In today’s dynamic financial landscape, option trading has emerged as a compelling strategy for discerning investors seeking to navigate the ebb and flow of the markets. Amidst the myriad of trading options available, Nifty Bank options stand out as a particularly lucrative and versatile instrument. Join us as we embark on an immersive exploration into the captivating world of Nifty Bank option trading, empowering you with the knowledge and insights to unlock its transformative potential.

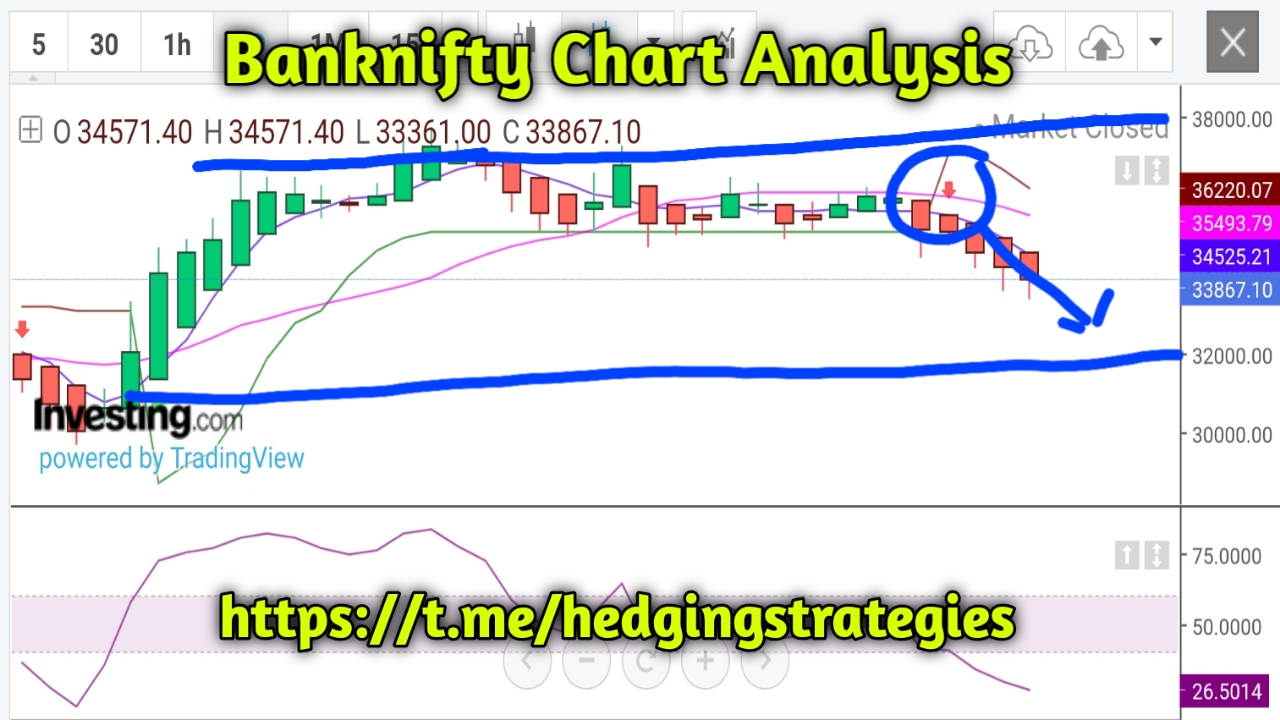

Image: hedgingstrategies.in

Defining Nifty Bank Options: A Gateway to Market Opportunities

Nifty Bank options are financial instruments that derive their value from the underlying Nifty Bank index, a benchmark that tracks the performance of the top 12 banking stocks in India. By engaging in Nifty Bank option trading, investors gain the ability to speculate on the future direction of the index, presenting an attractive opportunity to profit from market movements without requiring direct ownership of the underlying stocks.

Unlocking the Mechanics of Nifty Bank Option Trading

At the heart of Nifty Bank option trading lies a fundamental concept: the option contract. This contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) a predefined quantity of the underlying Nifty Bank index at a predetermined price (strike price) on a specific date (expiration date). This flexibility empowers investors to tailor their strategies to align with their market outlook and risk tolerance.

The Intricate Dance of Call and Put Options

Call options bestow upon the buyer the right to purchase the underlying Nifty Bank index at the strike price on or before the expiration date. These options are ideal for investors anticipating an uptrend in the index, as they stand to profit if the index price exceeds the strike price. Conversely, put options provide the buyer with the right to sell the index at the strike price. These options are favored by investors expecting a downtrend, allowing them to benefit from a decline in the index’s value.

Image: www.investarindia.com

Unveiling the Greeks: Deciphering Market Dynamics

In the realm of option trading, understanding the “Greeks” is paramount for gauging risk and potential returns. These mathematical metrics quantify how various factors, such as changes in the underlying index price, time decay, and interest rates, impact the value of an option contract. By decoding the Greeks, investors can make informed decisions about which options to trade and how to manage their positions.

Decoding the Impact of Volatility and Time Decay

Volatility, a measure of price fluctuations, plays a pivotal role in option pricing. Higher volatility generally translates to higher option premiums, as investors demand compensation for the increased risk. Time decay, on the other hand, refers to the erosion of an option’s value as it approaches its expiration date. This natural phenomenon underscores the importance of timing in option trading.

Mastering Risk Management: Strategies for Market Success

Disciplined risk management lies at the core of successful option trading. By employing prudent stop-loss orders, position sizing techniques, and hedging strategies, investors can mitigate potential losses and preserve capital. A comprehensive understanding of risk management principles is essential to navigate the inevitable ups and downs of the financial markets.

Unveiling Expert Insights: Navigating Market Complexities

Seeking guidance from seasoned experts can illuminate the path to successful Nifty Bank option trading. Their insights, honed through years of experience, provide valuable perspectives on market trends, option strategies, and risk management best practices. By tapping into the wisdom of experts, investors can enhance their decision-making and improve their chances of achieving their financial goals.

Empowering Action: Leveraging Nifty Bank Options for Financial Success

Armed with the knowledge and insights gleaned through this deep dive, investors can confidently explore the realm of Nifty Bank option trading. By understanding the mechanics of options, deciphering the Greeks, and implementing effective risk management strategies, they can harness the potential of this versatile instrument to navigate market complexities and unlock financial opportunities.

Option Trading Nifty Bank

Conclusion: A Path Paved with Empowerment

Nifty Bank option trading presents a captivating arena for discerning investors seeking to augment their financial acumen and capitalize on market movements. Through this comprehensive guide, we have shed light on the intricacies of this trading strategy, empowering readers with the knowledge and insights necessary to embark on their own trading journeys. Remember, the path to successful option trading is paved with continuous learning, sound decision-making, and prudent risk management. We encourage you to delve deeper into the world of Nifty Bank options, seize the opportunities it presents, and witness firsthand its transformative potential in your financial endeavors.