Introduction

Image: www.fool.com

The world of finance is a labyrinth of investment opportunities, each promising its own path to financial success. Among these, day trading and options trading stand out as two distinct yet equally alluring options. But navigating their intricacies can be daunting, leaving many investors unsure which avenue is right for them. This article aims to demystify the differences between these two trading strategies, empowering you to make informed decisions that align with your financial aspirations.

Day Trading: A Balancing Act of Precision and Timing

Day trading is a fast-paced, adrenaline-pumping endeavor that challenges traders to buy and sell stocks within a single trading day. It’s a game of calculated risks, where traders leverage market fluctuations to turn quick profits. To succeed, day traders rely on lightning-fast reflexes, a deep understanding of market dynamics, and a keen eye for patterns. They scrutinize charts, monitor news events, and chase volatility, hoping to capitalize on price movements that can materialize in seconds.

Options Trading: A Calculated Bet on the Future

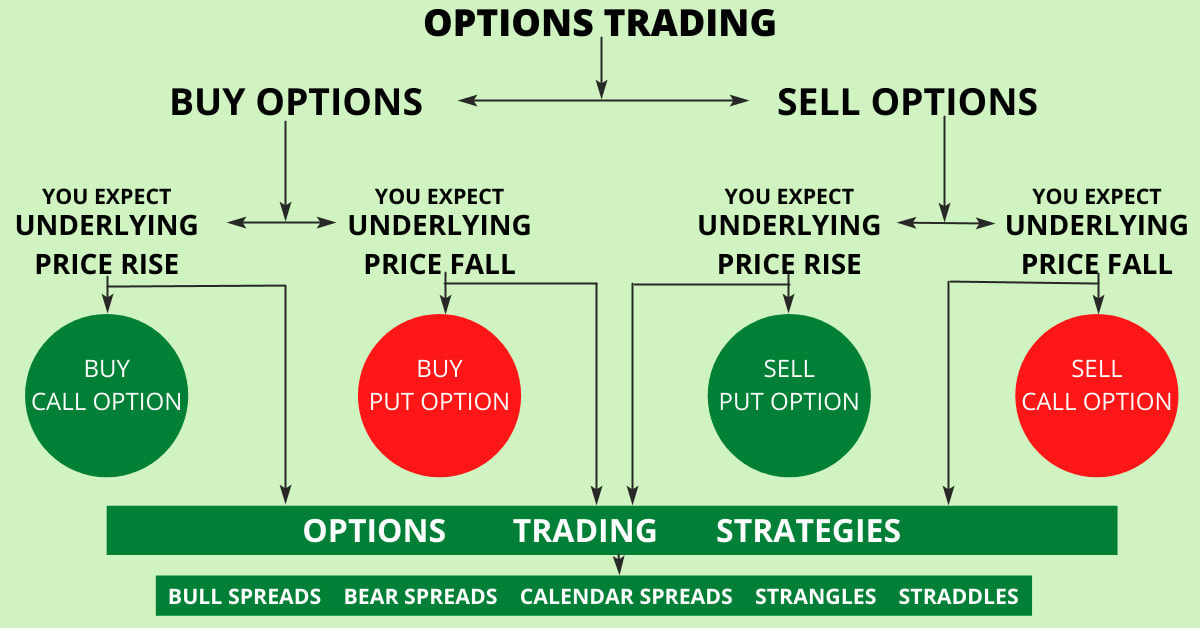

Options trading involves a different approach, one where traders are not directly buying or selling stocks but rather gaining the right to do so at a specified price in the future. Options contracts provide traders with the options to buy (call option) or sell (put option) a stock at a predetermined price (strike price) within a certain time frame (expiry date). Unlike day traders, options traders are not obligated to buy or sell the underlying stock; they have the freedom to let the option expire worthless or to exercise it at their discretion.

Key Differences: Risk, Return, and Time Horizon

The differences between day trading and options trading extend beyond their fundamental mechanisms. These two strategies vary significantly in terms of risk, return potential, and time horizon:

- Risk: Day trading inherently carries a higher level of risk compared to options trading. – Return Potential: Day traders aim for short-term gains through small, frequent trades, while options traders can play multiple sides of the market and pursue both long-term and short-term opportunities. – Time Horizon: Day trades are completed within the same trading day, while options can have varying expiry dates, allowing options traders to strategize based on different time frames.

Which Strategy Is Right for You?

The choice between day trading and options trading is a personal one, determined by your risk tolerance, financial goals, and time constraints. If you are energized by high-speed trading and are comfortable with the inherent risks, day trading might be your forte. On the other hand, if you prefer a more calculated approach, enjoy market analysis, and value flexibility in your trading strategy, options trading may be a better fit.

Conclusion

The financial markets offer a vast array of investment options, and day trading and options trading are two viable paths to financial success for those who are willing to invest their time, money, and intellect. Understanding the fundamental differences between these two strategies is essential for making informed decisions that align with your individual needs. With the right knowledge and preparation, you can unlock the secrets of the financial market and embark on a journey of informed investing.

Image: stewdiostix.blogspot.com

Difference Between Day Trading And Options Trading