What are Futures and Options?

Futures and options are two derivative financial instruments that allow investors to speculate on the price movements of underlying assets like commodities, stocks, bonds, or currencies. Futures are standardized contracts obligating the holder to buy or sell a specified quantity of the underlying asset at a predetermined price on a set date. Options, on the other hand, give the holder the right, but not the obligation, to buy or sell the underlying asset at a specified price on or before a specified date.

Image: www.pinterest.com

Understanding Futures Trading

Futures contracts are traded on futures exchanges, which set the contract specifications, including the underlying asset, contract size, delivery date, and minimum price fluctuation. When an investor buys a futures contract, they agree to purchase the underlying asset at the specified price on the delivery date. Conversely, if they sell a futures contract, they agree to sell the underlying asset at the specified price on the delivery date. Futures trading allows investors to hedge against price risk, speculate on price movements, or profit from arbitrage opportunities.

Exploring Options Trading

Options contracts trade on options exchanges, and they give the holder the right to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) on or before a specified date (expiration date). Depending on their investment strategy, investors can use options to hedge against risk, speculate on price movements, generate income, or create complex trading strategies. Unlike futures, options holders are not obligated to exercise their right to buy or sell the underlying asset.

Historical Evolution of Futures and Options

The concept of futures trading dates back to ancient Greece, where merchants used forward contracts to secure the delivery of goods at a specific price in the future. Formalized futures trading emerged in the 19th century in the United States, with the establishment of the Chicago Board of Trade. Options trading, on the other hand, has its roots in the early 20th century, with the development of standardized options contracts on stocks.

Image: navi.com

Recent Developments and Trends

The futures and options markets have witnessed significant advancements in recent years. The introduction of electronic trading platforms has enhanced market liquidity and reduced transaction costs. Regulation and oversight have also evolved to ensure market integrity and protect investors. The emergence of new asset classes, such as cryptocurrencies, has also led to the development of futures and options contracts tied to these assets.

Tips and Expert Advice for Successful Trading

- Understand the Underlying Asset: Thoroughly research the characteristics, price history, and market drivers of the underlying asset before trading futures or options.

- Manage Risk: Implement sound risk management strategies, such as setting stop-loss orders, using leverage cautiously, and diversifying trading portfolio.

- Monitor Market Conditions: Stay informed about economic data, news events, and market sentiment to make informed trading decisions.

- Consider Leverage: Leverage can magnify both profits and losses, so only use it when appropriate and with a clear understanding of the risks involved.

- Seek Professional Advice: Consult with a financial advisor or broker for personalized guidance and support, especially if you are new to futures and options trading.

Frequently Asked Questions

- Q: What is the difference between futures and options?

A: Futures contracts obligate holders to buy or sell the underlying asset, while options contracts give holders the right, but not the obligation, to do so.

- Q: Can I make money with futures and options trading?

A: Yes, it is possible to make profits, but futures and options trading involves risks and requires knowledge, skill, and a disciplined approach.

- Q: Is leverage necessary for successful futures and options trading?

A: Leverage can enhance potential profits, but it also amplifies losses. It is not essential for successful trading and should be used with caution.

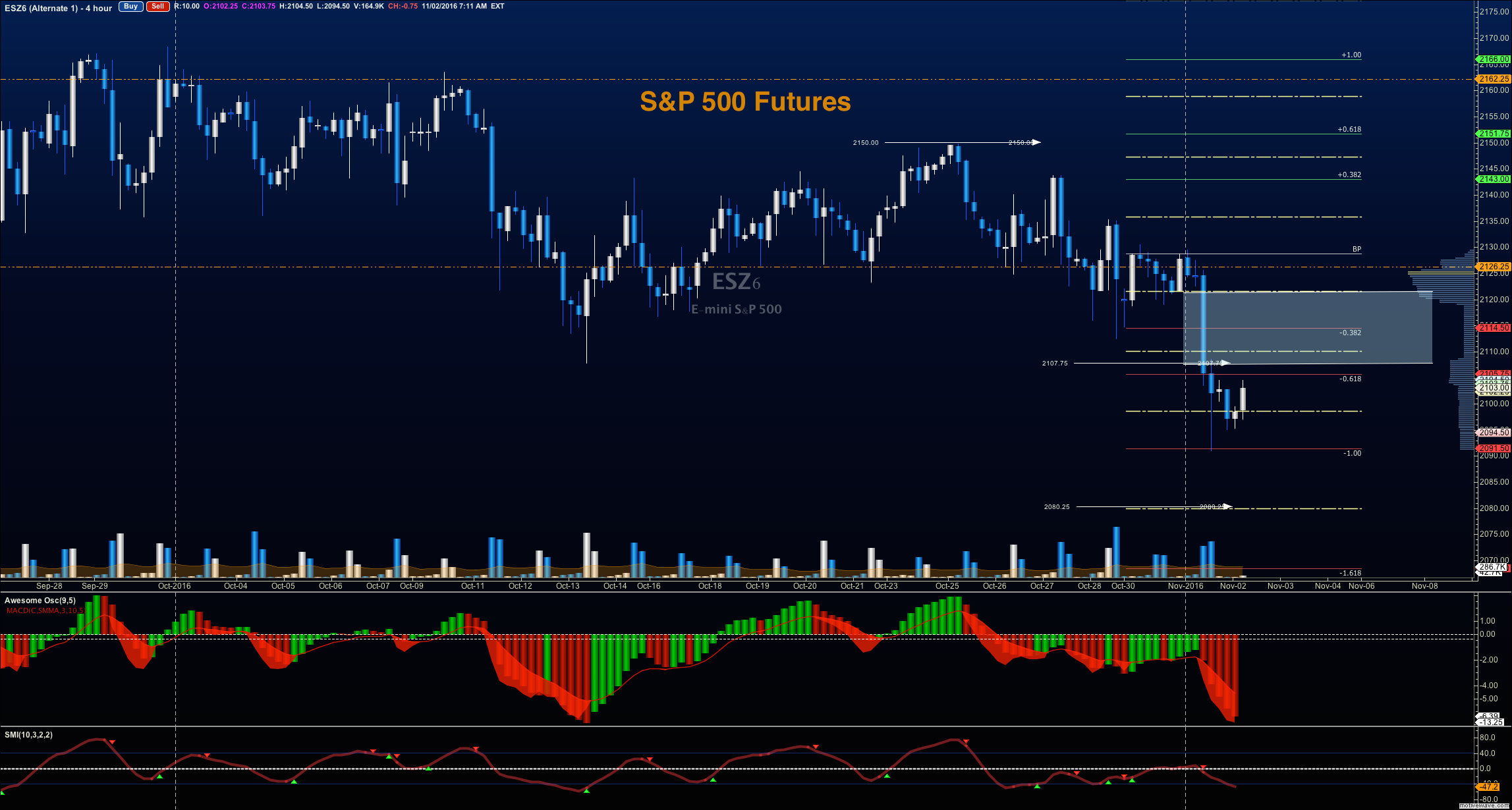

Futures And Options Trading Definition

Image: www.seeitmarket.com

Conclusion

Futures and options trading offer investors versatile tools to access financial markets and potentially profit from price movements. Understanding the complexities of these instruments and applying sound trading strategies is crucial for success. Whether you are a seasoned trader or new to the futures and options arena, continuous learning and adaptation are key to navigating the ever-changing market landscape.

Call to Action:

Are you interested in exploring the world of futures and options trading? Leave a comment below or reach out to me for further insights and resources.