In the labyrinthine world of finance, options trading has long been shrouded in an aura of complexity and exclusivity. But fear not, intrepid investor! In this comprehensive guide, we’ll unravel the secrets of this enigmatic realm, empowering you to harness its potential for financial gain.

Image: hustleventuresg.com

Whether you’re a seasoned pro or a novice yearning for financial freedom, this in-depth exploration will equip you with the knowledge and strategies to navigate the options market with aplomb. So, buckle up, embrace the thrill of the trade, and prepare to conquer the financial frontiers with our expert guidance.

**Options Demystified: Definition, History, and Essence**

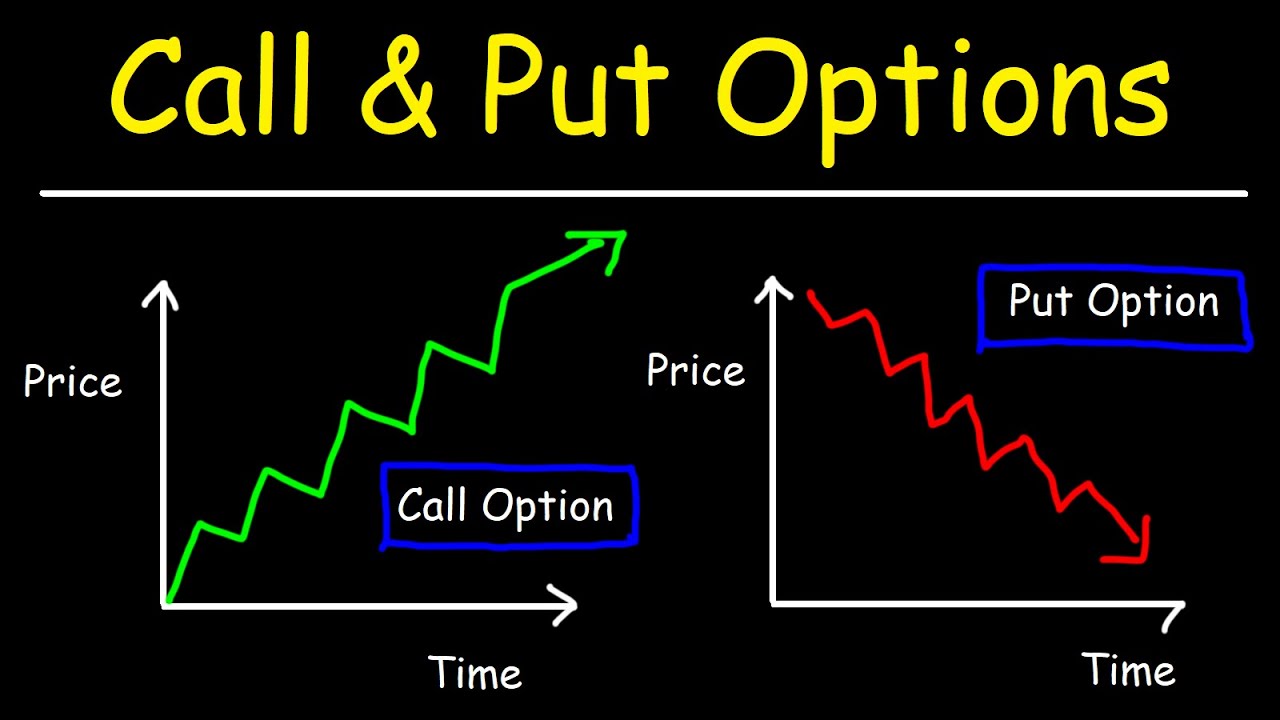

Definition: Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a set date (expiration date).

History: Tracing their roots to ancient Greece, options have evolved over centuries, serving diverse purposes from hedging risks to speculating on market movements. Their modern incarnation emerged in the late 19th century, with the Chicago Board of Trade (CBOT) playing a pivotal role in standardizing and legitimizing options trading.

Essence: At their core, options offer a unique blend of flexibility, leverage, and potential for profit, allowing investors to tailor strategies to their specific risk appetite and financial goals.

**Unveiling the Types of Options: Calls, Puts, and the Greek Alphabet**

Calls vs. Puts: Call options convey the right to buy an underlying asset, while put options bestow the right to sell. The choice between calls and puts depends on whether you anticipate the asset’s price to rise (call) or fall (put).

Greek Alphabet: Options traders wield the Greek alphabet as a secret weapon to decipher the complex nuances of options contracts. Each Greek letter represents a specific variable that influences the option’s price and risk profile, including Delta, Gamma, Theta, and Vega.

**Strategy and Execution: Crafting a Plan for Success**

Strategy Selection: The key to successful options trading lies in choosing the right strategy for your financial objectives and risk tolerance. Whether employing conservative hedging strategies to protect your investments or embracing bold speculative approaches to chase higher returns, a well-defined plan is paramount.

Execution: Once a strategy is in place, it’s time to enter the market. Carefully consider the timing of your trade, trade size, and order type to optimize your chances of success and mitigate risks.

Image: kurskpu.ru

**Recent Trends and Market Dynamics**

The options market is constantly evolving, fueled by macroeconomic trends, geopolitical events, and technological advancements. Staying abreast of these developments is crucial for making informed decisions and adapting your strategies accordingly.

News sources, financial forums, and social media platforms provide invaluable insights into market sentiment and potential opportunities. By monitoring these sources, you can gain an edge over your competitors and capitalize on emerging trends.

**Tips and Expert Advice for Options Domination**

1. Educate Yourself: Knowledge is power in the options market. Arm yourself with books, online resources, and courses to grasp the fundamentals and intricacies of options trading.

2. Practice and Simulate: Before risking real capital, hone your skills through paper trading or virtual simulations. This allows you to test strategies, gain experience, and build confidence.

3. Manage Risk Effectively: Options trading carries inherent risks. Implement risk management techniques such as stop-loss orders, position sizing, and diversification to safeguard your investments.

4. Stay Disciplined: The allure of high returns can be tempting. However, adhering to your trading plan and controlling your emotions is essential for long-term success.

**FAQ: Demystifying Options Trading for Beginners**

Q: How do I get started with options trading?

A: Opening an account at a brokerage that offers options trading is the first step. Ensure you possess a solid understanding of options concepts and have a comprehensive trading plan.

Q: What’s the difference between a call option and a put option?

A: A call option gives you the right to buy an asset at a specified price, while a put option gives you the right to sell an asset at a specified price.

How To Make Money By Option Trading

**Conclusion**

The path to mastering options trading may be strewn with challenges, but the rewards for those who persevere can be significant. Embrace the complexity, learn the art, and reap the benefits of this powerful financial tool. Conquering the options market is within your reach. Are you ready to seize the opportunity?