Introduction

Delving into the realm of options trading often necessitates navigating a multitude of brokerage platforms, each boasting unique features and offerings. Choosing the optimal brokerage for your trading needs can make all the difference in your success. In this comprehensive guide, we will delve into the nuances of options trading brokerages, comparing their offerings and equipping you with the knowledge to make an informed decision tailored to your specific requirements.

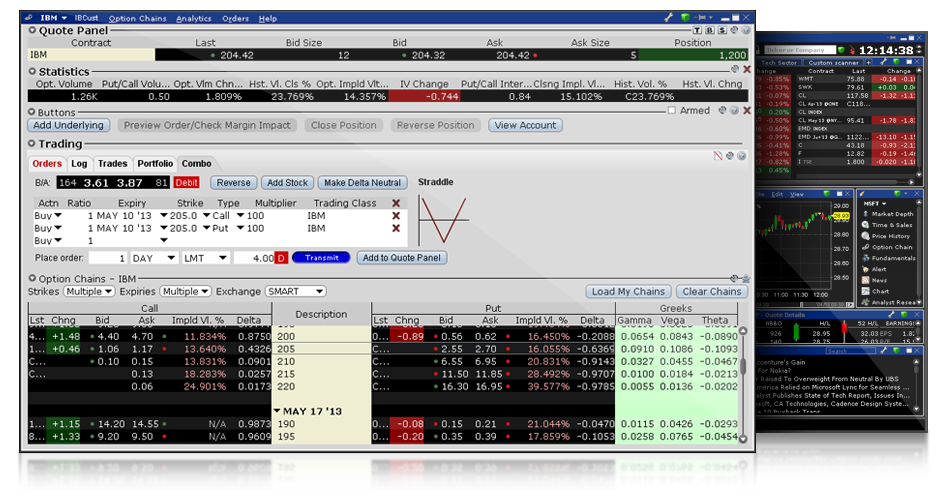

Image: www.interactivebrokers.com

Unveiling the Options Trading Arena

Options trading involves contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. These contracts provide traders with flexibility, enabling them to strategize their trades and potentially mitigate risk. Recognizing the importance of choosing a suitable brokerage, this guide will provide invaluable insights into the key factors to consider.

Platform Functionality: A Trader’s Lifeline

The foundation of any options trading experience lies in the brokerage platform. Intuitive platforms streamline the trading process, facilitating seamless order placement and real-time market analysis. Look for brokerages that offer user-friendly interfaces, robust charting tools, and advanced order types that cater to your specific trading style. Consider the platform’s ease of use, especially if you are a novice trader, and opt for brokerages that provide educational resources and support to enhance your trading acumen.

Fees and Commissions: Unveiling the Hidden Costs

Transaction costs can significantly impact your profitability, so it’s crucial to scrutinize the fees and commissions charged by different brokerages. These may vary depending on the type of options contract, the number of contracts traded, and the trading platform used. Evaluate the fee structure thoroughly and select a brokerage that aligns with your trading volume and budget. Opt for brokerages that offer transparent fee schedules, avoiding hidden charges that can erode your returns.

Image: www.pinterest.de

Market Depth and Liquidity: Ensuring Trade Execution

Market depth refers to the volume of orders at various price levels, indicating the availability of buyers and sellers. Liquidity is the ease with which an asset can be bought or sold without significantly affecting its price. Opt for brokerages connected to multiple exchanges, providing access to deep and liquid markets, ensuring swift trade execution and minimizing slippage, the difference between the intended and actual trade price. High liquidity is particularly crucial during volatile market conditions, allowing you to enter and exit positions efficiently.

Research and Analysis: Empowering Informed Decisions

Trading successfully hinges on informed decisions, and access to comprehensive research and analysis tools can empower you in navigating the complex options market. Seek brokerages that provide real-time market data, in-depth market analysis, and educational resources to stay abreast of market trends and make well-informed trading decisions. Look for platforms that offer charting capabilities, technical analysis tools, and economic calendars to enhance your understanding of market dynamics and identify potential trading opportunities.

Customer Support: A Lifeline in Turbulent Markets

Inevitably, you may encounter challenges or have queries during your trading journey. Swift and reliable customer support can make all the difference in resolving issues and ensuring a smooth trading experience. Evaluate the brokerages’ responsiveness, support channels, and availability during market hours. Consider brokerages that offer multiple support channels, such as phone, email, live chat, and comprehensive online support documentation, providing peace of mind and timely assistance when you need it most.

Account Types and Margin Trading: Tailoring to Your Needs

Different brokerages offer a range of account types, including cash accounts, margin accounts, and individual retirement accounts (IRAs). Each account type has its own characteristics and tax implications. Cash accounts require you to have the full value of the contract in your account before trading, while margin accounts allow you to borrow funds from the brokerage to increase your purchasing power. Carefully consider your trading style and financial situation when selecting the appropriate account type.

Security and Regulation: Shielding Your Assets

The security of your funds and personal information is paramount. Opt for brokerages regulated by reputable financial authorities, ensuring compliance with strict industry standards and safeguarding your assets. Evaluate the brokerages’ security measures, including encryption protocols, two-factor authentication, and data protection mechanisms, to protect your sensitive information and prevent unauthorized access. Seek brokerages with a proven track record and positive user reviews regarding their security practices.

Options Trading Brokerage Comparison

Image: www.msn.com

Conclusion

Choosing the right options trading brokerage is a critical decision that can significantly impact your trading success. By thoroughly evaluating the factors outlined in this comprehensive guide, you can identify the brokerage that best aligns with your trading style, needs, and preferences. Remember to conduct thorough research, compare various platforms, and prioritize brokerages that provide a user-friendly interface, competitive fees, ample market depth and liquidity, robust research tools, reliable customer support, suitable account types, robust security measures, and regulatory compliance.