Have you ever wondered how seasoned traders amplify their profits in the world of options, seemingly turning small investments into substantial gains? The answer lies in a powerful tool called margin. It’s a double-edged sword, capable of both boosting returns and amplifying risks. But before diving into the intricacies of margin, let’s first unravel the fundamentals of options trading – a realm where potential gains and losses can be magnified beyond ordinary stock investments.

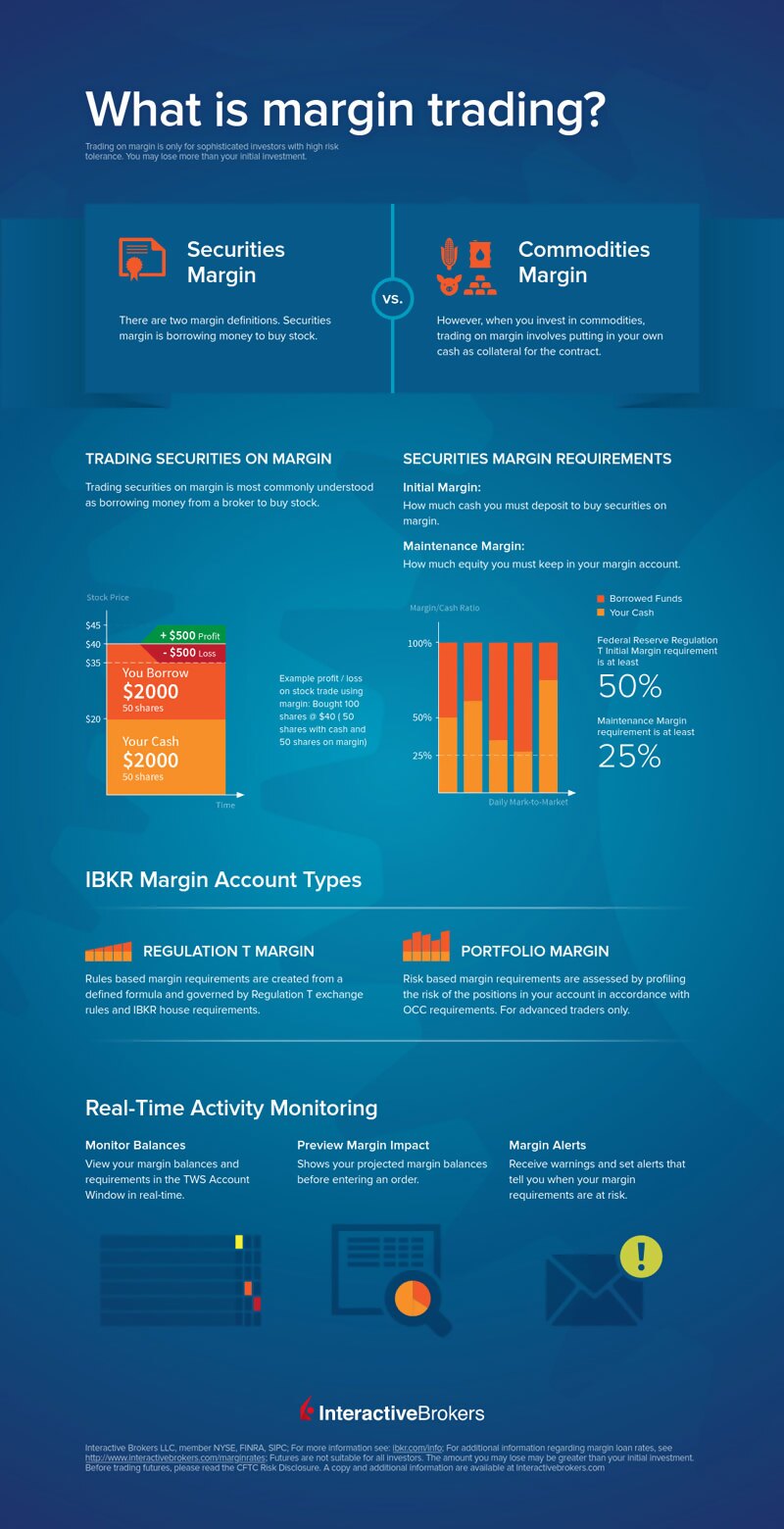

Image: www.interactivebrokers.com

Options, essentially contracts that give the holder the right – but not the obligation – to buy or sell an underlying asset at a predetermined price on or before a specific date, introduce a unique dimension to trading. Their inherent leverage allows traders to control large positions with relatively smaller capital. But this leverage also comes with increased risk, a factor amplified when margin comes into play.

Margin in Options Trading: The Basics

In essence, margin is the amount of money you deposit with your broker to secure your option positions. It serves as a safeguard against potential losses and enables you to leverage your capital. The margin requirement for options trading varies based on factors like the underlying asset, the type of option, its strike price, and the expiry date.

Types of Margin:

- Initial Margin: This is the money you need to deposit upfront to purchase or sell options contracts.

- Maintenance Margin: This refers to the minimum amount of equity you must maintain in your account to keep your position open. If your account balance drops below the maintenance margin, you may receive a margin call, requiring you to deposit additional funds.

Why Use Margin in Options Trading?

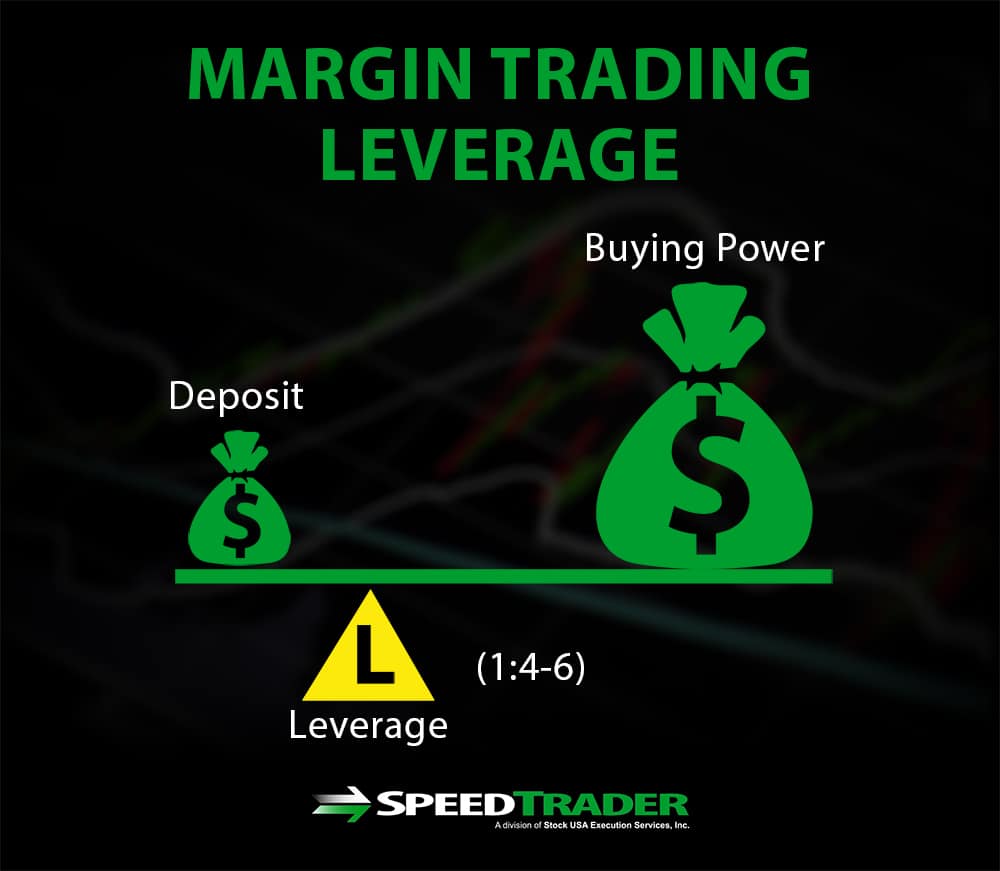

The primary reason traders utilize margin is to amplify their gains. By leveraging their initial capital, they can control larger positions, potentially magnifying profits with a successful trade. Here’s a simple example:

Suppose you want to buy 10 contracts of a call option with a strike price of $100, and the current market price of the underlying stock is $95. The margin requirement for this options trade is $1,000. However, to buy the actual underlying shares, you’d need ~$9,500 (10 contracts x 100 shares/contract x $95/share). Margin allows you to participate in the market with a significantly smaller initial investment.

Image: speedtrader.com

Understanding the Risks of Margin

The allure of magnified returns through margin comes with a caveat: amplified risks. Losses, too, can multiply. If the underlying asset moves against your position, your margin account balance may decrease. If the balance falls below the maintenance margin, the broker may liquidate your position. Losing your entire investment, or even more (margin calls can lead to losses beyond your initial margin), is a very real possibility.

Here are key risks associated with margin:

- Margin Calls: These can happen when your account balance drops below the maintenance margin. You’ll need to deposit additional funds to avoid liquidation. Margin calls can catch you off guard, particularly during volatile market conditions.

- Liquidation: If you fail to meet a margin call, the broker can liquidate your position, potentially at a loss, to cover their exposure. This can result in significant financial losses beyond your initial margin deposit.

- Large Losses: Leverage, while amplifying gains, also magnifies losses proportionally. A small movement against your position can translate into substantial losses, especially with options contracts that have a limited lifespan (expiry date).

Strategic Use of Margin in Options Trading

While margin presents clear risks, it can be a valuable tool for skilled options traders when used strategically and responsibly.

Here are some insights into prudent margin management:

- Thorough Research and Risk Assessment: Before engaging in any options trade involving margin, meticulously research the underlying asset, its historical volatility, and the potential risks. Develop a clear trading plan that defines your entry and exit points, along with your risk tolerance.

- Diversify your Portfolio: Don’t put all your eggs in one basket. Diversify your option positions across different assets, strike prices, and expiry dates to mitigate risk.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically close out positions when the price moves against you by a certain limit, helping to contain losses.

- Monitor Your Account Regularly: Continuously monitor your margin account balance, particularly during periods of market volatility. Adjust your positions accordingly to avoid margin calls.

- Gradually Increase Margin Use: Start with a smaller margin and gradually increase it as you gain more experience and confidence in your trading strategies. This approach helps minimize risk during the learning phase.

The Role of Brokers in Margin Trading

Brokers play a vital role in options trading involving margin. They establish margin requirements, monitor account balances, issue margin calls if necessary, and ultimately execute liquidation orders if you fail to meet those calls.

When choosing a broker, research their margin policies, commission rates, and overall reputation. Look for a broker with transparent margin requirements, competitive pricing, and robust risk management tools to help you navigate the complexities of margin trading.

Margin For Option Trading

Conclusion:

Margin in options trading is a powerful tool for amplifying potential returns but also increasing the risk of significant losses. Understanding its intricacies and managing it responsibly is crucial. By conducting thorough research, developing robust trading strategies, and utilizing stop-loss orders, you can harness the power of leverage while mitigating potential risks. However, remember, margin is not a quick-rich scheme or a guaranteed path to success. It requires a high level of experience, discipline, and risk management skills. If you’re new to options trading, consider starting small and slowly building your understanding and expertise before venturing into margin-based strategies.