Introduction

Stock market investments often carry significant risks, leaving investors exposed to unpredictable market fluctuations. Covered option trading emerges as a compelling strategy to navigate these risks while generating consistent income. This comprehensive guide delves into the world of covered option trading, empowering you with the knowledge to harness its potential.

Image: www.angelone.in

Covered option trading involves selling (writing) a call option against 100 shares of a stock that you already own. In essence, you grant another party (option buyer) the right to potentially purchase your shares at a predetermined price (strike price). In exchange for this privilege, the option buyer pays you a premium, which represents your upfront profit.

Understanding the Mechanics

Call Options: Call options give the buyer the right to buy a certain amount of shares at a specific price on or before a set date. Selling a call option (covered call) creates an obligation for you to sell the buyer your shares at the strike price if the option is exercised.

Stock Ownership: Covered option trading requires you to own the underlying stock before selling the call option. This ownership mitigates the potential losses if the stock price declines below the strike price.

Time and Price: The duration (expiration date) and strike price of the option contract are crucial factors. Choosing an expiration date that aligns with your bullish outlook on the stock and a strike price above the current market price allows you to maximize premiums.

Benefits of Covered Option Trading

Risk Management: By owning the underlying stock and selling a call option, you limit your potential downside risk. If the stock price falls below the strike price, your stock ownership acts as a natural hedge.

Premium Income: The premiums collected from selling call options provide immediate profit potential. Even if the stock price does not move significantly, you can collect a portion of the option’s premium.

Flexibility: Covered option trading offers flexibility in terms of investment duration and profit targets. You have the option to close the trade before the expiration date if market conditions change.

Expert Insights

“Covered option trading is an effective way to generate consistent income while managing risks,” says Mark Groebner, a renowned option trader. “By carefully selecting stocks that fit your investment strategy and choosing appropriate expiration dates and strike prices, you can enhance your chances of success.”

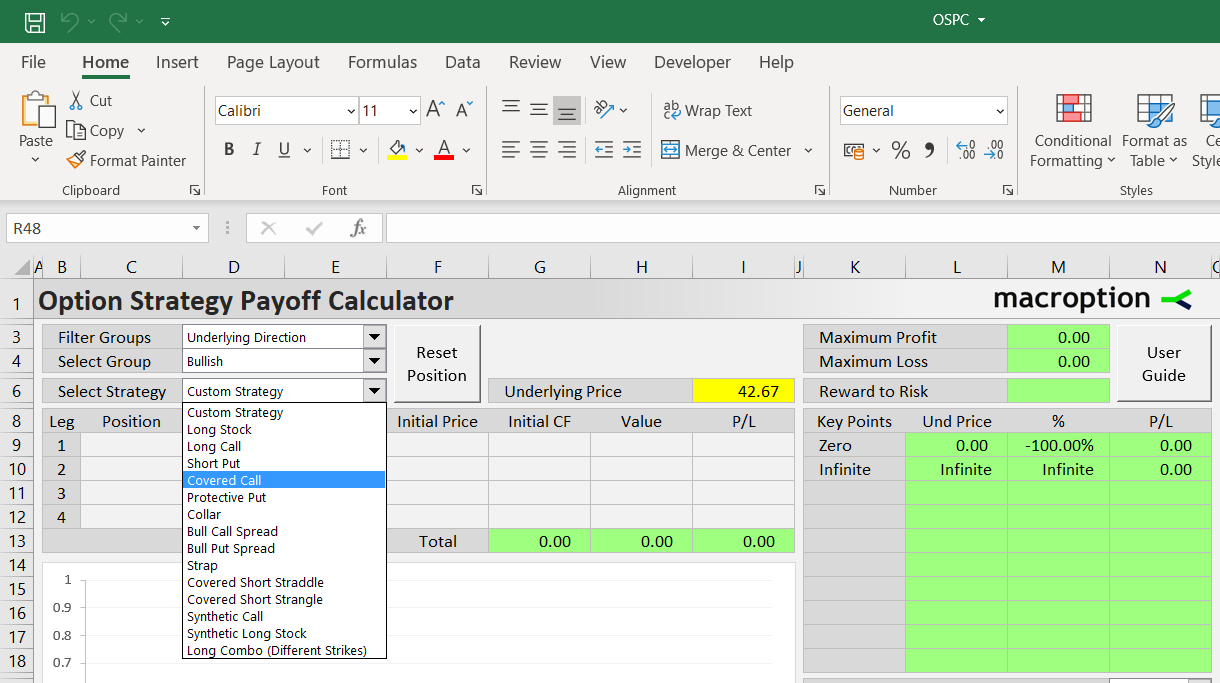

Image: www.macroption.com

Tips for Success

Proper Research: Conduct thorough research on the underlying stock, industry trends, and option pricing models to make informed decisions.

Smart Stock Selection: Choose stocks with a favorable outlook, low volatility, and sufficient liquidity to ensure the availability of options.

Appropriate Strike Price: Set the strike price realistically, taking into account the current market price and your expectations for the stock’s future movement.

Expiration Date Selection: Select an expiration date that aligns with your bullish outlook and provides sufficient time for potential stock price appreciation.

Monitor Regularly: Keep an eye on the performance of your covered call trades after initiation. Adjust your strategy if market conditions change or if your investment objectives evolve.

Covered Option Trading

Conclusion

Covered option trading can be a powerful tool to mitigate risks, generate income, and enhance returns in stock market investments. By understanding the mechanics, advantages, and expert insights outlined in this guide, you can confidently navigate this strategy and leverage its potential to achieve your financial goals.