Imagine a world where you could profit not just from the price movement of an asset but also from your prediction of its potential volatility. While seemingly complex, this possibility is unlocked by the fascinating world of futures options trading, where traders can leverage their insights into market fluctuations to potentially generate significant returns.

Image: www.seeitmarket.com

Futures options, often referred to simply as “options,” work by granting the holder the right, but not the obligation, to buy or sell an underlying futures contract at a predetermined price (strike price) on or before a specified expiration date. This unique structure empowers traders to capitalize on both upward and downward price movements of an underlying futures contract while simultaneously managing risk. This guide delves into the intricacies of futures options trading, shedding light on its history, underlying concepts, applications, and strategic considerations, empowering you with a deeper understanding of this valuable trading tool.

Understanding the Basics of Futures Options

The Fundamentals of Options

Before diving into the specifics of futures options, it’s crucial to grasp the fundamental concepts of options trading. At its core, an option contract gives the buyer the right, but not the obligation, to execute a transaction on the underlying asset at a specific price within a predetermined timeframe. This right comes at a cost, known as the premium, which the buyer pays to the seller.

Options are categorized into two types: call options and put options. A call option grants the holder the right to buy the underlying asset at the strike price, while a put option grants the right to sell the underlying asset at the strike price. The choice between a call or put depends on the trader’s view on the future price movement of the asset.

Futures Contracts – A Foundation for Options

Futures contracts are agreements to buy or sell a specific asset at a predetermined price on a future date. They provide a means for hedging against price fluctuations and allow traders to speculate on the direction of future prices. Futures contracts serve as the underlying assets for futures options, offering an extra layer of flexibility and risk management.

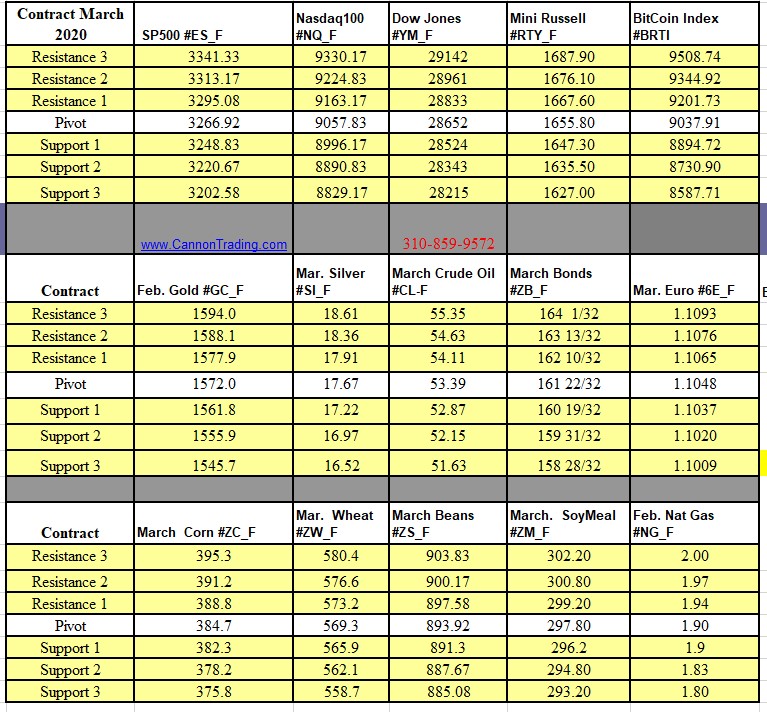

Image: www.cannontrading.com

Understanding the Payoff Structure

The payoff structure of an options contract is inherently complex yet offers significant potential for profit. For a call option, the potential profit is unlimited as the underlying asset can theoretically rise indefinitely, while the maximum loss is limited to the premium paid. Conversely, a put option offers a limited profit potential, determined by the strike price minus the asset’s price at expiry, but unlimited potential loss, though mitigated by the premium paid.

A Deeper Dive into the Language of Options

Navigating the world of options trading requires familiarity with its specific terminology. For instance, in-the-money refers to an option where the strike price is advantageous to the option holder. Out-of-the-money options, conversely, have strike prices that are unfavorable to the holder. At-the-money options have strike prices that are close to the current market price.

Strategic Considerations for Futures Options

Futures options trading is not merely a guessing game; it involves strategizing based on market analysis, risk tolerance, and investment goals. Traders can employ various strategies, such as covered calls, protective puts, and straddles, to achieve their desired outcomes. The complexity of these strategies necessitates careful planning and execution.

The Advantages of Trading Futures Options

Futures options offer a compelling proposition for traders, providing flexibility and risk management tools not ordinarily found in traditional futures trading.

Leveraging Market Volatility

Futures options excel in leveraging market volatility. When market uncertainties escalate, options premiums tend to rise, presenting an opportunity for traders to profit from the heightened volatility itself. This can be particularly advantageous during periods of economic upheaval, geopolitical tensions, or unexpected events that can cause sudden price fluctuations in the underlying futures contracts.

Hedging Against Price Risks

Futures options can serve as a powerful tool for hedging against price risks. For example, a farmer can buy put options on corn futures to protect themselves against a potential decline in corn prices. Similarly, an airline can purchase call options on oil futures to hedge against a rise in fuel prices.

Limited Loss Potential

A crucial advantage of futures options is the limited loss potential associated with their purchase. Unlike traditional futures trading, where losses can be unlimited, options trading provides a predetermined maximum loss, which is equal to the premium paid for the option contract. This aspect significantly reduces the risk associated with market exposure while still allowing the upside potential of market movements.

Types of Options Strategies: Tailoring Your Approach

Futures options trading offers a diverse range of strategies that cater to different risk profiles and objectives. Understanding these strategies is crucial for navigating the options market effectively.

Covered Calls

A covered call strategy involves selling a call option while simultaneously owning the underlying futures contract. This strategy generates income through the premium received from the sold call and mitigates potential losses by taking advantage of the futures position. This approach is suitable for those seeking to capitalize on moderate market appreciation.

Protective Puts

A protective put strategy utilizes a put option to limit potential losses on a held futures position. The put option provides insurance against a decline in the price of the underlying futures contract, safeguarding the trader from significant losses. This strategy is ideal for investors seeking downside protection while maintaining the potential for upside gains.

Straddles

A straddle strategy involves simultaneously purchasing both a call and a put option on the same underlying futures contract with the same strike price and expiration date. This strategy benefits from significant market volatility, as it profits from large price movements in either direction. However, it requires a high risk tolerance and is best suited for traders who anticipate a substantial price fluctuation, regardless of its direction.

Navigating the Risks and Rewards

While futures options trading offers compelling prospects for both hedging and profit-seeking, it’s essential to acknowledge the inherent risks associated with this complex financial instrument.

Time Decay

Options contracts have a finite lifespan, and their value gradually erodes as they approach their expiration date, a phenomenon known as “time decay.” As time passes, the potential for the underlying asset to move significantly in either direction diminishes, impacting the option’s value. Therefore, traders must carefully consider the time decay factor when evaluating options strategies.

Limited Upside Potential

While options offer significant profit potential, it is important to note their limited upside. The maximum profit potential for call options, for example, is determined by the difference between the strike price and the price of the underlying asset at expiration. This can be a limiting factor for traders seeking substantial gains, particularly when the market experiences an extended upward trend.

Volatility Risks

Although futures options can be used to profit from market volatility, they are also vulnerable to it. Unexpected fluctuations in the price of the underlying asset can significantly impact the value of options contracts, potentially leading to substantial losses. Therefore, traders must carefully consider the volatility risks associated with any options strategy.

Navigating the Future of Futures Options Trading

The landscape of futures options trading is constantly evolving, with new technological advancements and evolving regulatory frameworks shaping the industry. Here are some key trends to note:

Rise of Automated Trading

Algorithmic trading and artificial intelligence are increasingly influencing futures options markets. Automated trading systems can execute complex strategies with greater speed and precision than manual trading, enabling traders to capitalize on fleeting opportunities. However, they also raise concerns about market stability and transparency.

Growth of Options Exchanges

The emergence of new options exchanges has broadened access to the futures options market for a wider range of participants. These exchanges offer diverse trading options, enhanced liquidity, and efficient execution mechanisms. However, they also come with their own set of rules and regulations, which traders need to understand thoroughly.

Increased Regulatory Scrutiny

The complexities of futures options trading have drawn increased regulatory scrutiny. Regulators are working to ensure market stability, protect investors, and prevent market manipulation. Traders need to stay informed about these regulatory changes and comply with all applicable rules.

Futures Option Trading

The Final Word: Unlocking the Potential of Futures Options

Futures options trading presents a compelling opportunity for both experienced and novice traders to participate in the dynamic world of derivatives. This guide has explored the fundamental principles of futures options, their advantages and limitations, and the strategic considerations that guide successful trading. By understanding the intricacies of this market, traders can capitalize on the potential of both volatility and price fluctuations in underlying futures contracts, effectively managing risk while navigating the exciting landscape of futures options trading.

As you delve deeper into futures options trading, remember that continuous learning, thorough research, and responsible risk management are paramount. Stay informed about industry developments, leverage available resources, and always prioritize informed decision-making. This approach will empower you to maximize the potential of futures options while navigating the unique challenges and opportunities it presents.