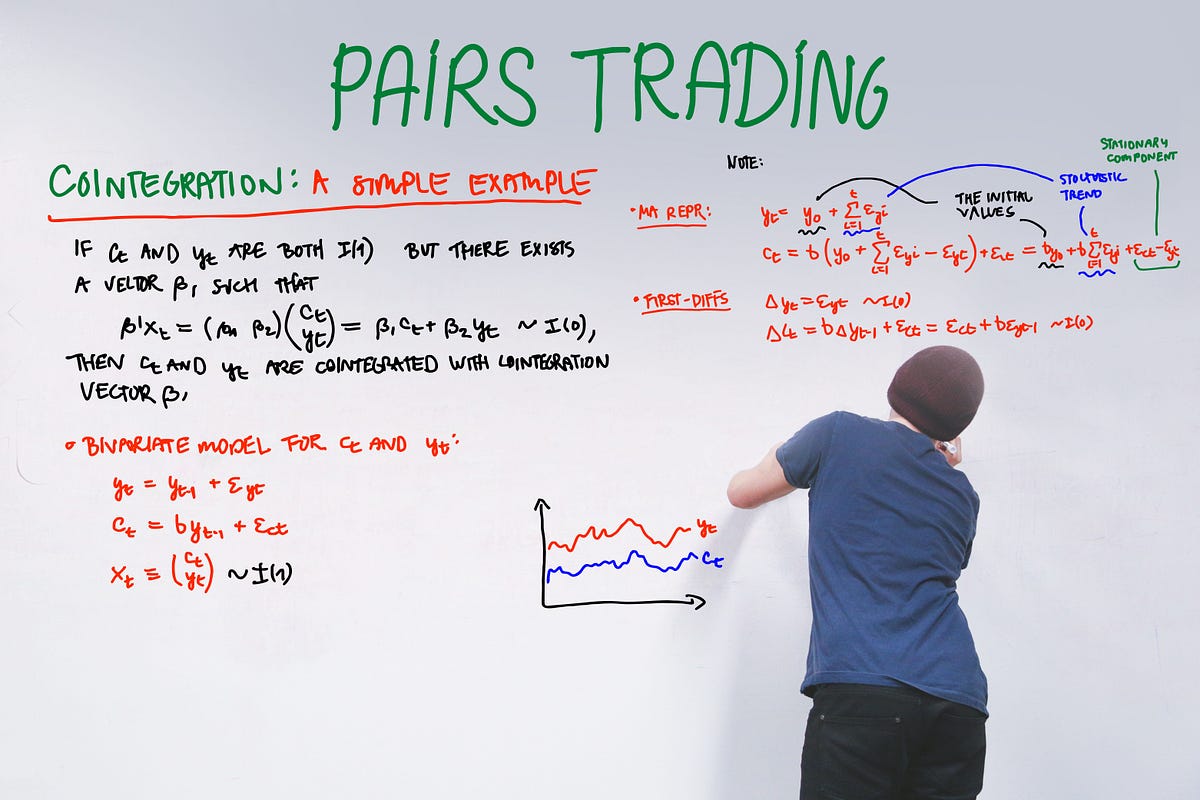

1. Cointegration: The bedrock of pairs trading lies in identifying and exploiting cointegrated securities. Two assets are considered cointegrated if their price movements exhibit a persistent long-term relationship, even though they might fluctuate in the short term. This relationship can arise from various factors like shared industry trends, similar business models, or a common dependency on a particular market condition.

2. Spread: The spread represents the difference between the prices of the two cointegrated assets. Understanding and analyzing historical spreads is crucial for establishing entry and exit points for your trades. By identifying patterns, you can identify deviations from the norm and determine when the spread is likely to revert back to its historical average.

3. Mean Reversion: Mean reversion is the tendency of a price series to move back towards its historical average. In pairs trading, this principle is applied to the spread between the two assets. If the spread deviates significantly, it is likely to eventually revert back to its mean, creating an opportunity for profit.

4. Option Strategies for Pairs Trading: When you combine pairs trading with options, the possibilities become incredibly diverse. Here’s a basic overview of some powerful options strategies to consider:

-

Spread Strategies: Using options, you can create combinations that profit from the convergence of the price spread.

-

Long/Short Call/Put Spread: This involves buying a call option with a lower strike price and selling a call option with a higher strike price (or vice versa for puts) on the same underlying asset. This strategy profits if the spread converges, even if the overall market direction is unfavorable.

-

Collar Strategy: This combination involves selling a covered call and buying a protective put. This strategy helps to limit potential losses and cap gains, providing a more defined risk/reward profile.

-

5. Risk Management is Paramount: Unlike traditional stock trading, pairs trading with options requires a nuanced approach to risk management.

- Stop-Loss Orders: Use stop-loss orders for both your stock and option positions to limit potential losses in case your trade goes against you. By setting predefined exit points, you can mitigate the impact of unexpected market moves.

- Position Sizing: Carefully consider position sizing relative to your overall portfolio and risk tolerance. Leverage often amplifies gains, but it can also amplify losses.

- Diversification: By spreading your investments across various pairs and strategies, you can reduce your overall risk exposure.

Navigating the Market: Real-World Applications and Expert Insights

Real-World Example: Consider two large energy companies, ExxonMobil (XOM) and Chevron (CVX). Historically, their prices have moved in a consistent and predictable way. Let’s say XOM is currently trading at $100 and CVX at $95. Their historical spread has averaged around $5.

If XOM suddenly falls to $90 while CVX remains relatively stable at $95, this creates a deviation in the spread. You could then employ a pairs trading strategy by buying XOM and selling CVX with the expectation that the spread will revert back to its historical average as XOM climbs back toward its typical relationship with CVX.

Imagine you used options instead of stocks. You could buy a call option on XOM, betting on its recovery, and simultaneously sell a put option on CVX, taking advantage of its relative stability.

Expert Insights for Success:

- Embrace Fundamental Analysis: While technical analysis and statistical modeling are crucial tools, don’t neglect the fundamental story behind each company. Understanding a pair’s underlying business drivers, industry dynamics, and potential catalysts can enhance your trading decisions.

- Start Small and Scalable: Begin with small trades and gradually increase your position size as you gain experience and confidence in your trading strategy.

- Embrace Learning and Adaptability: The markets are constantly evolving. Stay updated on the latest trends, market dynamics, and changes in regulations to adjust your strategies accordingly.

Image: towardsdatascience.com

Pairs Trading With Options

Your Trading Journey Begins Now

Pairs trading with options is a fascinating strategy that combines the power of correlation analysis with the flexibility of options. With a solid understanding of the concepts, strategies, and risk management practices, you can be empowered to navigate this exciting world of market leverage. Remember, every successful trade is the result of careful deliberation, rigorous analysis, and unwavering discipline. Start your journey today, and unlock the potential of profitable pairs trading with options!