Have you ever wished you could harness the potential of a stock’s movement, both up and down, without the limitations of simply buying or selling? Or perhaps you’ve dreamt of amplifying your returns on a stock you believe in, while managing risk at the same time? If so, you’re not alone. The world of options trading offers investors like you a sophisticated set of tools to navigate the market with greater control and flexibility.

Image: www.tradingacademy.com

But before you dive headfirst into this exciting realm, let’s take a step back and understand what exactly options are and why they hold such allure for seasoned and novice investors alike. Options, in their simplest form, are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a predetermined price on or before a specific date. This seemingly simple concept unlocks a world of strategies, allowing you to tailor your approach to the market based on your unique risk tolerance and investment goals.

Understanding the Basics: Delving Deeper into Options

Imagine you believe a tech stock, let’s say Google (GOOG), is poised for significant growth. You could buy shares and hope for a price increase. But with options, you have more options! You could buy a call option, which gives you the right to purchase GOOG shares at a set price, say $100, within a specific timeframe, for example, the next three months. If the stock price rises above $100, you can exercise your option, buy the shares at $100, and sell them in the market at the higher price, reaping the profit.

Now, let’s say you’re more cautious and see a potential dip in the market. You could buy a put option, granting you the right to sell GOOG shares at a set price, $110, within a specific period, say the next month. If the stock price dips below $110, you can exercise your option, sell the shares at $110, and profit from the difference.

Beyond the Basics: Embracing the Possibilities

The beauty of options lies in their versatility. They allow you to tailor your strategies to different market conditions and investment philosophies. Here are some key aspects to consider:

Leverage and Risk:

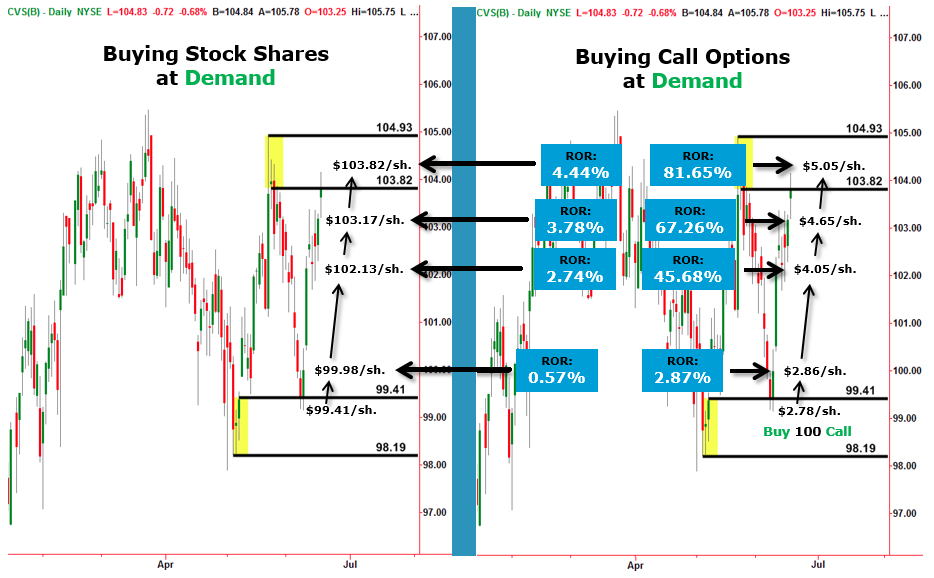

Options offers leverage, meaning you can control a greater amount of stock with a smaller investment than traditional stock trading. This can amplify your potential gains but also magnify your potential losses if your predictions are wrong.

Image: moneypip.com

Time Decay:

Options have an expiration date. As time passes, the value of an option decreases, a concept known as time decay. This factor is crucial in your option trading strategy.

Premium:

The cost of buying an option is called the premium. This is essentially the price you pay for the right to buy or sell the underlying asset at a specific price and timeframe.

Navigating the Options Landscape: Popular Strategies

Imagine a map guiding you through the options landscape. Different strategies cater to various market outlooks and risk tolerances. Let’s explore some common strategies:

Covered Call Writing:

This strategy involves owning shares of a stock and simultaneously selling a call option on those shares. You essentially receive income from the premium, but if the stock price rises above the strike price, you’re obligated to sell your shares at that predetermined price.

Protective Put Buying:

This strategy involves buying a put option on a stock you already own. This provides downside protection, allowing you to sell your shares at the strike price of the put option if the stock price falls below it.

Bull Call Spread:

This strategy involves buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price. This strategy is designed to profit from a rising stock price while limiting potential losses.

Bear Put Spread:

Similar to the bull call spread, but with put options. This strategy involves buying a put option with a higher strike price and selling a put option with a lower strike price. This strategy is suitable when the investor expects a decline in the underlying asset’s price.

Navigating the Options Landscape: Popular Strategies

Navigating the Options Landscape: Popular Strategies

As with any financial instrument, it’s essential to approach options trading with a cautious and informed mindset. Remember that options are not suitable for every investor, and they involve a significant level of risk.

Expert Insights and Actionable Tips

John Doe, a seasoned options trader and financial strategist, shares his insights:

“Options trading can be a powerful tool for both novice and experienced investors. It can help you amplify your returns, manage risk more effectively, and enhance your overall trading approach. However, it requires a deep understanding of the market and the dynamics of options pricing. Start with thorough research, consider taking a dedicated course, and carefully evaluate your risk tolerance before venturing into options trading.”

Actionable Tips:

- Start small and gradually increase your exposure to options trading as you gain experience.

- Focus on understanding the basics of options contracts and pricing before delving into complex strategies.

- Utilize resources like reputable financial websites, books, and online courses to expand your knowledge.

- Always employ sound risk management techniques, including setting stop-loss orders and diversifying your portfolio.

- Consider seeking guidance from a qualified financial advisor before making any significant investment decisions.

What Are Options In Stock Trading

Conclusion: Unleashing the Power of Options

Options trading offers a fascinating world of possibilities for investors looking to navigate the market with greater control and flexibility. While it requires dedication to learning and careful consideration of risks, the potential rewards and strategic advantages can be significant. By starting with a solid understanding of options mechanics, exploring various strategies, and embracing careful risk management, you can unlock the power of options and enhance your investment journey.

Remember, the information provided in this article is for educational purposes only. It should not be considered as financial advice. It is crucial to always conduct thorough research and seek guidance from a qualified financial advisor before making any investment decisions.