Welcome to the world of options trading, where calculated risks and potential rewards collide. In this comprehensive guide, we will delve into the intricacies of BrokerageLink options trading, empowering you to navigate the dynamic financial markets with confidence.

Image: www.interactivebrokers.com

BrokerageLink: A Gateway to Options Mastery

BrokerageLink is a renowned online brokerage firm that has carved a niche for itself in the options trading arena. Its user-friendly platform and comprehensive educational resources make it an ideal partner for traders of all experience levels. With BrokerageLink, you gain access to a vast array of options contracts, giving you unparalleled flexibility in crafting your trading strategies.

Understanding Options Trading: The Basics

Options contracts grant you the right, but not the obligation, to buy or sell an underlying asset at a specified price on a predetermined date. This contractual flexibility allows you to speculate on market movements without directly owning the underlying asset. The two main types of options are **calls** and **puts**.

- **Calls**: Give you the right to buy an asset at a specified price (the strike price) on or before a designated date (the expiration date).

- **Puts**: Confer the right to sell an asset at the strike price on or before the expiration date.

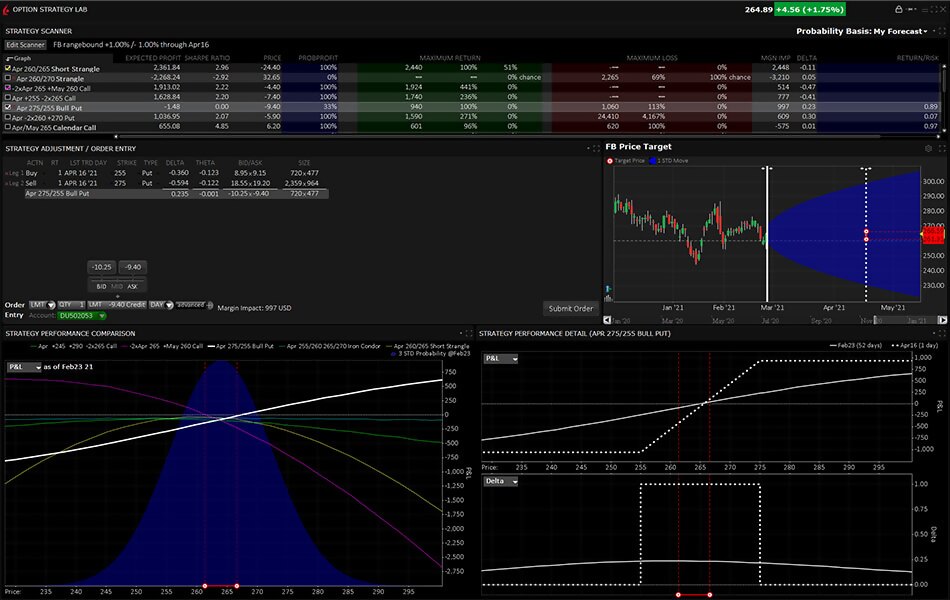

Strategy Customization: Maximizing Potential

The beauty of options trading lies in its customizable nature. You can tailor your strategies to suit your risk tolerance and market outlook. While speculative traders may prefer to take on higher risks for the potential of greater rewards, conservative investors can opt for more balanced approaches.

Seasoned options traders employ various strategies, including covered calls, cash-secured puts, and credit spreads. These strategies involve combining multiple options contracts to create tailored risk-reward profiles. Understanding the intricacies of these strategies is crucial for maximizing your trading outcomes.

Image: www.ibkrguides.com

Market Developments and Expert Insights

To stay ahead in options trading, it is essential to monitor market trends and gather insights from industry experts. BrokerageLink provides a wealth of educational resources, including market analysis, webinars, and in-depth guides. By leveraging this knowledge, you can anticipate market movements and make informed trading decisions.

Tips and Expert Advice for Success

Based on my experience as a seasoned blogger, here are a few tips to enhance your options trading journey:

- Start small and gradually increase your position size: Discipline and risk management are paramount. Do not overextend yourself initially.

- Understand the concepts thoroughly: Before making any trades, ensure you have a firm grasp of options pricing, volatility, and the associated risks.

FAQs on BrokerageLink Options Trading

- Q: What is the minimum balance required to open an options trading account at BrokerageLink?

A: BrokerageLink requires a minimum balance of $2,000 to open an options trading account.

- Q: Does BrokerageLink support paper trading for options?

A: Yes, BrokerageLink offers a paper trading platform where you can practice options trading strategies without risking real capital.

Brokeragelink Options Trading

Image: www.brokerage-review.com

Conclusion: Embark on Your Options Trading Journey

In the realm of financial markets, options trading can be both rewarding and challenging. By partnering with BrokerageLink and embracing the principles outlined in this guide, you can confidently navigate this dynamic arena. Are you ready to unlock the potential of options trading?