Imagine the thrill of predicting the future, of knowing when a stock will surge or plummet – that’s the allure of options trading. It’s a high-stakes game, where profits can soar, but losses can sting. To navigate this complex world, a trusty tool becomes essential: the options trading spreadsheet.

Image: db-excel.com

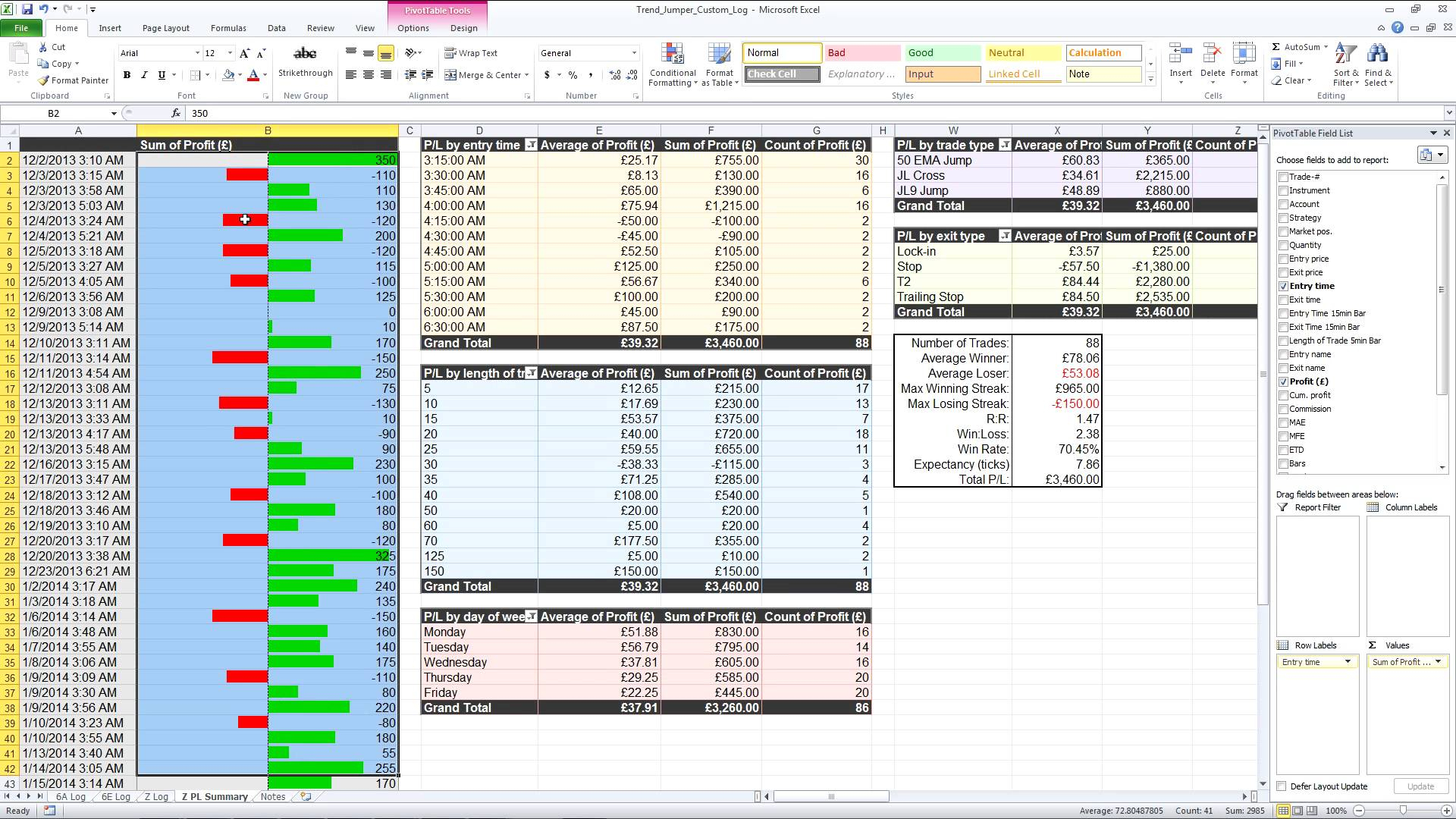

A well-crafted options trading spreadsheet isn’t just a fancy table; it’s your strategic command center. It empowers you to analyze potential plays, calculate risks, and manage your portfolio with precision. This comprehensive guide will equip you with the knowledge to wield this powerful tool, turning you into a more informed and confident options trader.

Decoding the Spreadsheet: Unveiling the Basics

Before we dive into the intricacies of crafting your spreadsheet, let’s break down the fundamental concepts behind options trading:

- Call Options: These give you the right, but not the obligation, to BUY an underlying asset at a specified price (strike price) on or before a specific date (expiration date). You profit when the asset price rises above the strike price.

- Put Options: These grant you the right, but not the obligation, to SELL an underlying asset at a specified price (strike price) on or before a specific date (expiration date). You profit when the asset price falls below the strike price.

Now, let’s dissect the key components of your options trading spreadsheet, those columns that hold the secrets to profitable strategies:

Pillars of your Spreadsheet: Essential Columns

Your spreadsheet is like a canvas, and the columns are your brushes, painting a picture of your trading plan. Here’s a breakdown of the essential columns that must be included:

- Symbol: The ticker symbol of the underlying asset you’re trading (e.g., AAPL, TSLA). This simplifies your analysis and ensures you’re tracking the correct asset.

- Expiration Date: The date when your option contract expires. This is crucial for determining the time remaining in your position and assessing time decay (theta).

- Strike Price: The price at which you can buy or sell the underlying asset (depending on the type of option). This defines your profit/loss potential.

- Option Type: Whether it’s a call or a put option. This determines the direction you’re betting on (up or down).

- Premium: The price you pay to buy the option contract. This is your initial capital investment.

- Breakeven Price: The point where your option contract becomes profitable. This is calculated based on the strike price, premium, and option type.

- Max Profit/Loss: The maximum potential profit or loss you can experience on the option. This is determined by the strike price, premium, and the underlying asset’s movement.

- Position Size (Shares): The number of contracts you’re buying or selling. This directly impacts your overall profit/loss potential.

- Current Price: The current market price of the underlying asset. This is crucial for tracking the option’s value and making real-time adjustments to your strategy.

- Theoretical Value (IV): The implied volatility of the option. This reflects the market’s expectation of price movement in the underlying asset. Higher implied volatility means potentially higher profits/losses.

- Days to Expiration: The number of days remaining until the option expires. This is important for gauging time decay, as options lose value over time.

- Entry Date: The date you entered the position. This helps track your trading performance and analyze your strategies over time.

- Exit Date: The date you exited the position. This provides you with a complete picture of your investment duration and overall profitability.

- Profit/Loss: The actual profit or loss you’ve realized on the position. This is based on the entry price, exit price, and the option contract’s details.

Building your Arsenal: Crafting the Spreadsheet

Now that we’ve uncovered the essential components, it’s time to construct your options trading spreadsheet. There are several avenues you can take:

- DIY Approach: Dive deep into Excel or Google Sheets. You’ll have total control over customization. This option requires basic spreadsheet knowledge and a bit of time to create your perfect setup.

- Online Templates: Numerous websites offer free or paid options trading spreadsheet templates. These often come with pre-built formulas and calculations, saving you time and effort. However, you may have less flexibility in tailoring them to your specific needs.

- Dedicated Platforms: Trade platforms like Thinkorswim and Interactive Brokers offer built-in spreadsheet tools and real-time data integration. This streamlines your process but may come with a subscription fee.

Whether you forge your spreadsheet from scratch or utilize existing templates, remember the following core principles:

- Organization: Keep your spreadsheet neat and well-organized. This enhances readability and makes it easier to analyze your trades. Use color-coding, formatting, and clear labels.

- Automation: Leverage formulas and functions to automate calculations. This frees you from manual calculations and reduces the risk of human error.

- Dynamic Updates: Link your spreadsheet to external data sources like real-time price feeds. This ensures your data is up-to-date and your analysis is accurate.

Image: db-excel.com

Beyond the Basics: Expanding Your Arsenal

As your trading experience grows, so too should your spreadsheet’s capabilities. Here are some advanced features to consider adding:

- Backtesting: Implement historical data to simulate past trades. This helps you assess your strategies’ profitability and identify potential weaknesses.

- Risk Management: Integrate stop-loss orders and position sizing rules to control potential losses.

- Portfolio Tracking: Monitor your overall portfolio performance and visualize your investment holdings.

- Real-Time Alerts: Set up alerts based on specific market conditions or price triggers to manage your positions proactively.

- Trade Journal: Document your trading decisions, rationale, and outcomes for future analysis and improvement.

Options Trading Spreadsheet

The Enduring Value: A Spreadsheet for Life

A well-crafted options trading spreadsheet isn’t just a tool; it’s an investment in your financial future. It empowers you to make informed decisions, manage risks effectively, and navigate the complex world of options trading with confidence.

As you continue to refine your spreadsheet and learn from your trading experiences, you’ll develop a deeper understanding of market dynamics and ultimately, become a more successful trader. Remember, this journey is continuous, and your spreadsheet is your constant companion, helping you navigate the exciting and sometimes challenging world of options trading.

Now, it’s your turn to take action. Start building your spreadsheet, explore different templates, and tailor the tool to fit your individual needs. And remember, every trade you make, every lesson you learn, contributes to shaping your options trading strategy – and your spreadsheet will be there to guide you along the way.