In the ever-expanding financial landscape, options trading has emerged as a potent tool for investors seeking to amplify their returns and hedge against market volatility. Central to the accessibility of options trading is the advent of online platforms that offer a user-friendly and cost-effective gateway to this complex investment strategy.

Image: www.etnasoft.com

This comprehensive guide will delve into the intricacies of platform for trading options, exploring their versatility, functionality, and the key considerations for investors venturing into this dynamic realm. From navigating the platform interface to grasping advanced trading strategies, we will illuminate the intricacies of options trading, equipping you with the knowledge and confidence necessary to make informed investment decisions.

Section 1: A Beginner’s Guide to Options Trading

Options, financial instruments derived from underlying assets such as stocks, bonds, or commodities, confer the right – but not the obligation – to buy or sell the asset at a predetermined price within a specified time frame. This flexibility allows investors to capitalize on market fluctuations while limiting their potential losses.

In the case of call options, the holder possesses the right to buy the underlying asset at the strike price, while put options grant the holder the right to sell at the strike price. The premium paid to acquire the option represents the cost of this right.

Section 2: Exploring the Platform for Trading Options

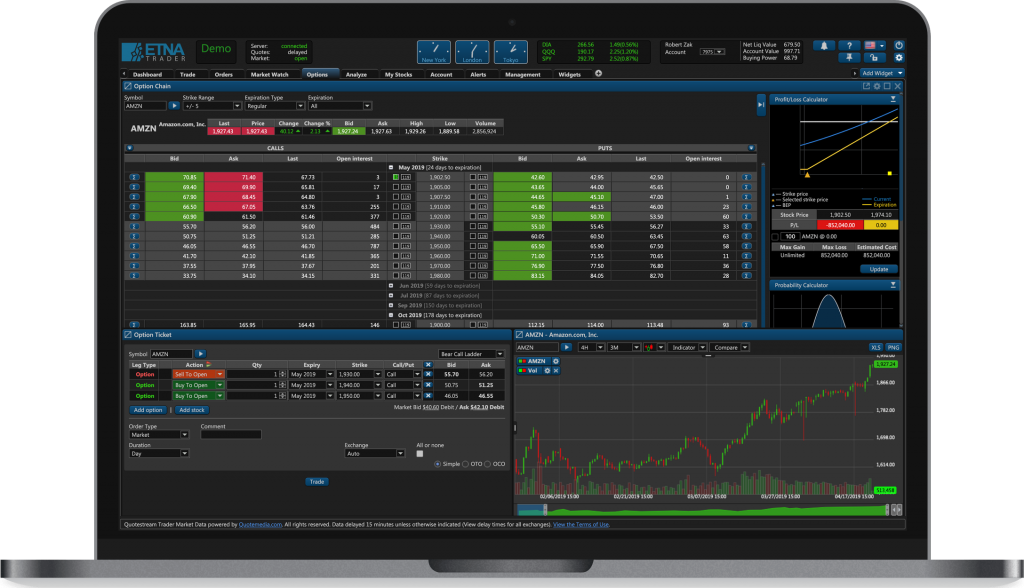

Platforms for trading options provide a comprehensive suite of tools and resources that empower investors to execute trades, monitor market conditions, and track their portfolio performance. These platforms typically offer intuitive interfaces that cater to traders of all experience levels.

Order Types: Platforms support a range of order types, enabling investors to tailor their trading strategies to specific market conditions. Limit orders allow investors to set a desired price at which the trade will be executed, while market orders execute trades immediately at the prevailing market price. More advanced order types, such as stop-loss and stop-limit orders, provide additional control over trade execution and risk management.

Trade Analysis Tools: Comprehensive charting tools and technical indicators help investors analyze market trends and identify potential trading opportunities. These tools allow traders to visualize price fluctuations, identify patterns, and make informed decisions based on historical data and market conditions.

Real-Time Market Data: Platforms provide real-time market data, including quotes, charts, and news feeds, ensuring that investors have access to the most up-to-date information. This real-time data is crucial for making informed trading decisions and reacting swiftly to market movements.

Section 3: Choosing the Right Platform for Trading Options

Navigating the myriad of platforms for trading options necessitates careful consideration of factors such as fees, trading tools, educational resources, and customer support. Evaluating these aspects will help investors select the platform that best aligns with their trading needs and preferences.

Fees: Brokerage fees associated with options trading vary, affecting an investor’s overall profitability. Comparing fees for different platforms will help investors identify cost-effective options without compromising on platform quality.

Trading Tools: The availability of sophisticated trading tools, including advanced charting techniques and customizable alerts, empowers investors to make more nuanced trading decisions. Choosing a platform that offers a robust suite of trading tools is essential for serious options traders.

Educational Resources: Educational resources, such as webinars, tutorials, and articles, play a pivotal role in enhancing investors’ knowledge of options trading strategies and risk management techniques. Platforms that provide comprehensive educational support can help investors make informed decisions and navigate the complexities of options trading.

Customer Support: Responsive and knowledgeable customer support is invaluable for addressing trading inquiries, resolving technical issues, and navigating the intricacies of options trading. Identifying platforms with reliable customer support ensures that investors have access to assistance when needed.

Image: tradewithmarketmoves.com

Platform For Trading Options

Section 4: Advanced Strategies for Options Trading

Beyond basic buy and sell orders, options trading encompasses a wide range of advanced strategies that offer investors the potential to enhance their returns or hedge against risk.