Introduction: Unlocking the Lucrative World of Currency Options

Have you ever dreamed of profiting from currency fluctuations without owning the underlying asset? If so, currency option trading may be the answer you’ve been looking for. Options provide a unique way to gain exposure to exchange rates while limiting your potential losses. In this comprehensive guide, we’ll delve into the world of currency option trading strategies, providing you with the knowledge and tools you need to navigate this dynamic market.

Image: optionstradingiq.com

Option traders capitalize on market movements without the high capital investment required for direct currency trading. Options offer flexibility, allowing traders to tailor their strategies to specific risk appetites and profit goals. However, with great potential rewards come inherent risks, so it’s crucial to approach option trading with a measured and well-informed strategy.

Currency Option Basics: Empowering you with Knowledge

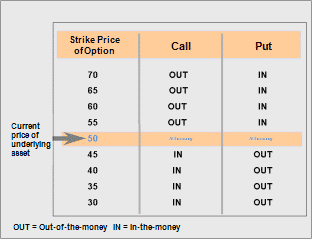

Currency options are contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific amount of a currency at a predetermined price (strike price) within a specified period (expiration date). Unlike forwards and futures contracts, options offer the added flexibility of not exercising the right to buy or sell, allowing traders to manage risk more effectively.

Call options provide the right to buy a currency at the strike price, while put options grant the right to sell. The value of an option contract fluctuates based on factors such as the underlying currency’s price, time to expiration, implied volatility, and interest rates. By understanding these factors, traders can gauge the potential value and risk of an option strategy.

Trading Strategies for Currency Options: Navigating the Market

The currency option market offers a diverse range of trading strategies that cater to different risk appetites and profit targets. Here are some of the most popular and effective strategies:

- Bullish Strategies: Designed to profit from an expected rise in the underlying currency’s value. These strategies include buying call options or selling put options.

- Bearish Strategies: Aim to capitalize on an anticipated decline in the currency’s value. Traders may employ strategies like buying put options or selling call options.

- Neutral Strategies: Seek to profit from fluctuations in implied volatility without a strong bias on the direction of the underlying currency’s value. These strategies involve combinations of buying and selling options with different strike prices and expiration dates.

- Pairs Trading: Involves trading two correlated currency pairs simultaneously, attempting to profit from the convergence or divergence of their exchange rates.

Expert Advice: Mastering Currency Option Trading

Mastering currency option trading requires a combination of knowledge, experience, and a disciplined trading approach. Here are some invaluable tips from seasoned experts:

- Understand Your Risk Tolerance: Clearly define your risk appetite and stick to it. Options can amplify gains, but they can also magnify losses.

- Choose the Right Strategy for Your Needs: Carefully evaluate the different trading strategies and select the one that aligns with your goals and risk profile.

- Manage Your Portfolio: Spread your risk across multiple options and strike prices to reduce exposure to any single asset or strategy.

- Monitor the Market: Stay abreast of global economic news and currency market trends to inform your trading decisions.

Image: lakshyaprofit.blogspot.com

Frequently Asked Questions: Addressing Your Concerns

To provide a comprehensive overview of currency option trading, here are some frequently asked questions and concise answers:

- Q: What is the difference between a call and put option?

A: Call options grant the right to buy, while put options provide the right to sell. - Q: How is the value of an option determined?

A: Option value is influenced by factors such as underlying currency price, time to expiration, implied volatility, and interest rates. - Q: What is implied volatility?

A: Implied volatility is a measure of the market’s expectation of future price fluctuations in the underlying currency. - Q: How do I manage risk in currency option trading?

A: Risk management techniques include defining a risk appetite, choosing appropriate strategies, diversifying your portfolio, and setting stop-loss orders.

Currency Option Trading Strategies

Conclusion: Embracing the Transformative Power of Currency Option Trading

Currency option trading offers a strategic approach to capitalizing on market movements with limited capital outlay. By equipping yourself with a comprehensive understanding of the topic, including trading strategies, expert advice, and a deep appreciation of risk management, you can unlock the potential of this dynamic market. Remember, knowledge is the cornerstone of successful trading. Knowledge empowers you to navigate the complexities of currency options and make informed decisions that align with your financial goals.

Whether you’re a seasoned trader or just starting your journey into currency option trading, there’s always something new to learn and discover. Stay curious, engage with the market, and seek continuous improvement to maximize your trading success. The world of currency option trading awaits those who dare to explore its unparalleled opportunities.