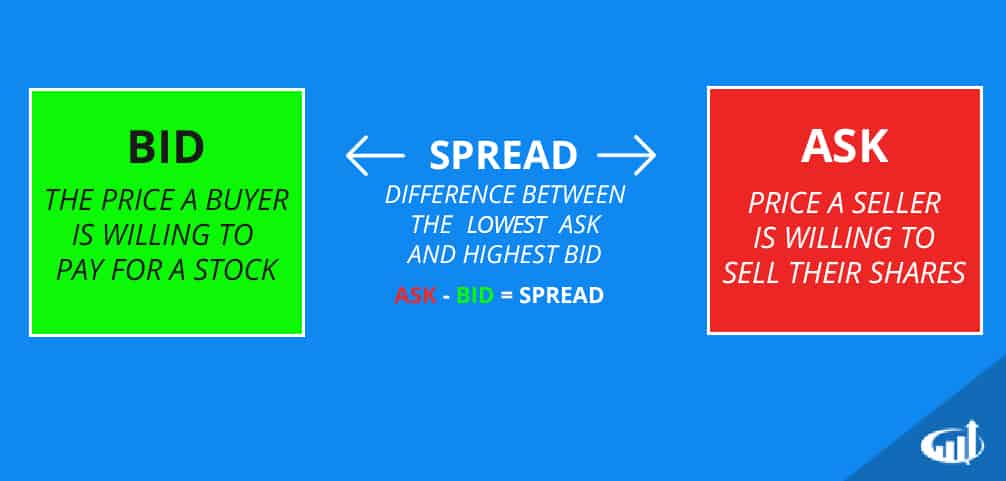

Have you ever wondered how options traders navigate the complexities of the financial markets? In the world of options trading, understanding bid-ask spreads is paramount. Bid-ask spread represents the difference between the price at which a buyer is willing to buy an option (bid price) and the price at which a seller is willing to sell (ask price). Grasping the significance of bid-ask spread is crucial for traders seeking to optimize their trading strategies.

Image: www.investorsunderground.com

Decoding Bid-Ask Options Trading

Understanding the Basics

In options trading, bid-ask spread indicates the market depth and liquidity of an option contract. It directly influences the profitability of a trade, as it determines the potential profit or loss. A wider spread implies lower liquidity, making it more challenging to execute trades at desired prices. Conversely, a narrower spread signifies higher liquidity, facilitating smoother trade executions.

Exploring the Dynamics of Bid-Ask Spreads

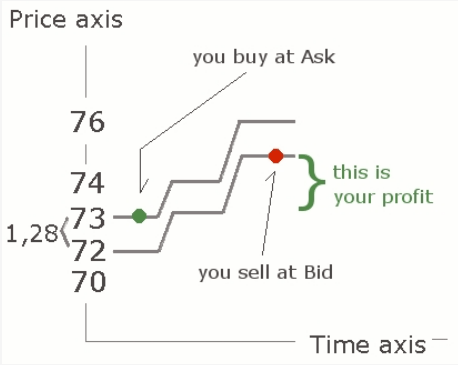

Image: learningcenter.fxstreet.com

Market Depth and Liquidity

Market depth, which refers to the availability of willing buyers and sellers, heavily influences bid-ask spreads. When there are numerous buyers and sellers actively participating in the market, liquidity is high and spreads tend to be narrower. Conversely, low liquidity, characterized by a limited number of participants, results in wider spreads.

Highly traded options, such as those on popular stocks or indices, typically exhibit narrower spreads due to the substantial liquidity. In contrast, less actively traded options often have wider spreads, reflecting their lower liquidity.

Time to Expiration

The time remaining until an option’s expiration date also impacts bid-ask spreads. Options with longer expirations generally have tighter spreads than those with shorter expirations. This is because longer-term options provide more time for price fluctuations, reducing uncertainty and making it easier for market participants to agree on prices.

Market Volatility

Market volatility, which measures the extent of price fluctuations, significantly affects bid-ask spreads. During periods of high volatility, spreads tend to widen as market participants demand a higher premium for taking on additional risk. Conversely, low volatility typically leads to narrower spreads.

Trading Tips and Expert Advice

- Monitor market depth and liquidity: Observe the number of bids and asks at various price levels to gauge liquidity. Look for options with higher liquidity and narrower spreads.

- Consider the time to expiration: Choose options with longer expirations for tighter spreads and reduced uncertainty.

- Beware of market volatility: Be cognizant of market conditions and adjust your trading strategies accordingly. During periods of high volatility, wider spreads may necessitate larger profit targets.

- Utilize limit orders: Limit orders allow you to specify the maximum price you are willing to pay (bid) or the minimum price you are willing to sell (ask). This helps prevent unfavorable executions outside your desired price range.

- Educate yourself: Stay informed about market trends, news, and economic events that may influence option prices. Knowledge empowers traders to make informed decisions.

Frequently Asked Questions

- Q: What does a wide bid-ask spread indicate?

A: A wide bid-ask spread suggests low liquidity and higher uncertainty in the market.

- Q: How can I find options with narrow spreads?

A: Look for options with higher liquidity, longer expirations, and during periods of lower volatility.

- Q: Why are some options spreads wider than others?

A: Spreads vary based on factors such as market depth, time to expiration, and market volatility.

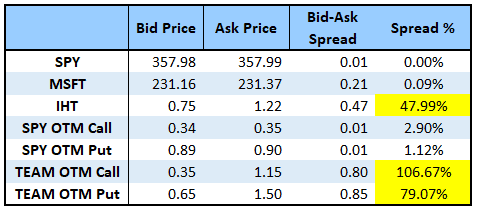

Bid Ask Options Trading

Image: optionstradingiq.com

Conclusion

Understanding the nuances of bid-ask options trading is essential for success in the financial markets. By considering market depth, time to expiration, market volatility, and utilizing effective trading strategies, traders can optimize their profit potential. If you find this article informative and are interested in delving deeper into bid-ask options trading, we encourage you to explore additional resources online and consult with a financial advisor for personalized guidance.