In the realm of financial trading, mastering advanced strategies can elevate your portfolio’s potential. Allow me to introduce you to the captivating world of box spread option trading, an alluring strategy that savvy investors employ to navigate market volatility and secure substantial returns.

Image: www.traderslaboratory.com

Unlocking the Essence of Box Spreads

Navigating Box Spreads: A Delineation

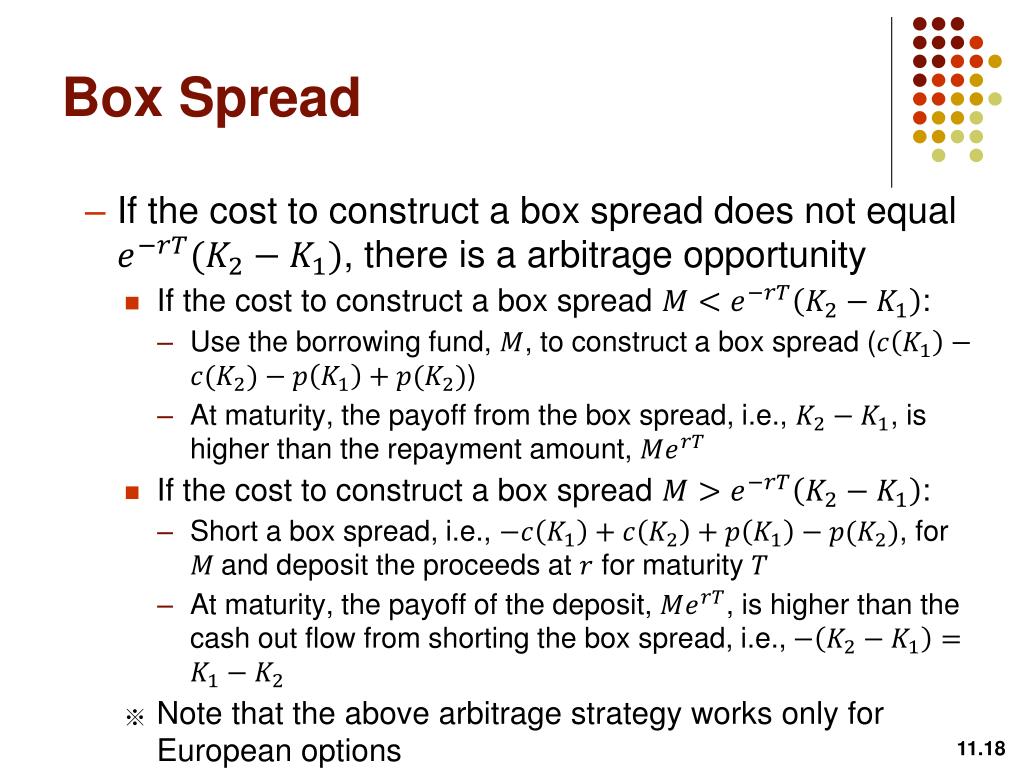

A box spread is an ingenious option trading strategy that hinges on the simultaneous purchase and sale of four options: two calls at different strike prices and two puts at corresponding strike prices. This intricate arrangement creates a well-defined ‘box’ on a price-time graph, within which the trader anticipates the underlying asset’s price will fluctuate.

The Art of Crafting Box Spreads

The strike prices of the options in a box spread are meticulously selected to create a balanced position with minimal risk and the potential for enticing returns. The purchased call option and the sold call option possess the same expiration date but differ in their strike prices. Similarly, the purchased put option and the sold put option share the same expiration date but divergent strike prices.

The difference between the strike prices of the purchased and sold options is known as the ‘spread width’. This spread width effectively limits the potential profit but also reduces the overall risk of the strategy.

Image: www.slideserve.com

Forecast the Future: The Predictive Power of Box Spreads

The essence of box spread trading lies in its predictive nature. Traders harness this strategy to speculate on the future price movements of an underlying asset within a prescribed timeframe. If the price of the asset remains within the confines of the ‘box’ defined by the strike prices, the trader stands to reap handsome profits.

Conversely, if the underlying asset’s price ventures beyond the ‘box,’ the trader may incur losses. However, due to the inherent risk mitigation baked into the box spread structure, these potential losses tend to be bounded within manageable limits.

Matching Boxes with Market Trends

Seasoned traders employ box spreads to capitalize on various market conditions:

- Neutral markets: Box spreads thrive in markets characterized by low volatility and limited price swings, where the underlying asset’s price is anticipated to meander within a narrow range.

- Bullish markets: Box spreads can amplify profits in bullish markets, where the trader foresees a steady upswing in the underlying asset’s price. In such scenarios, the trader will design the ‘box’ to accommodate a potential price appreciation.

- Bearish markets: Box spreads can also be adapted to bearish markets, where the trader predicts a decline in the underlying asset’s price. By crafting the ‘box’ appropriately, traders can profit from the expected downturn.

Tips and Expert Advice for Box Spread Success

As you embark on your box spread trading journey, heed these invaluable tips and expert recommendations:

- Choose wisely: The selection of underlying assets for box spreads warrants careful consideration. Opt for assets with adequate liquidity and predictable volatility patterns.

- Strike price precision: Selecting the appropriate strike prices for your options is paramount. Conduct thorough research and analysis to determine optimal strike prices that align with your market outlook.

- Manage risk: Box spreads inherently mitigate risk, but prudent risk management practices remain crucial. Set clear profit targets and stop-loss levels before initiating any trades.

- Expiration timing: Determine expiration dates strategically. Shorter-term expirations amplify potential returns but magnify risk, while longer expirations offer more time for the underlying asset’s price to realize your predictions.

Unveiling Commonly Asked Box Spread Queries

To elucidate your understanding further, let’s unravel some frequently asked questions about box spreads:

- Q: Are box spreads inherently profitable?

- A: Box spreads are not inherently profitable. Their profitability hinges on accurate predictions of the underlying asset’s price movements and prudent trade management.

- Q: How do I determine the potential profit of a box spread?

- A: Potential profit is influenced by several factors, including the spread width, volatility, and the underlying asset’s price movement. Utilize profit calculators or consult with financial professionals to estimate potential returns.

- Q: How does time decay affect box spreads?

- A: Time decay gradually erodes the value of options as they approach expiration. Box spreads are particularly susceptible to time decay due to their longer expirations. Closely monitor time decay and adjust positions accordingly.

Box Spread Option Trading Strategy

Image: rehojuvuyequ.web.fc2.com

Embrace the Box Spread Advantage

Mastering box spread option trading can unlock a world of strategic advantages for discerning investors. Its inherent risk-buffering nature, coupled with the potential for substantial returns, renders it a versatile tool for navigating market uncertainties.

As you delve into the intricacies of this strategy, remember that knowledge is power. Continuous education and a commitment to prudent trade management will empower you to harness the full potential of box spreads and elevate your financial endeavors to new heights.

Now, I invite you to share your thoughts and experiences with box spread option trading. Have you employed this strategy in your investment journey? What insights and observations can you offer our community of traders? Your contributions will enrich our collective knowledge and further the exploration of this captivating financial instrument.