Embarking on the journey of options trading with limited capital demands a multifaceted approach that emphasizes strategic planning and disciplined risk management. While many may assume that options trading is exclusively reserved for individuals with substantial financial resources, this misconception can be effectively challenged with the right knowledge and a well-defined strategy. This guide delves into the intricacies of options trading with limited capital, offering valuable insights to aspiring traders seeking to navigate this dynamic market successfully.

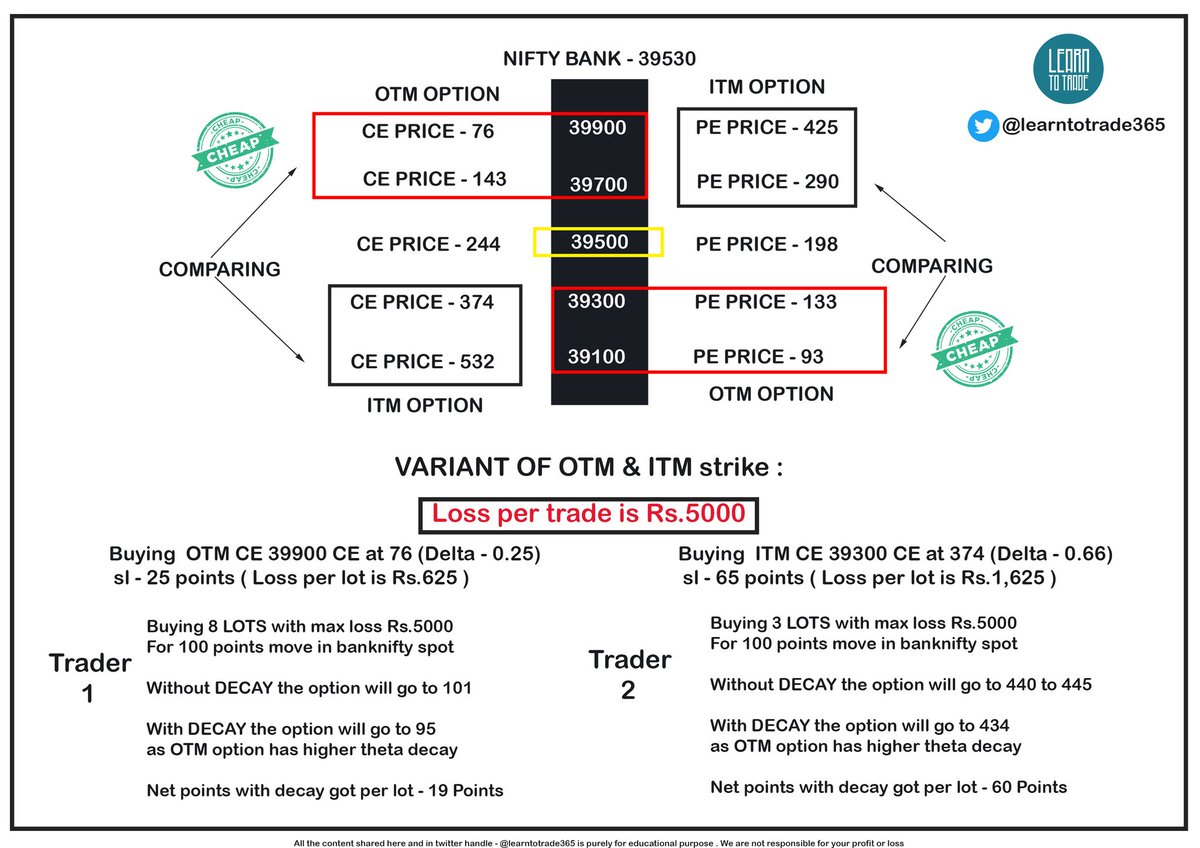

Image: en.rattibha.com

Understanding the Fundamentals

Options, derivative instruments that grant the buyer the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specified date, provide an array of opportunities for investors. However, unlike stocks or bonds, options trading involves additional layers of complexity. The critical distinction lies in their time-sensitive nature and the potential for substantial gains or losses. Before venturing into options trading, it is paramount to grasp the underlying principles, including options types, option pricing models, and trading strategies. This foundational knowledge serves as the cornerstone for informed decision-making and successful navigation of the options market.

Strategies for Trading Options with Limited Capital

With limited capital at your disposal, the judicious allocation of resources becomes paramount. Employing strategies that maximize potential returns while mitigating risk should be at the forefront of your trading endeavors. One effective approach is to focus on trading options with high implied volatility, often associated with stocks experiencing significant price fluctuations. This volatility can amplify potential profits but also magnifies risk, necessitating prudent position sizing and careful risk management practices. Additionally, selling covered calls, a strategy involving selling call options against an underlying stock you own, can generate income while limiting downside risk.

Leveraging Technology and Brokers

In the realm of options trading, technology plays an indispensable role, providing traders with a wealth of resources to enhance their decision-making process. Online trading platforms offer advanced charting tools, real-time market data, and sophisticated analysis capabilities, empowering traders to identify trading opportunities and manage their portfolios effectively. Additionally, selecting a broker that caters to options traders with limited capital is essential. Look for brokers offering low commissions, educational resources, and trading tools tailored to meet your specific needs and risk tolerance.

Image: www.icmarkets-zhe.com

Managing Risk and Discipline

Risk management is the cornerstone of successful options trading, especially when operating with limited capital. Establishing clear risk parameters, including predetermined stop-loss levels and profit targets, is crucial to safeguard your financial well-being. Discipline in adhering to these parameters, even amidst market volatility, is paramount to preventing substantial losses and preserving capital. Furthermore, it is essential to trade within your financial means, only risking capital you can afford to lose. Emotional trading, often fueled by fear or greed, can lead to impulsive decisions and significant losses.

Continual Learning and Improvement

The pursuit of options trading is an ongoing journey that necessitates continuous learning and professional development. With the constant evolution of markets and trading strategies, staying abreast of the latest trends and advancements is essential. Utilize resources such as online courses, webinars, and books to enhance your knowledge and skills. Additionally, maintaining a trading journal, meticulously recording your trades, and analyzing your performance can provide valuable insights and help identify areas for improvement.

Trading Options With Little Money

Conclusion

Trading options with limited capital is an attainable endeavor for those willing to invest the time and effort required to master this dynamic market. By thoroughly understanding options fundamentals, employing strategic approaches, leveraging technology and resources, and adhering to disciplined risk management practices, you can increase your chances of success. Remember, consistency, patience, and a continuous commitment to learning are the keys to unlocking the full potential of options trading. Embrace the challenges, learn from your experiences, and strive for continuous improvement to achieve your financial goals.