The world of options trading is brimming with potential, offering seasoned investors attractive opportunities for substantial gains. However, the exhilaration of diving into this financial frontier is often tempered by the inherent risk involved. This is where the concept of margin comes into play, acting as a powerful yet double-edged sword that can either amplify your profits or intensify your losses. Understanding the intricacies of margin trading is paramount for navigating the dynamic landscape of options markets.

Image: www.livingfromtrading.com

Understanding Margin in Option Trading

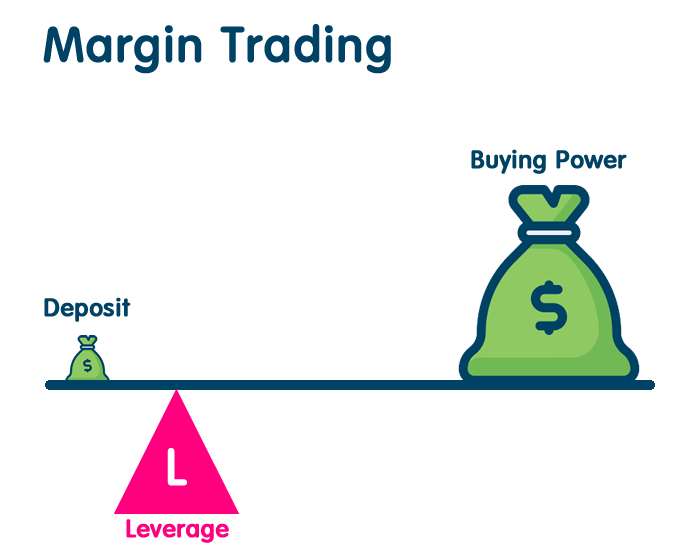

In essence, margin is a loan provided by your brokerage firm that allows you to amplify your trading power beyond the limits of your account balance. By utilizing margin, you can control a larger position in an underlying asset, potentially maximizing your returns. However, this convenience comes with a fundamental drawback: the potential for magnified losses exceeding your initial investment.

Calculating Margin Requirements

The amount of margin you are eligible for is determined by Regulation T of the Federal Reserve, which sets specific limits on margin requirements for various types of securities. These requirements vary depending on the volatility and risk associated with the underlying asset. For instance, stocks typically have lower margin requirements than options, which are inherently more speculative.

Managing Margin Risk

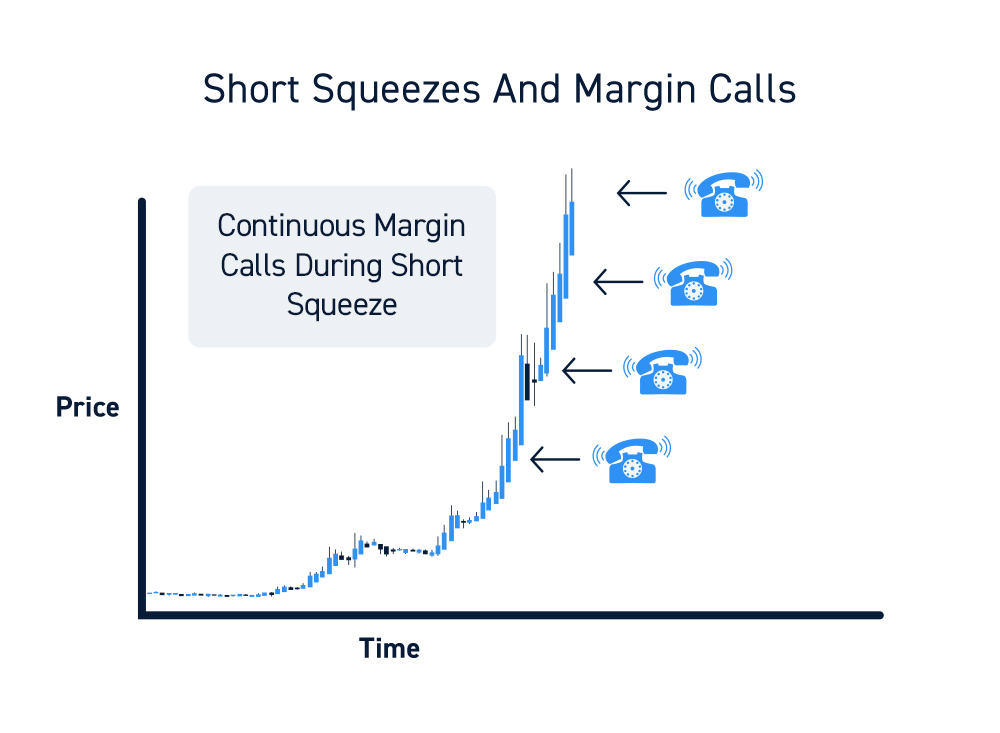

Trading on margin is a delicate balancing act that requires a keen understanding of risk management. Here are some essential considerations for responsible margin trading:

Image: centerpointsecurities.com

Maintain Adequate Equity

Your account equity acts as a buffer against market fluctuations. Maintaining sufficient equity is crucial for mitigating the impact of potential losses and avoiding margin calls.

Use Stop-Loss Orders

Stop-loss orders safeguard your investments by automatically closing out positions when they reach a predetermined price threshold. This mechanism prevents excessive losses and ensures that your risk exposure is capped.

Monitor Market Conditions

Vigilantly track market trends and volatility levels to gauge suitable margin utilization. During periods of heightened uncertainty, consider reducing your use of margin to mitigate potential risks.

Expert Insights on Option Trading Margin

“Margin trading can be a powerful tool for enhancing profitability, but it’s essential to approach it with caution,” advises Jim Cramer, financial analyst and host of CNBC’s “Mad Money.” “Traders must thoroughly comprehend the risks involved and ensure they have a sound understanding of risk management principles.”

According to veteran options trader Karen Finerman, “Successful margin trading requires discipline and strict adherence to pre-determined risk parameters. Traders should meticulously map out their strategy and have a clear plan for managing both profits and losses.”

Unlocking the Potential of Margin Trading

If you possess a solid understanding of margin trading dynamics and have a risk tolerance that aligns with this approach, then margin can be a valuable asset in your trading arsenal. Here are some actionable tips for unlocking its potential:

Start Small

Begin with modest margin utilization to minimize risk exposure until you gain confidence and proficiency.

Diversify Your Portfolio

Spread your investments across multiple positions to reduce the impact of any single trade.

Option Trading Margin

Image: www.prospertrading.com

Seek Guidance

Consult with experienced financial advisors or take courses on margin trading to sharpen your skills and gain valuable insights.

Remember, option trading should be approached with a measured and responsible mindset. Margin trading can magnify both profits and losses, so it is imperative to exercise sound judgment and adhere to established risk management practices. By thoroughly grasping the principles outlined in this comprehensive guide, you will be well-equipped to navigate the complexities of option trading margin and harness its power while safeguarding your financial integrity.