A Personal Journey into the World of Options

As an avid investor, I was intrigued by the potential returns promised by options trading. However, I quickly realized that the complexities of this market warranted a deeper understanding. Embarking on a journey to demystify options, I spent countless hours researching, attending workshops, and consulting with experts. The knowledge I gained propelled me to share my insights with fellow investors seeking to navigate the enigmatic world of options.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Use_a_Moving_Average_to_Buy_Stocks_Jun_2020-02-85609403fbee41089d13a9ffa649bdac.jpg)

Image: leadsplora.weebly.com

Understanding Options Trading: What It Is and How It Works

Options contracts, simply put, are financial agreements that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price and within a defined time frame. These contracts are traded on futures exchanges and classified into two primary types: calls and puts. A call option gives the holder the right to buy an asset at a predetermined price, while a put option offers the right to sell.

The value of options contracts fluctuates based on factors such as the price of the underlying asset, time to expiration, interest rates, and market volatility. This dynamic nature presents both opportunities and risks for traders.

Latest Trends and Developments in Options Trading

The realm of options trading is constantly evolving, propelled by technological advancements and market innovations. One notable trend is the rise of exchange-traded funds (ETFs) and exchange-traded notes (ETNs) linked to options. These instruments provide investors with diversified exposure to options strategies, reducing individual contract risk.

Tips and Strategies for Success in Options Trading

Seasoned options traders have honed their strategies and developed valuable insights to enhance their success rates. Among the most effective approaches are:

- Risk Management: Implementing a comprehensive risk management strategy is paramount. This includes selecting trades aligned with one’s risk tolerance, allocating capital wisely, and employing stop-loss orders.

- Understanding Volatility: Gaining a firm grasp of market volatility is crucial. Options contracts become more valuable as volatility increases, while low volatility can erode their value. Studying historical volatility patterns and market indicators aids in anticipating price movements.

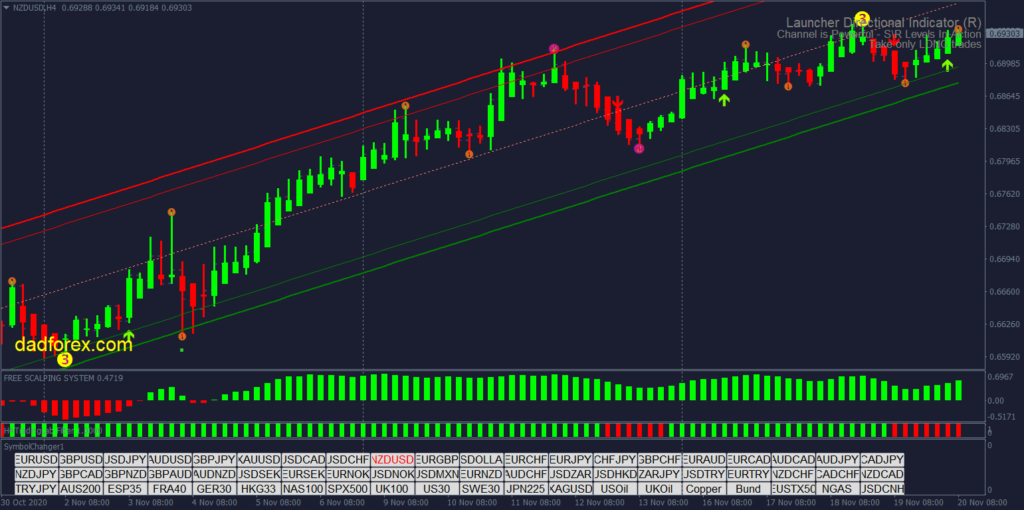

- Technical Analysis: Studying price charts and using technical indicators can provide valuable insights into potential market trends. These techniques assist traders in identifying support and resistance levels, gauging momentum, and spotting trading opportunities.

Image: dadforex.com

Frequently Asked Questions on Options Trading

Q: How do I get started with options trading?

A: Opening an account with a brokerage firm that offers options trading is the first step. Once your account is established, educate yourself on options concepts, strategies, and risk management.

Q: What are the best options strategies for beginners?

A: Covered calls, cash-secured puts, and bull and bear credit spreads are considered suitable strategies for novice traders. These strategies involve lower risk and can generate income over time.

Q: How can I mitigate the risks involved in options trading?

A: Proper risk management is essential. Diversify your portfolio by trading multiple options contracts, set stop-loss orders, and avoid overtrading.

2000 For Option Trading

Conclusion: Empowering Investors with Knowledge

In the realm of investing, knowledge is power. This article aimed to elucidate the intricacies of 2000 for option trading, providing readers with a solid foundation to embark on their own options trading journey. Remember, understanding the market, implementing sound strategies, and managing risks are crucial for success. As you delve deeper into the world of options, stay informed about industry updates and seek mentorship from experienced traders.

Are you eager to continue exploring the fascinating world of 2000 for option trading? Your comments and questions are welcome below. Together, let’s unlock the potential of options and achieve financial success.