In the labyrinthine world of options trading, a strategy that has captivated traders for its alluring profit potential is swing trading option premiums. I stumbled upon this goldmine a few years ago and instantly recognized its power. Swing trading allowed me to capture substantial gains from the rhythmic fluctuations of options premiums, transforming my trading journey.

Image: bullsonwallstreet.com

Options Premiums: A Gateway to Hidden Profits

Options premiums are the price you pay to acquire an option contract. They embody the intrinsic value, representing the potential profit if exercised, and the time value, which measures the remaining days until expiration. Understanding the dynamics of option premiums is crucial for successful swing trading.

Impact of Time Value

Time is the relentless nemesis of options premiums, eroding their value with each passing day. This decay accelerates as expiration approaches, influencing the pricing and strategy in swing trading.

Trading the IV Spectrum

Implied volatility (IV) measures the market’s perception of an asset’s future price swings. Swing traders navigate the spectrum between low and high IV, capitalizing on opportunities presented by these extremes.

Image: www.it2rhine2020.eu

Swing Trading Option Premiums: A Comprehensive Guide

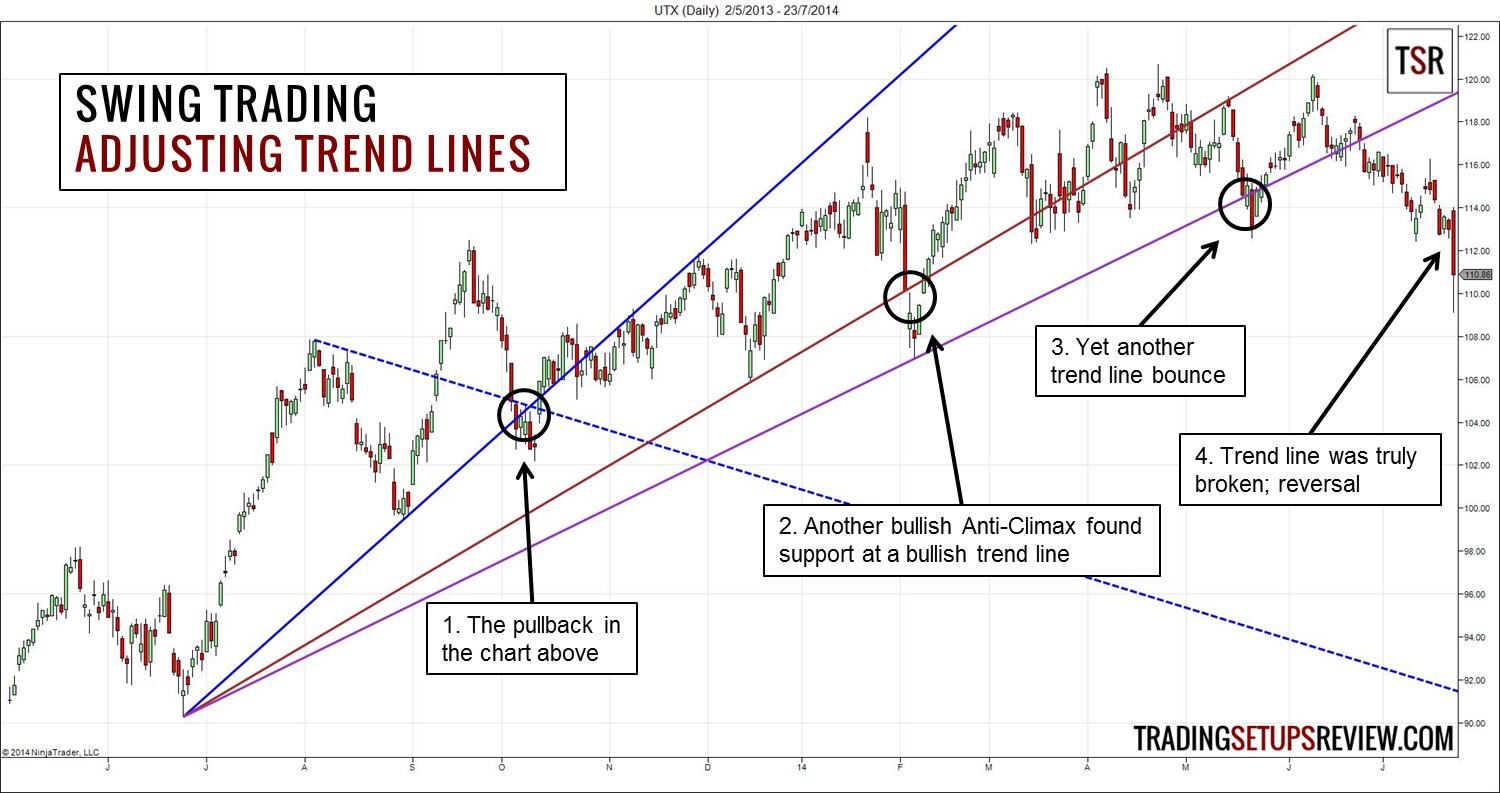

Defining Swing Trading

Swing trading involves trading over a period of several days to weeks, aiming to exploit price momentum or reversals within a larger trend. It allows traders to leverage longer-term price movements without the risks associated with overnight trading.

Identifying Swing Trading Opportunities

Technical analysis plays a pivotal role in identifying swing trading opportunities. Traders study price patterns, support and resistance levels, and momentum indicators to pinpoint potential entry and exit points.

Managing Risk

Risk management is paramount in swing trading. Traders should employ strategies such as stop-loss orders and position sizing to mitigate losses while maximizing profit potential.

Expert Tips and Market Insights

Utilizing Options Spreads

Options spreads involve buying and selling options of different strike prices or expiration dates. Spreads offer defined risk and reward profiles, enhancing the potential for profitable trades.

Capitalizing on IV Crush

IV crush is a phenomenon where IV decreases rapidly toward expiration. Swing traders can capitalize on this by selling options with high IV, capturing the premium erosion as they approach worthless status.

Frequently Asked Questions

Q: What is the minimum capital required for swing trading option premiums?

A: Capital requirements vary depending on the strategies employed and the underlying assets traded. However, typically, a minimum of $5,000 is recommended.

Q: Can swing trading option premiums be profitable for beginners?

A: While swing trading can offer opportunities for beginners, it is crucial to acquire a solid understanding of options trading and risk management before diving in.

Swing Trading Option Premiums

Image: www.pinterest.com

Conclusion

Swing trading option premiums presents a lucrative path to trading success, generating profits from the ebb and flow of market emotions. By grasping the dynamics of option premiums, implementing swing trading strategies, and embracing risk management, you can unlock the potential of this captivating trading technique.

Are you intrigued by the prospect of swing trading option premiums? Take the plunge and embark on a journey to harness the power of options markets and seize the opportunities they offer.