In the thrilling realm of finance, options trading presents a captivating avenue to explore. Among the diverse strategies, credit spread option trading holds a prominent place. Embark on this article as we delve into the nuances of this strategy, unraveling its secrets and empowering you to harness its potential.

Image: www.projectoption.com

Credit Spread Option Trading: A Primer

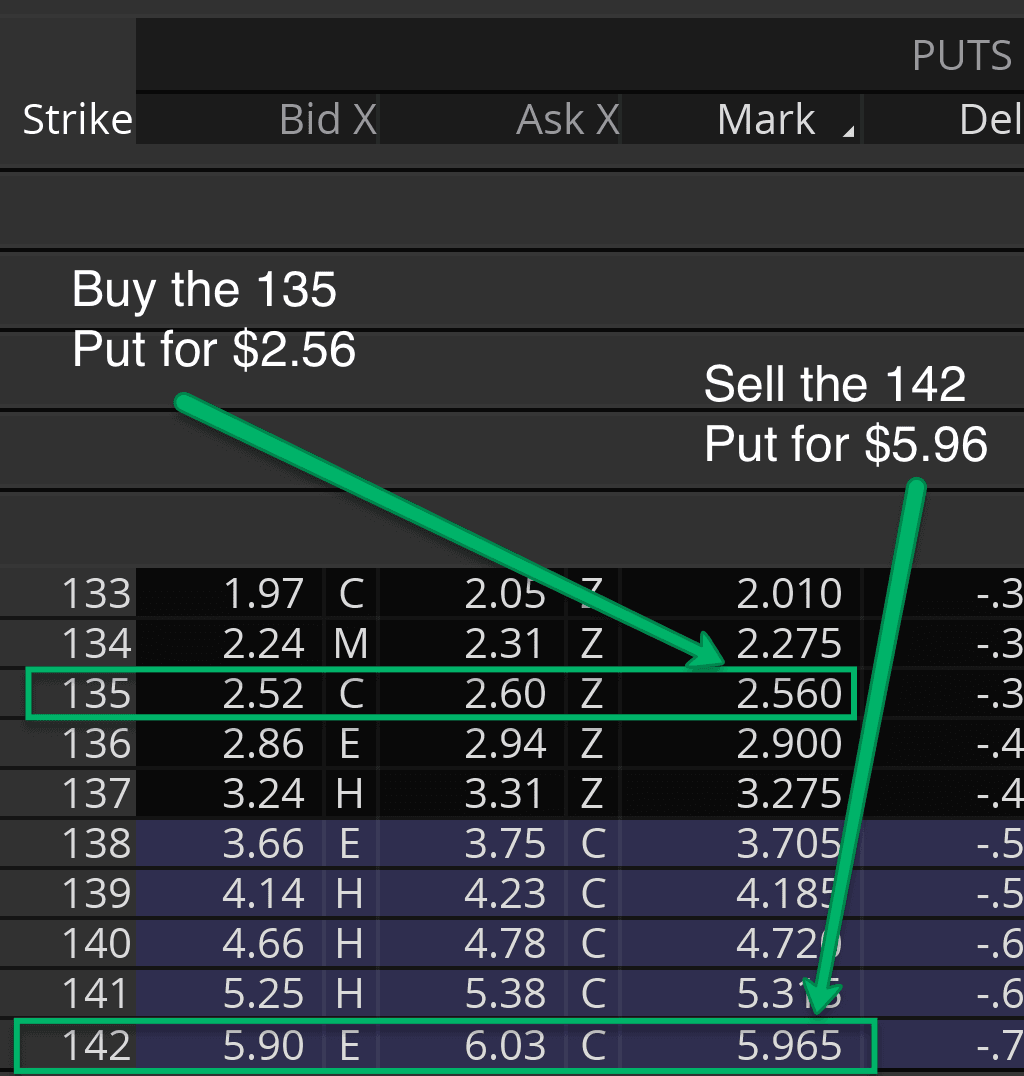

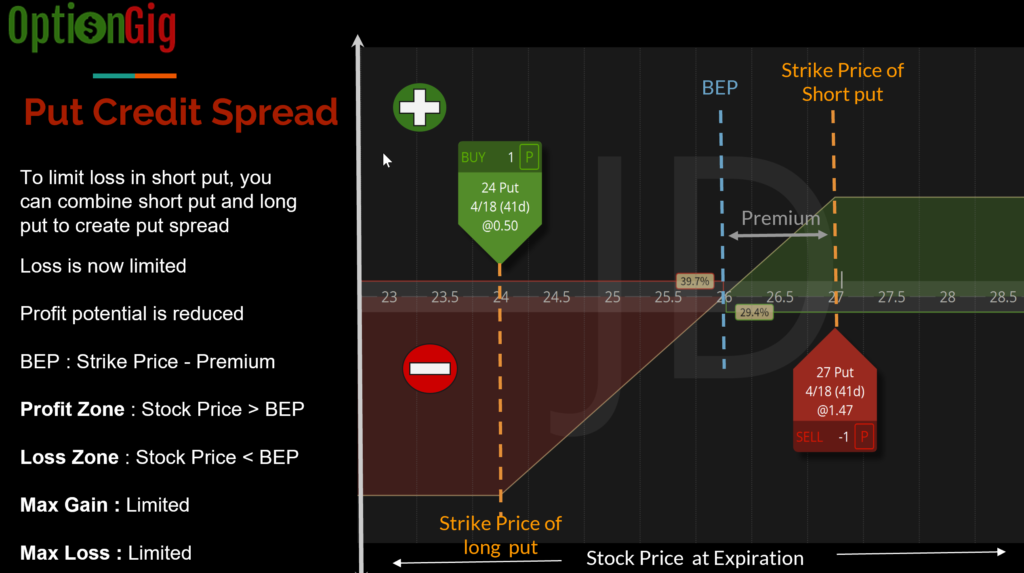

A credit spread option trading strategy involves selling a higher-priced option (with the same strike price and expiration date) while simultaneously buying a lower-priced option. This strategy is executed with the intent of generating a net premium, which represents the difference between the sale price of the higher-priced option and the purchase price of the lower-priced option.

Navigating the Mechanics

At the heart of a credit spread option trading strategy lies a foundational concept: selling options entails receiving a premium, whereas buying options requires you to pay a premium. In this strategy, the premium you receive by selling the higher-priced option should outweigh the premium you pay to buy the lower-priced option, thereby generating a net premium profit.

To illustrate, suppose you sell a call option with a strike price of $X for $0.50 and buy a call option with a strike price of $X+Y for $0.20, where Y is a positive value. If the underlying asset price rises above $X+Y (the higher strike price) but below $X (the lower strike price), you will capture the net premium as profit. However, it is crucial to note that if the underlying asset price moves outside of this favorable range, you may incur losses.

Identifying Suitable Scenarios

Credit spread option trading strategy finds its optimal application in situations where you anticipate the underlying asset’s price to remain stagnant or exhibit minimal fluctuations. This strategy allows you to generate a steady flow of income through the net premium, provided the asset price remains within the desired range.

Successful execution of this strategy requires careful consideration of factors such as the current market trend, potential for price volatility, and the time value of options. A deep understanding of the underlying asset’s historical price movements and current market conditions is paramount for making informed decisions.

Image: optiongig.com

Harnessing Volatility and Time

Credit spread option trading strategy can be particularly lucrative in low-volatility environments. When the underlying asset price is relatively stable, the value of the options tends to decay gradually over time. As a result, the net premium you receive may exceed the potential losses incurred from price fluctuations.

Moreover, this strategy benefits from the concept of time value decay. As options approach their expiration date, their time value diminishes, which can further magnify your net premium profits. By meticulously selecting options with longer durations, you can capitalize on the benefits of time decay.

Expert Advice for Enhanced Execution

- Conduct thorough research: Before implementing a credit spread option trading strategy, it is imperative to conduct thorough research on the underlying asset, market conditions, and historical price movements. This will help you make informed decisions and mitigate potential risks.

- Manage your risk exposure: Credit spread option trading involves a degree of risk. To manage your exposure effectively, consider trading only with a portion of your investment capital. Additionally, employing risk-management techniques such as stop-loss orders can safeguard your profits and limit potential losses.

- Monitor your investments: Once you have executed a credit spread option trading strategy, it is essential to monitor the position closely. Tracking the underlying asset’s price movements and staying abreast of market updates will enable you to make timely adjustments or exit the trade if necessary.

FAQs on Credit Spread Option Trading

- Q: What are the key benefits of a credit spread option trading strategy?

A: Credit spread option trading offers the potential for generating a steady stream of income through net premium while providing a degree of protection against adverse price movements. - Q: In which market conditions is a credit spread option trading strategy most suitable?

A: This strategy is ideal for low-volatility market environments where the underlying asset price is expected to remain stagnant or fluctuate within a specific range. - Q: How can I minimize the risks associated with credit spread option trading?

A: Risk management strategies such as conducting thorough research, trading with a portion of your capital, and employing stop-loss orders can help mitigate potential losses.

Credit Spread Option Trading Strategy

Unveiling the Path of Success

Credit spread option trading strategy presents a unique opportunity to harness the potential of the options market. By understanding the mechanics, identifying suitable scenarios, and incorporating expert advice, you can unlock the doors to financial success. Whether you are a seasoned trader or a novice seeking new avenues for growth, this strategy offers a pathway to enhance your financial acumen and pursue profitable opportunities.

As you embark on this journey, we invite you to explore the wealth of resources available. Engage with online forums, connect with experienced traders, and continually expand your knowledge base. Remember, the key to unlocking the full power of credit spread option trading strategy lies in embracing education, embracing exploration, and committing to excellence.