In the dynamic realm of options trading, understanding Greek letters is crucial for success. One of these enigmatic Greeks is gamma, a measure that gauges the sensitivity of an option’s delta to changes in the underlying asset’s price. In this article, we delve into the world of gamma, exploring its nature, significance, and practical applications in options trading.

Image: optionstradingiq.com

Delving into the Nature of Gamma

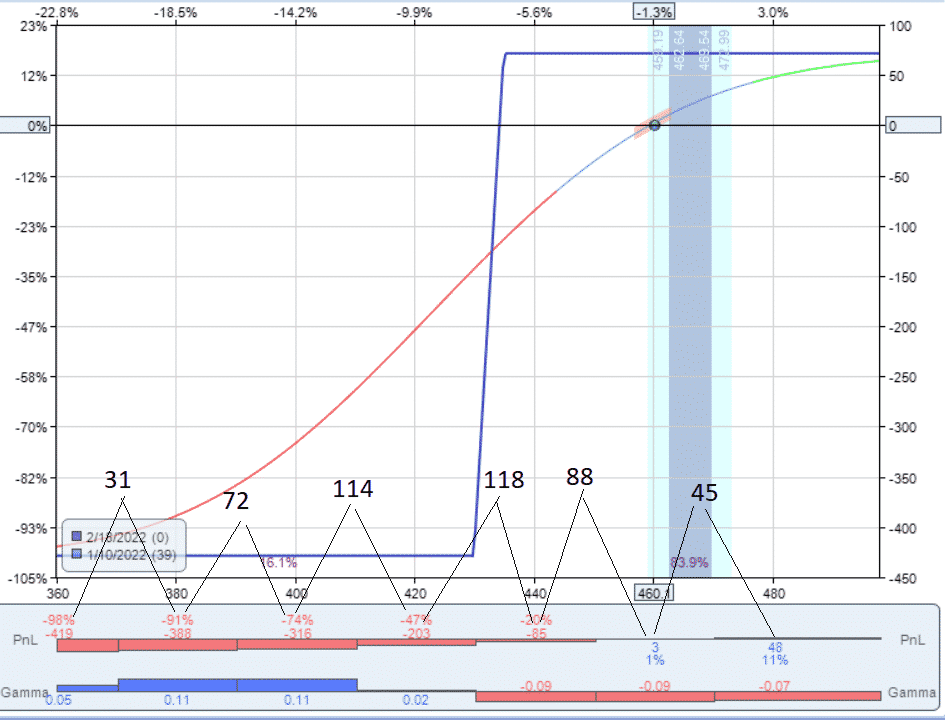

Gamma represents the rate of change in delta with respect to the underlying asset’s price. In simpler terms, it measures how much the delta of an option changes for every $1 movement in the underlying asset. The value of gamma is positive for both calls and puts, indicating that the delta increases as the underlying asset’s price rises and decreases as the price falls.

The Significance of Gamma

Gamma plays a vital role in options trading for various reasons. Firstly, it helps traders determine the potential profit or loss from an option position, as it measures the sensitivity of the delta to changes in the underlying asset’s price. Secondly, gamma is crucial for hedging strategies, where traders use options to offset risks associated with changes in the underlying asset’s price. Thirdly, it allows traders to assess the potential for profit or loss in option strategies involving multiple legs, such as spreads.

Practical Applications of Gamma

Traders can utilize gamma effectively in a myriad of ways. One common application is in the delta-hedging strategy, where traders adjust their option positions to maintain a constant delta exposure. Additionally, gamma provides valuable insights for traders who speculate on the volatility of the underlying asset, helping them identify options with high sensitivity to price changes. Furthermore, gamma plays a role in volatility trading strategies, where traders capitalize on rapid fluctuations in the underlying asset’s price.

Image: www.youtube.com

What Is Gamma In Options Trading

Exploring Further Resources and Conclusion

For a more thorough understanding of gamma and its applications in options trading, consider delving into authoritative resources such as “The Complete Guide to Options Trading” by McMillan and “Options as a Strategic Investment” by Hull. Remember, the effective utilization of gamma requires a comprehensive comprehension of its nature and practical implications. Embrace the power of gamma to navigate the dynamic landscape of options trading with confidence and precision.