Image: www.plafon.id

Introduction

In the labyrinthine realm of financial markets, where risk and reward dance in a delicate balance, option trading has emerged as a powerful tool for both seasoned investors and aspiring traders. However, navigating this complex terrain requires an intricate understanding of the underlying mechanisms and meticulously crafted strategies. Enter the enigma of option trading algorithms, automated systems designed to enhance decision-making, increase efficiency, and maximize profitability.

Delving into the Heart of Option Trading Algorithms

Option trading algorithms leverage sophisticated mathematical models and computational techniques to analyze market data, identify trading opportunities, and execute trades autonomously or semi-autonomously. By sifting through vast quantities of information in real-time, these algorithms can detect market inefficiencies, exploit price discrepancies, and identify potential market trends that may be beyond human perception.

The allure of option trading algorithms lies in their:

-

Speed and Efficiency: Algorithms can process and execute trades in lightning-fast times, seizing fleeting opportunities that might otherwise be missed.

-

Objectivity: Free from human emotions and biases, algorithms provide a dispassionate perspective, reducing the likelihood of impulsive or erratic trading decisions.

-

Flexibility: Algorithms can be customized to suit individual trading strategies, enabling investors to adapt to changing market conditions with ease.

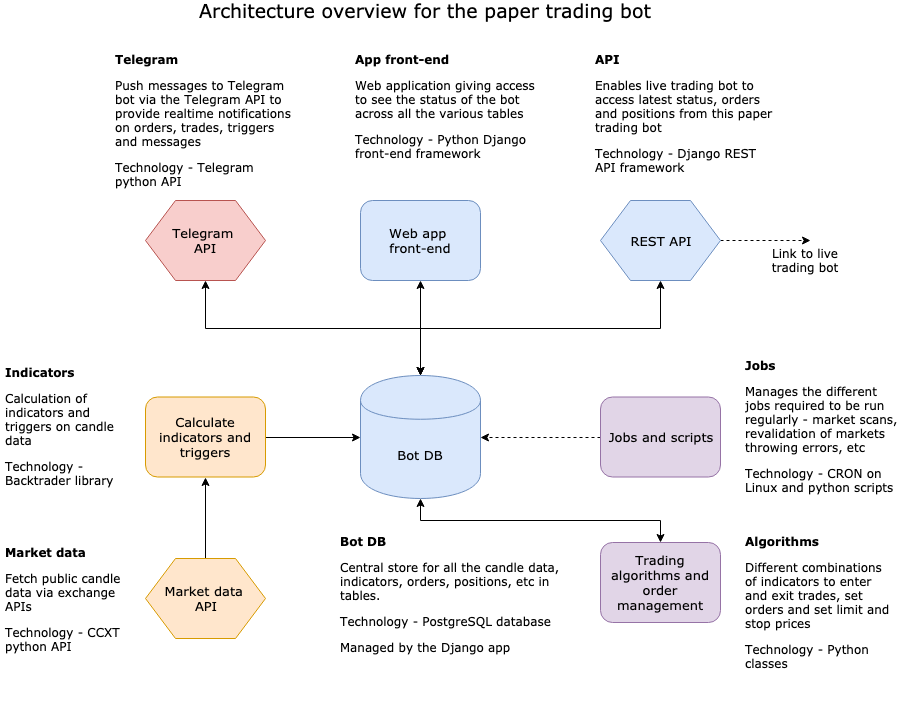

Unraveling the Anatomy of an Option Trading Algorithm

At the heart of any option trading algorithm lies a set of rules and parameters that govern its behavior. These rules determine how the algorithm analyzes market data, identifies trading opportunities, and executes trades. Let’s dissect the anatomy of a typical algorithm:

-

Data Gathering: The algorithm collects data from multiple sources, including market feeds, historical archives, and sentiment indicators.

-

Market Analysis: Advanced mathematical models and statistical techniques are employed to analyze market data, identify patterns, and forecast price movements.

-

Trade Identification: Based on the analysis, the algorithm pinpoints potential trading opportunities, taking into account risk tolerance, profit targets, and trading strategy.

-

Trade Execution: The algorithm executes trades in the designated venue, following predefined parameters for price, quantity, and timing.

-

Performance Evaluation: Continuous monitoring and evaluation ensure that the algorithm remains aligned with its objectives and yields optimal results.

Harnessing the Power of Option Trading Algorithms

Embracing option trading algorithms can amplify your trading prowess, but it’s imperative to approach them with a discerning eye. Here are some key factors to consider:

-

Reliability: Choose algorithms from reputable sources with a proven track record of delivering consistent results.

-

Transparency: Opt for algorithms that disclose their underlying rules and parameters, fostering trust and confidence.

-

Customization: Seek algorithms that can be tailored to your specific trading strategy and risk tolerance, enabling personalized performance.

Conclusion

Option trading algorithms have revolutionized the landscape of financial markets, providing investors with unprecedented opportunities for calculated decision-making. By understanding their intricacies and discerning their merits, you can harness their power to navigate the complexities of option trading, maximizing your potential for success while mitigating risks. Remember, the key to unlocking the full potential of option trading algorithms lies in finding the optimal fit for your trading style and objectives. Embark on an informed journey into the realm of algorithmic trading, transforming your trading prowess and achieving financial empowerment.

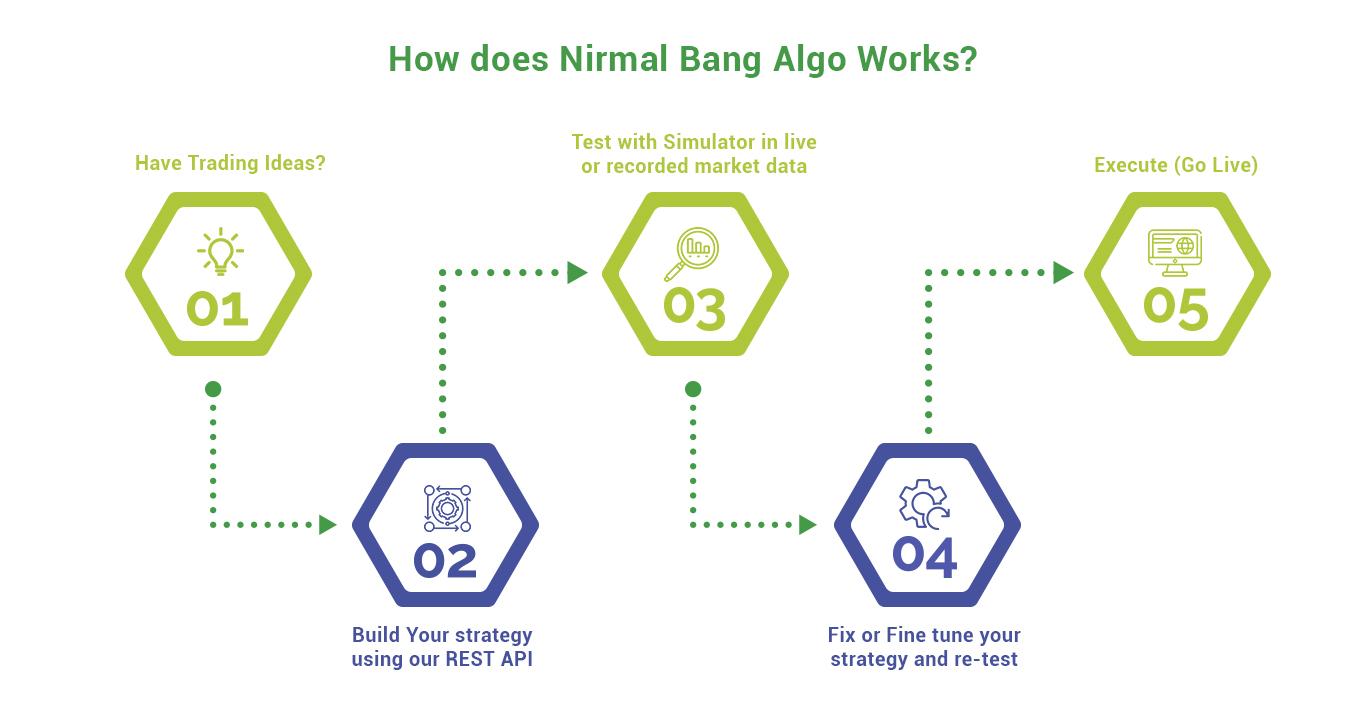

Image: www.nirmalbang.com

Option Trading Algo