Navigating the Complex World of Futures Trading

Futures trading involves agreements to buy or sell specific assets at a predefined price and time in the future. Options on futures offer additional flexibility and risk management opportunities, allowing traders to speculate on the future direction of an underlying asset without actually having to purchase or sell it. Understanding the trading hours of these instruments is crucial for successful engagement in this dynamic market.

Image: www.top1insights.com

Overview of Options on Futures Trading Hours

Options on futures contracts typically have standardized trading hours, varying based on the underlying asset and exchange. These hours are determined by the trading exchange to facilitate efficient trading and ensure adequate liquidity during specific time slots. For instance, the Chicago Mercantile Exchange (CME) sets trading hours for futures options on stock indices like the S&P 500 and Nasdaq 100 from 8:00 AM to 3:00 PM Central Standard Time (CST) on weekdays.

Extended Trading Hours for Increased flexibility

In a bid to cater to traders’ diverse needs and provide extended market access, some exchanges have introduced extended trading hours for certain options on futures contracts. This allows traders to adjust their trading strategies to suit their schedules and market preferences. For example, CME offers extended trading hours for E-mini S&P 500 futures options from 6:00 AM to 5:00 PM CST, providing traders with extra time to react to market fluctuations.

Impact of Time Zones on Trading

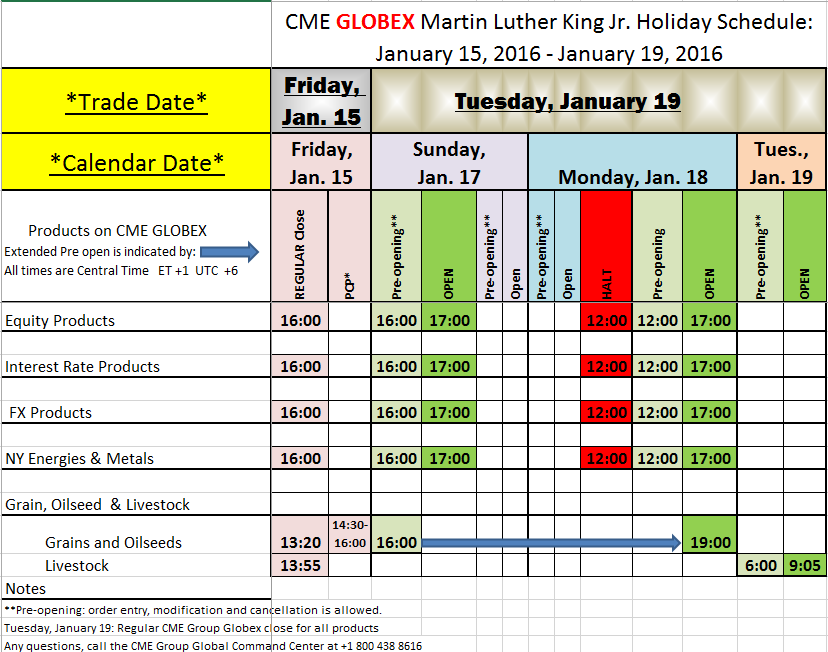

Traders must be cognizant of the time zone differences when dealing with options on futures from various exchanges. For instance, if a trader based in London wants to trade CME options on futures, they would need to consider the 6-hour time difference between CST and Greenwich Mean Time (GMT). This knowledge ensures timely entry and exit from trades to maximize profitability.

Image: www.ampfutures.com

Key considerations for Effective Trading

-

Market Volatility: Trading during peak trading hours, when liquidity is high, can help mitigate slippage risks and facilitate smooth execution of trades. However, during these times, market fluctuations tend to be more pronounced, requiring keen monitoring and risk management strategies.

-

News and Announcements: Economic data releases, corporate earnings reports, and political events can significantly impact the prices of underlying assets and their respective options. Traders should stay abreast of such events and adjust their trading strategies accordingly.

-

Trading Costs: Trading outside peak trading hours may result in higher transaction costs due to reduced liquidity. It’s essential to factor in these costs when planning trades to optimize profitability.

Expert Insights on Options on Futures Trading Hours

“Optimal trading hours for options on futures not only depend on the underlying asset but also on the trader’s risk tolerance and trading style,” says Dr. Mark Johnson, a renowned finance professor and options trading expert. “Understanding the volume and liquidity patterns during different trading hours is essential for informed decision-making.”

“Successful options traders often employ a combination of fundamental analysis and technical analysis to identify potential trading opportunities during specific trading hours,” adds Mrs. Sarah Williams, a seasoned options trader and market analyst. “By incorporating both approaches, traders can develop comprehensive trading strategies that align with market conditions.”

Actionable Tips for Effective Options on Futures Trading

-

Plan Trading Hours: Determine the trading hours that align with your schedule, risk tolerance, and strategy. Consider the liquidity, volatility, and news events during those times.

-

Monitor Market News: Stay informed about upcoming economic events and corporate announcements that may influence the underlying assets. Adjust your trading strategies accordingly.

-

Utilize Trading Tools: Employ charting software, technical indicators, and market scanners to identify trading opportunities during optimal trading hours.

Options On Futures Trading Hours

Conclusion

Options on futures trading hours play a pivotal role in the success of traders. Understanding the trading hours, taking into account market volatility, monitoring news announcements, and considering expert insights are crucial for