Picture this: the ticker tape relentlessly scrolls, charting the relentless dance of stock prices. You, like a seasoned captain navigating choppy waters, seek to harness the market’s ebb and flow. But how do you navigate this tumultuous sea and seize opportunities that align with your convictions? Enter options: a versatile instrument that empowers traders to speculate on directional price movements.

Image: www.youtube.com

Unveiling the Power of Options

Options, quite simply, are contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility grants traders the ability to speculate on future price movements without committing to the direct purchase or sale of the asset.

Understanding the Options Landscape

Options come in two flavors: calls and puts. Call options grant the holder the right to purchase the underlying asset at a set price, while put options provide the right to sell it. Each option has an expiration date, which determines the timeframe within which this right can be exercised.

Directing Your Options Strategy

Directional trading with options involves utilizing these instruments to speculate on the uptrend or downtrend of an underlying asset. Here are key elements to consider:

-

Volatility: Options premiums are heavily influenced by volatility. Higher volatility signifies a wider expected price range, increasing the potential for profit but also amplifying the risk.

-

Time Decay: Option premiums erode over time as the expiration date approaches. This “time decay” factor necessitates timely execution of options strategies.

-

Sentiment: Market sentiment plays a crucial role in shaping options pricing. Understanding the prevailing market outlook can enhance decision-making.

Image: thecoursedl.com

Expert Insights and Practical Tips

From Dr. John Hull, Professor of Derivatives and Risk Management at the Rotman School of Management: “Options offer exceptional flexibility, allowing traders to tailor strategies to their risk tolerance and market views.”

Trading Tip: Consider the R/R Ratio (Reward-to-Risk Ratio). Calculate the potential profit versus potential loss to optimize risk management.

Using Options For Directional Trading

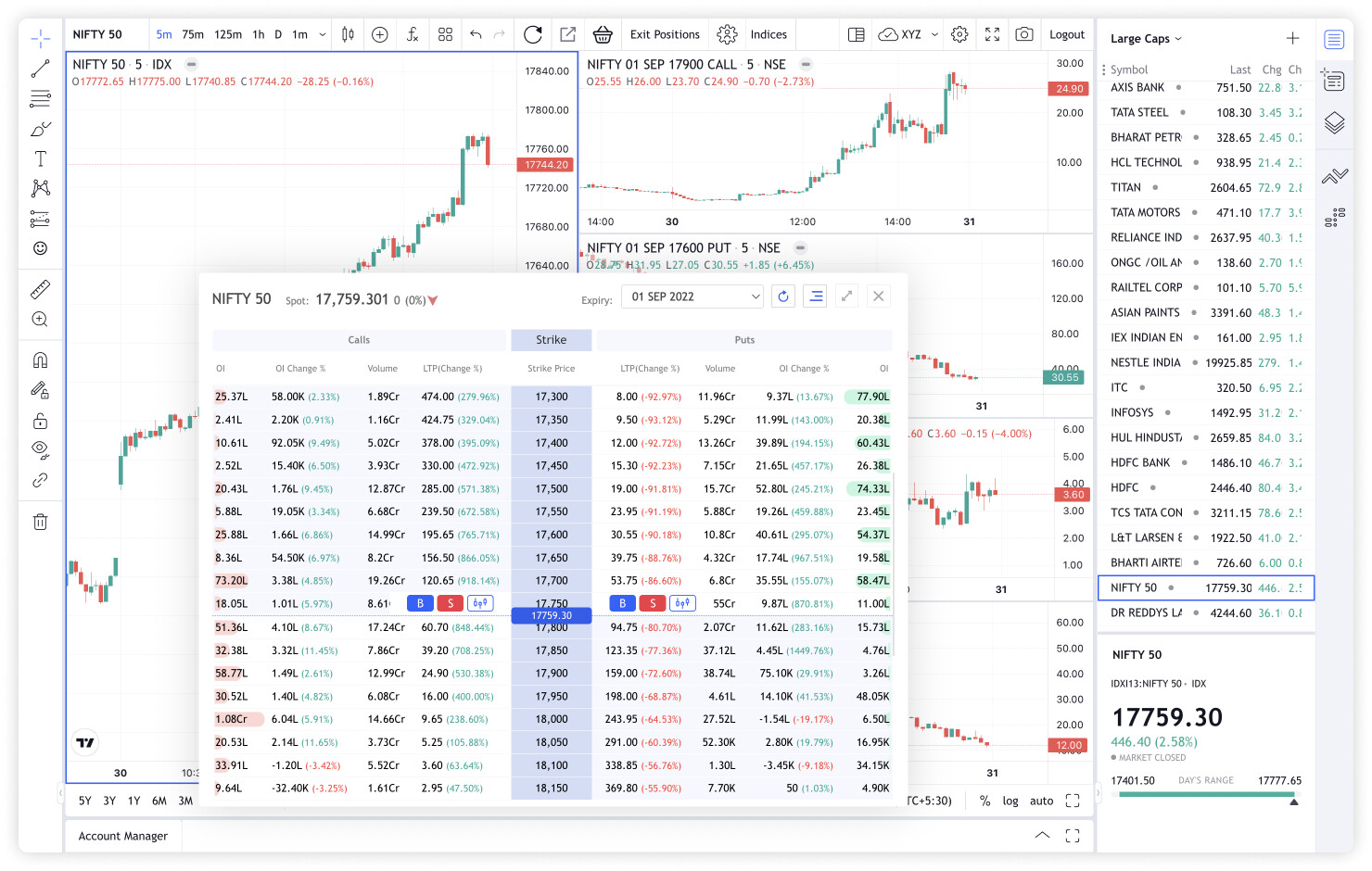

Image: community.dhan.co

Navigating the Conclusion

By embracing options, directional traders gain the power to exploit market movements strategically. Understanding options fundamentals, employing smart trading practices, and harnessing expert insights enable them to navigate the ever-evolving financial landscape with confidence. Remember, options can amplify both returns and risks; thorough research and a disciplined approach are paramount to maximizing profit potential while mitigating exposure.