Title: Options Trading Tips: Strategies for Success in the NSE

Image: squareoff.in

In today’s volatile market, understanding options trading has become an invaluable skill for investors seeking to maximize their returns and mitigate potential losses. The National Stock Exchange (NSE) of India offers a wide array of options contracts, providing traders with ample opportunities to capitalize on market fluctuations.

Combining theoretical knowledge with practical guidance, this article delves into the nuances of options trading in the NSE, empowering readers with proven strategies, expert insights, and actionable tips for enhancing their trading outcomes.

Understanding Options Trading

Options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility offers traders the potential for both profit and loss, depending on whether the underlying asset’s price moves in line with or counter to their predictions.

Key Options Trading Concepts

- Call option: Gives the holder the right to buy an underlying asset at the strike price on or before the expiration date.

- Put option: Gives the holder the right to sell an underlying asset at the strike price on or before the expiration date.

- Premiums: The cost of purchasing an options contract is known as the premium.

- Time value: The value of an option contract decreases as it approaches its expiration date.

- Intrinsic value: The difference between the strike price and the spot price of the underlying asset.

- Out of the money: An option with a strike price that is significantly different from the current spot price of the underlying asset.

- In the money: An option with a strike price that is within a small range of the current spot price of the underlying asset.

Image: www.pinterest.com

Tips for Trading Options Effectively

- Define Your Trading Objectives: Determine your financial goals, risk appetite, and time horizon before initiating any option trades.

- Thoroughly Research the Underlying Asset: Analyze the historical performance, future prospects, and market sentiment surrounding the underlying asset to make informed decisions.

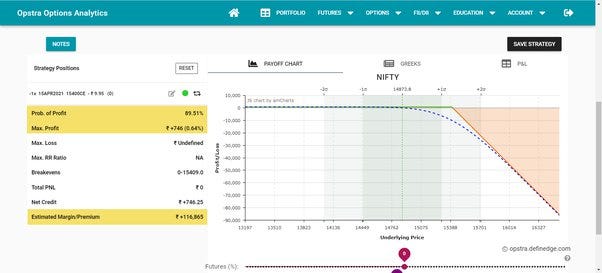

- Understand Greek Letters: Greek letters are metrics that quantify the risk and reward associated with options. They include delta, gamma, theta, vega, and rho.

- Manage Risk Wisely: Options trading can be highly leveraged, so it’s crucial to use position management techniques to minimize losses and protect your capital.

- Consider Hedging Strategies: Options can be used to hedge against market fluctuations or protect existing positions.

- Stay Informed: Regularly monitor market news and company-specific developments that could affect your options positions.

- Utilize Volatility: Options offer the potential to profit from market volatility. Use volatility indicators to assess market trends and adjust your trading strategy accordingly.

Expert Insights

“Options trading is a powerful tool for risk management and enhancing returns. By understanding the key concepts, managing risk effectively, and staying informed, you can unlock the potential of the options market,” says leading options expert and market advisor, Ms. Ayesha Khan.

Options Trading Tips Nse

Image: omosajuze.web.fc2.com

Conclusion

Options trading in the NSE is a complex yet rewarding endeavor for knowledgeable and strategically-minded investors. Embracing the insights and actionable tips outlined in this article will equip you with the tools and know-how to navigate the ever-changing market landscape, make informed trading decisions, and maximize your trading outcomes. Remember to tread cautiously, manage risk responsibly, and continually seek knowledge to stay ahead in the dynamic world of options trading.