Introduction: Understanding Stop Loss in Option Trading

As a beginner in option trading, it’s crucial to grasp the concept of stop loss. Stop loss is a risk management technique employed to limit potential losses from trades. In Zerodha, the leading trading platform in India, traders can utilize stop loss orders to safeguard their investments.

Image: www.adigitalblogger.com

In this article, we’ll delve into the intricacies of stop loss in Zerodha option trading, encompassing its importance, nuances, and effective implementation. By the end, you’ll be equipped with the knowledge and strategies to implement stop loss effectively, enhancing your risk management skills and maximizing trading efficiency.

Mechanism of Stop Loss Orders

A stop loss order at Zerodha is a contingent order that triggers an automatic trade execution when the price of an underlying asset reaches a predetermined level. This level is known as the stop price. When the stop price is reached or breached, a stop loss order converts into a market order and liquidates the trader’s position.

Types of Stop Loss Orders

Zerodha offers two types of stop loss orders, catering to different trading strategies and risk profiles:

- Normal stop loss order: Triggers a trade execution when the stop price is reached or exceeded.

- Bracket order: Combines a stop loss order with a target order. Once executed, a bracket order simultaneously places a stop loss and a target order, defining both the potential loss and profit levels.

Implementing Stop Loss in Zerodha Option Trading

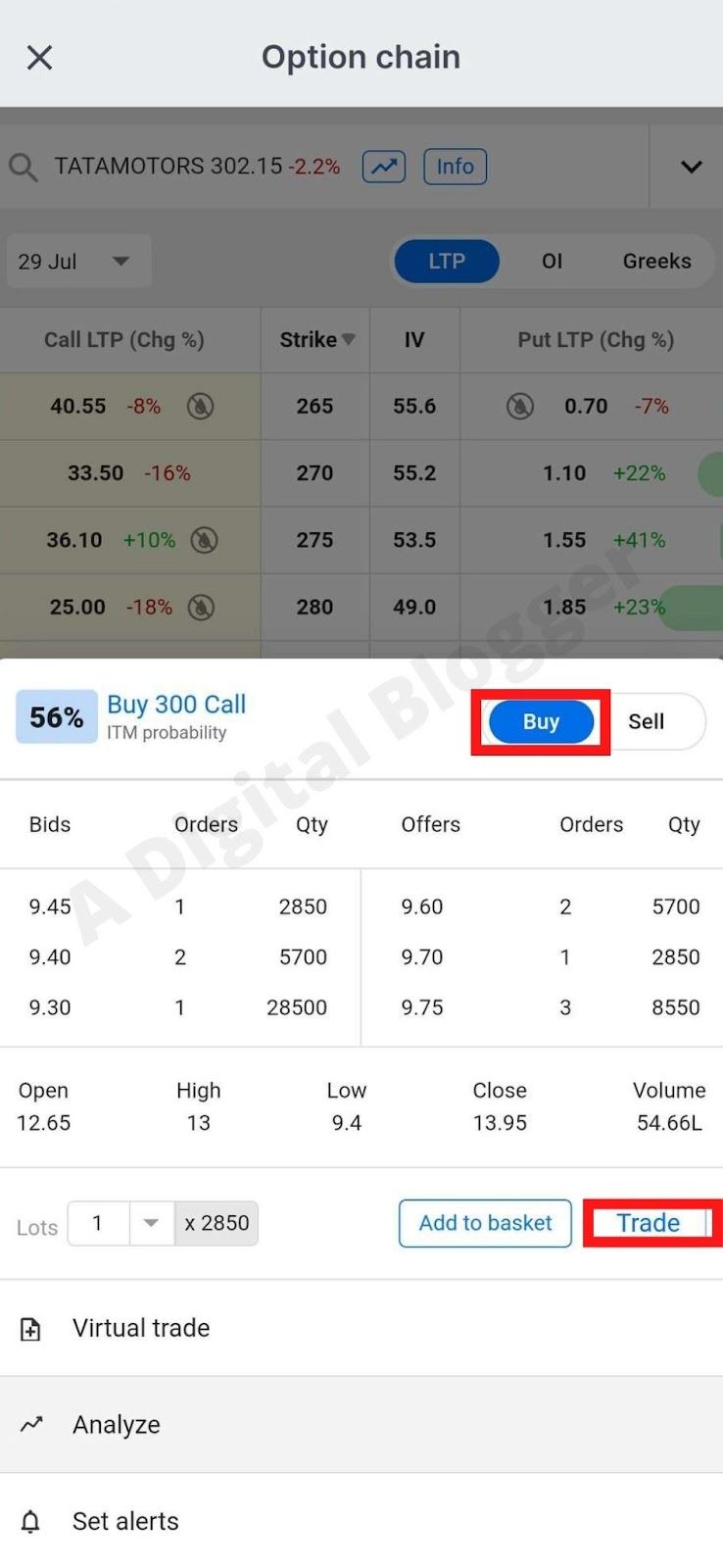

Setting stop loss orders in Zerodha is straightforward, following these steps:

-

Log in to your Zerodha trading account

-

Select the option chain for the underlying asset you wish to trade

-

Enter the contract quantity, strike price, and expiry date

-

Under the “Order Type” tab, select either “Normal” or “Bracket” for stop loss

-

Specify the stop loss price

-

Review the order details and confirm the trade

Image: tradingqna.com

Advantages of Using Stop Loss in Zerodha Option Trading

-

Prevents catastrophic losses: Stop loss orders act as safety nets, preventing significant asset devaluation by automatically liquidating positions when predefined thresholds are met.

-

Preserves capital: By minimizing losses, stop losses protect trading capital and enhance the longevity of trading endeavors.

-

Promotes disciplined trading: Implementing stop loss orders instills discipline by enforcing adherence to predefined risk parameters, preventing emotional decision-making during market volatility.

-

Improves risk-reward ratio: Stop losses optimize the risk-reward ratio by limiting the potential downside while allowing for profit maximization within predetermined boundaries.

Expert Tips for Effective Stop Loss Placement

-

Set realistic stop levels: Avoid placing stop loss orders too close to the current price, as this can lead to unnecessary trade disruptions. Ensure the stop price is a reasonable distance away to accommodate potential price fluctuations.

-

Consider market volatility: Market volatility influences stop loss placement. In volatile markets, wider stop levels may be appropriate to prevent premature order executions.

-

Evaluate technical indicators: Leverage technical analysis tools like support and resistance levels and moving averages to determine optimal stop loss placement.

-

Monitor and adjust: Regularly review your open positions and adjust stop loss levels as market conditions change.

FAQs on Zerodha Option Trading Stop Loss

Q: Can stop loss orders protect against all losses?

A: While stop loss orders mitigate downside risk, they cannot entirely prevent losses in highly volatile markets.

Q: Is it necessary to use stop loss orders in every trade?

A: While Stop loss orders are advantageous, they may not be suitable for all trading strategies. Discretion should be exercised based on the trader’s risk tolerance and trading style.

Q: Can I place multiple stop loss orders for a single position?

A: Yes, Zerodha allows you to place multiple stop loss orders for a single position to implement complex risk management strategies.

Q: What happens if the stop loss price is not reached before the expiry date

A: If the stop loss price is not reached before the expiry date, the stop loss order will expire worthless.

Zerodha Option Trading Stop Loss

https://youtube.com/watch?v=XpUhj9oZQmg

Conclusion: Empowering Risk Management with Stop Loss

Incorporating stop loss orders into your Zerodha option trading empowers you with strategic risk management techniques. By limiting potential losses, optimizing the risk-reward ratio, and instilling discipline, stop loss orders play a pivotal role in preserving trading capital and enhancing trading efficiency. Remember, the effectiveness of stop loss orders lies in their judicious placement and monitoring, allowing you to trade with confidence while mitigating risks.

We encourage you to explore and implement stop loss orders in your trading and witness their transformative impact on your risk management strategy. Are you ready to harness the power of stop loss and elevate your trading performance?