Introduction: The Art of Strategic Trading

In the fast-paced and ever-evolving world of finance, option trading has emerged as a sophisticated strategy for investors seeking to navigate market uncertainties and enhance their returns. Chatroll option trading, in particular, has gained significant traction as an innovative platform that democratizes access to advanced trading techniques. This article aims to unravel the intricacies of chatroll option trading, providing a comprehensive guide to its concepts, applications, and potential rewards.

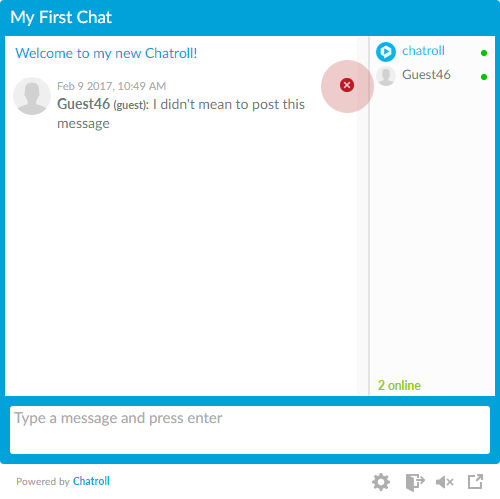

Image: support.chatroll.com

Historical Roots: A Kaleidoscope of Trading Methods

The concept of option trading has a rich history, dating back to ancient Greece. Traders have long employed options to mitigate risks and profit from market fluctuations. In the modern era, the introduction of electronic trading platforms has revolutionized the option trading landscape, making it more accessible and efficient. Chatroll, with its intuitive interface and powerful trading capabilities, has emerged as a prominent player in this transformative digital realm.

Understanding Option Trading: A Balancing Act

Options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Understanding the interplay between the option’s strike price and expiration date is crucial for making informed trading decisions.

Options come in two primary forms: calls and puts. A call option provides the holder with the right to buy an asset, while a put option provides the right to sell. The price of an option is influenced by factors such as the underlying asset’s volatility, time to expiration, interest rates, and market sentiment.

Chatroll: A Navigational Tool for Option Trading

Chatroll, recognized for its user-friendly platform, empowers traders with a comprehensive suite of tools and resources. The platform seamlessly integrates charting functions, technical indicators, and real-time market data, enabling traders to analyze market trends and identify potential trading opportunities. Additionally, Chatroll offers a vibrant community where traders can interact, share insights, and collaborate on strategies.

Image: www.tradingview.com

Key Features of Chatroll:

- Intuitive Platform: Chatroll prioritizes ease of use, allowing novice traders to quickly navigate the platform and execute trades efficiently.

- Advanced Charting Tools: Traders can leverage sophisticated charting capabilities to analyze price action, identify patterns, and make informed decisions.

- Technical Indicators: A diverse range of technical indicators is available, providing traders with valuable insights into market momentum, volatility, and trend direction.

- Real-Time Market Data: Access to real-time market data ensures that traders remain up-to-date on the latest price movements and market conditions.

- Community of Traders: Chatroll fosters a strong community of traders, promoting knowledge sharing, idea exchange, and collaboration.

Strategies for Success: Navigating the Uncertainties

Chatroll option trading offers ample opportunities for traders to develop and refine their strategies. However, success in this domain requires a thorough understanding of market dynamics, risk management techniques, and the psychological aspects of trading.

1. Risk Management: A Prudent Approach

Risk management is paramount in option trading, as it helps traders limit potential losses and preserve capital. Traders should assess their risk appetite, monitor their trading positions, and employ stop-loss orders to protect against adverse price movements.

2. Trend Trading: Riding the Market’s Momentum

Trend trading involves identifying and capitalizing on market trends. Traders can use technical analysis tools to determine the direction of a trend and position themselves accordingly. Trend trading strategies aim to capture the momentum of a trending market and maximize profits.

3. Volatility Trading: Embracing Market Fluctuations

Volatility trading exploits the price fluctuations inherent in financial markets. Traders can employ options strategies to profit from both increasing and decreasing volatility. Volatility trading requires an understanding of the factors influencing market volatility and the ability to gauge market sentiment accurately.

4. Hedging: Mitigating Risks Amidst Uncertainty

Hedging involves using options to reduce the risk exposure associated with an existing investment. Traders can combine a long position in a stock with a corresponding short position in a put option. This strategy aims to offset potential losses in the stock by profiting from the rising value of the put option in case of a market downturn.

Chatroll Option Trading

Image: www.youtube.com

Conclusion: Mastering the Market Maze

Chatroll option trading empowers traders with the tools and knowledge to navigate the complexities of financial markets. By embracing sound trading strategies, managing risks prudently, and continuously honing their skills, traders can unlock the potential of option trading and achieve their financial goals. Whether you are a seasoned veteran or an aspiring newcomer, the world of Chatroll option trading beckons, offering boundless opportunities for growth and financial empowerment.