Introduction

In the labyrinth of financial markets, options trading stands as an alluring yet intricate realm. Amidst this tapestry of investment strategies lies American Airlines Group Inc. (AAL), whose options offer investors a compass to navigate the often-turbulent skies of equity trading. This comprehensive guide delves into the intricate world of AAL option trading, empowering you to decipher its complexities, make informed decisions, and soar towards financial success.

Deciphering AAL Options

At the heart of AAL option trading lies the fundamental concept of an option contract. These versatile instruments grant the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific number of shares of AAL stock at a predetermined price (known as the strike price) on or before a specified date (known as the expiration date). While options trading involves substantial rewards, it also carries inherent risks, making it imperative to approach this arena with a measured mindset and a comprehensive understanding of its intricacies.

Understanding the Dynamics of AAL Options

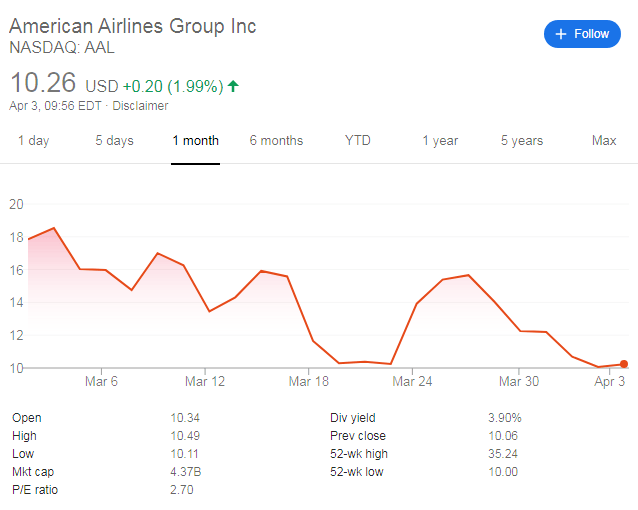

To thrive in the dynamic world of AAL option trading, it’s essential to master the interplay of various factors that shape their value and behavior. Key among these are the stock price, the strike price, the expiration date, and the level of volatility. By carefully considering each element’s impact, traders can enhance their ability to craft astute trading strategies.

Striking a Profitable Accord

Unlocking the true potential of AAL option trading lies in the strategic execution of well-defined strategies. Whether aiming to capitalize on bullish or bearish market sentiments, there’s a wealth of tactics to explore. Call options, particularly, prove a popular choice for traders seeking to capture stock price appreciation, while put options empower investors to safeguard their portfolios against potential market downturns.

The Power of Volatility: A Double-Edged Sword

Volatility, a measure of stock price fluctuations, plays a profound role in the realm of AAL option trading. While increased volatility generally translates into higher option premiums, it also magnifies potential risks. Traders must exercise caution when navigating this terrain, as excessive volatility can lead to substantial losses.

Risk Management: The Cornerstone of Success

Embarking on the journey of AAL option trading demands a steadfast commitment to risk management. This multifaceted approach involves implementing prudent strategies to mitigate potential losses while preserving the sanctity of your investment capital. Among the most effective risk management techniques are diversification, position sizing, and leveraging stop-loss orders.

Conclusion

Unveiling the intricacies of AAL option trading presents both challenges and opportunities for discerning investors. By embracing a thorough understanding of this complex arena, you can unlock the potential for financial rewards. However, it’s paramount to approach this endeavor with a measured mindset, a keen eye for risk management, and a commitment to continuous learning. As you delve deeper into the captivating world of AAL option trading, you’ll discover a realm where strategic acumen, calculated risk-taking, and the pursuit of financial success converge.

Image: www.fxstreet.com

Image: www.fool.com

Aal Option Trading