“The thrill of victory and the disappointment of defeat. That’s the essence of options trading. But know this: it’s a game with strict rules that demand adherence.”

Image: icc.academy

Navigating the Slippery Slope: Compliance as a Trader’s Lifeline

In the world of high-stakes finance, compliance serves as a beacon of integrity, guiding traders through the intricate labyrinth of regulations that govern options trading. It’s not just a box to tick; it’s a lifeline that ensures fairness, transparency, and investor protection. By understanding and adhering to options trading compliance, traders can navigate the markets with confidence.

Delving into the Anatomy of Options Trading Compliance

Options trading, with its alluring promises of potential gains, comes under the watchful eye of regulatory bodies worldwide. These bodies have meticulously crafted a framework of rules, regulations, and oversight mechanisms to maintain market integrity and protect investors from misconduct. This framework forms the backbone of options trading compliance.

It starts with a clear definition: an option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before an expiration date. This right comes at a cost – the premium, which is paid upfront by the buyer.

The options trading landscape is further shaped by the presence of two primary markets: the exchange-traded market, where standardized options are traded on exchanges, and the over-the-counter market, where customized options are traded bilaterally. Each of these markets poses unique regulatory considerations.

Now, let’s navigate the key concepts of options trading compliance, ensuring that ethical practices prevail throughout your trading journey.

Navigating the complexities of Options Trading Compliance

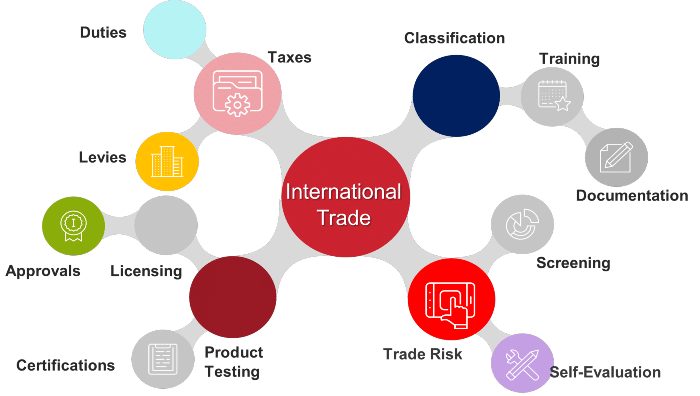

Options trading compliance is a multifaceted domain, spanning market conduct, licensing, and transparency requirements. Grasping these concepts is paramount for traders seeking to avoid costly pitfalls.

Market Conduct Rules: These rules serve to prevent unfair trading practices and promote market integrity. They prohibit activities such as market manipulation, insider trading, and front-running, ensuring that all traders have equal access to information and a level playing field.

Licensing and Registration: To protect investors and ensure trader competency, most jurisdictions mandate that individuals and firms engaged in options trading obtain licenses or registrations from the relevant regulatory authorities. These licenses attest to the trader’s qualifications and ethical conduct.

Transparency and Disclosure: Compliance requires traders to maintain transparent records and promptly disclose all relevant information about their trading activities. This includes disclosing conflicts of interest, material changes in assets, and order execution details. Transparency fosters trust and protects investors from misinformed decision-making.

Image: performansc.com

The Evolving Landscape of Options Trading Compliance: Staying in Sync with the Times

The options trading landscape is in a constant state of flux, driven by technological advancements and regulatory updates. Traders must remain vigilant in monitoring these changes to ensure they are adapting to the latest compliance standards.

Technological Advancements: The rise of electronic trading platforms and algorithmic trading has brought forth novel compliance challenges. Regulatory bodies are actively exploring how to monitor and regulate these automated trading systems, ensuring they do not undermine market fairness or stability.

Regulatory Updates: Governments and international organizations are continuously reviewing and updating options trading regulations. These updates may address emerging issues, such as the regulation of crypto options or the harmonization of rules across borders. Staying informed about these changes is crucial for compliance and avoiding costly consequences.

Tips and Expert Advice: Steering Clear of Compliance Pitfalls

Seasoned options traders and industry experts have generously shared their wisdom to guide you on the path of successful compliance:

- Conduct Due Diligence: Familiarize yourself with the applicable laws, regulations, and market conduct rules that govern options trading in your jurisdiction.

- Obtain Necessary Licenses and Registrations: Ensure you have the required licenses or registrations from the appropriate regulatory authorities before engaging in trading activities.

- Maintain Transparency and Accurate Records: Keep meticulous records of your trades, including order execution details, conflicts of interest, and asset positions. Make prompt and accurate disclosures as required by law.

FAQ on Options Trading Compliance: Unraveling Common Queries

Q: What are the main objectives of options trading compliance?

A: To protect market integrity, prevent unfair trading practices, ensure trader competency, and safeguard investors from misconduct.

Q: What happens if traders violate options trading compliance regulations?

A: Violations can result in severe consequences, including fines, license revocation, and even criminal charges.

Q: How can traders stay informed about the latest compliance updates?

A: Monitor official announcements from regulatory bodies, attend industry conferences, and consult with reputable legal and compliance professionals.

Options Trading Compliance

Image: himycexusyvah.web.fc2.com

Conclusion: Embracing Compliance for Triumphant Trading

Options trading compliance is a dynamic and ever-evolving field, demanding a proactive approach from traders. By understanding and adhering to regulatory requirements, adopting the tips and expert advice provided, and seeking continuous education, traders can navigate the complexities of options trading with confidence, reaping the rewards of thriving in a compliant and ethical marketplace.

Do you find yourself grappling with additional queries regarding options trading compliance? Share your questions, and let’s collectively navigate this ever-changing landscape together.