Headline: Unleashing the Power of Options Trading: A Guide to Mastering the Market

Image: es.tradingview.com

Introduction:

In the realm of investing, few things ignite excitement and trepidation like options trading. With its potential for exponential returns, it beckons to those seeking a more dynamic path to financial growth. Yet, shrouded in complexities, it can also evoke a sense of uncertainty. Enter this definitive guide, your compass through the labyrinth of options trading.

Options trading, in essence, is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This versatile tool allows investors to make calculated bets on the trajectory of markets, amplify their returns, and protect their portfolios.

Delving into Options Trading Fundamentals:

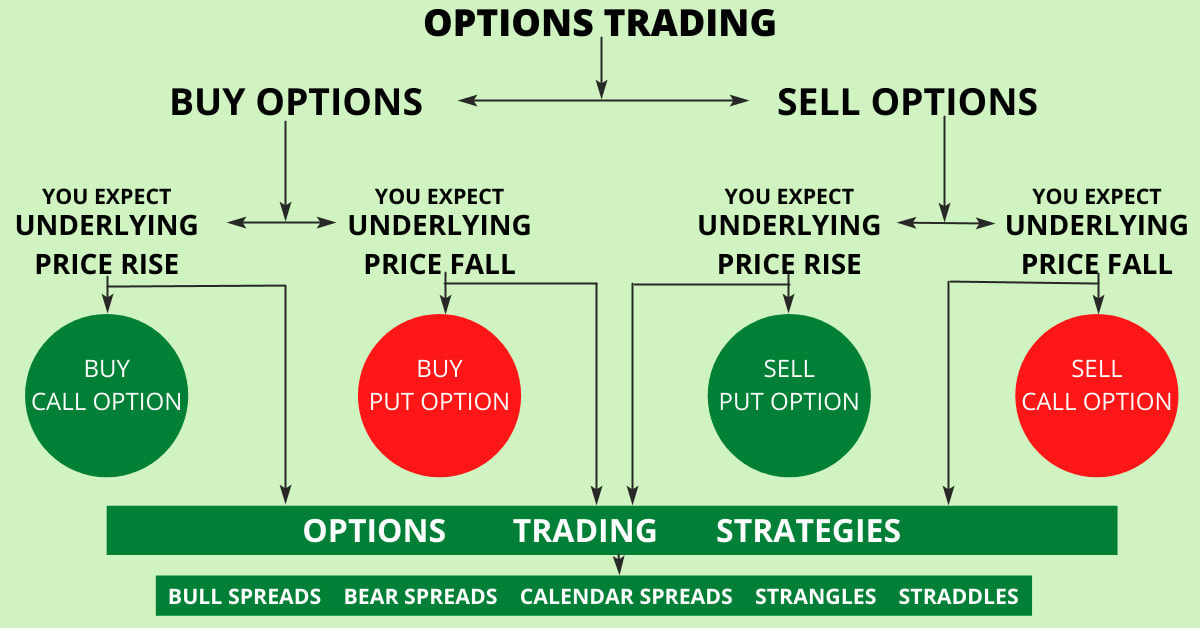

At its core, an option is a two-sided contract involving a buyer and a seller. The buyer acquires the right, while the seller assumes the obligation, to fulfill the contract’s terms. Options are classified into two primary types: calls and puts.

Call options confer upon the buyer the right to buy the underlying asset at the strike price, while put options grant the right to sell. The strike price is the predetermined price at which the underlying asset can be bought or sold, and the expiration date marks the deadline for exercising this right.

Call and Put Options in Action:

Imagine a tech stock currently trading at $100 per share. An investor who believes the stock will rise in value may purchase a call option with a strike price of $105, expiring in two months. If the stock indeed rises to $110 before expiration, the investor can exercise the call option and buy the stock at $105, even though the market price is now $110.

Conversely, if the investor expects the stock to decline, they might buy a put option with a strike price of $100. If the stock falls to $95, they can exercise the put option and sell the stock at $100, profiting from the price drop.

Managing Risk and Enhancing Returns:

Options trading offers immense potential, but it also comes with inherent risks. Managing these risks is crucial for successful trading. Employ strategies like spreading, hedging, and diversification to mitigate losses.

Moreover, options provide a unique way to enhance returns. Selling options, known as writing options, generates income through option premiums. This strategy suits investors with a well-defined risk tolerance and the ability to gauge market direction accurately.

Expert Insights and Practical Guidance:

To navigate the options market effectively, draw upon the knowledge of seasoned experts. Attend seminars, consult online resources, and consider seeking guidance from a reputable broker.

Additionally, practice simulated trading using virtual platforms before committing real capital. This allows you to experiment with different strategies and hone your skills without risking any funds.

Conclusion:

Options trading is a sophisticated tool that can unlock significant financial opportunities. By understanding its fundamentals, managing risks, and leveraging expert insights, investors can harness its power to augment their portfolios and achieve their financial aspirations.

Let this guide serve as your gateway to the world of options trading. With dedication and prudent decision-making, you can navigate the complexities of the market and reap the rewards that lie ahead.

Image: fundsmagazine.optionfinance.fr

Options Trading Lear

Image: stewdiostix.blogspot.com