In the fast-paced world of options trading, understanding the complexities of wash sales is crucial to avoid costly missteps and ensure compliance. A wash sale occurs when substantially identical options are bought and sold within a short time frame. This seemingly simple concept belies a labyrinth of tax implications and potential loopholes that can lead to unintended consequences.

Image: www.marottaonmoney.com

The purpose of this comprehensive guide is to provide a thorough understanding of wash sale options trading, enabling you to identify opportunities, minimize risks, and make informed decisions to enhance your trading acumen. Delving into the intricacies of wash sales, we will examine its implications, explore the nuances of the applicable regulations, and uncover strategies to legally exploit loopholes while mitigating potential pitfalls.

Unmasking Wash Sales: The ABCs and Why They Matter

A wash sale, sanctioned by the Internal Revenue Service (IRS), arises when identical securities are disposed of and reacquired within a 30-day period. This “match day” principle pertains not only to the same options contract but also to other options with the same underlying stock, expiration date, and strike price, albeit differing series. Notably, the wash sale rule applies to both realized losses and gains. However, its primary focus lies in the tax implications.

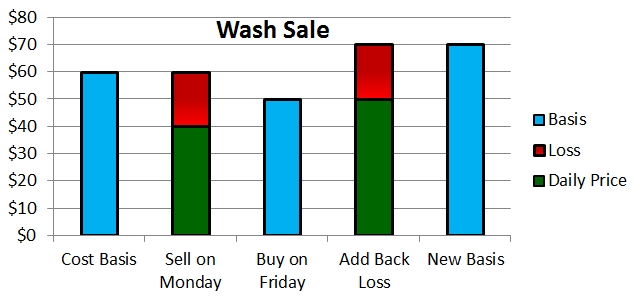

When a wash sale occurs, the holding period is not reset. This has significant implications for realizing losses. Typically, the IRS allows you to deduct realized losses from your capital gains, reducing your taxable income. However, if the transaction qualifies as a wash sale, the loss is disregarded for tax purposes until the replacement shares are sold. This deferral deprives you of immediate tax savings unless you subsequently generate a taxable gain on the replacement shares.

Exploiting Loopholes: Strategies for Safeguarding Gains

Despite the potential pitfalls, wash sales present a window of opportunity for savvy traders to minimize their tax burdens. By carefully navigating loopholes within the wash sale rule, traders can offset capital gains while preserving their tax savings. One such tactic involves initiating short-term trades with no overlapping holding periods. For instance, if you purchase a call option in January and sell it in February, then purchase another with the same terms in March, the transaction will not constitute a wash sale, allowing you to claim the realized loss.

Another legal loophole stems from the IRS’s “substantially identical” requirement. Suppose you sell an out-of-the-money (OTM) option and promptly buy an in-the-money (ITM) option with an identical underlying stock and expiration date. Due to the slight difference in strike prices, the IRS may not consider these two options as “substantially identical.” However, traders should note that this interpretation has been subject to legal challenges and is not universally accepted.

Mitigating Risks: Prudence in the Face of Ambiguity

While the potential benefits of wash sale options trading may be tempting, it is crucial to approach this strategy with prudence. Remember, the IRS is constantly monitoring and adjusting its interpretations of the wash sale rule. To mitigate risks, consider the following precautions:

1. Accurate Record Keeping: Maintain meticulous trading records, including the details of all transactions involving substantially identical options to protect against potential IRS audits.

2. Informed Trading: Thoroughly familiarize yourself with wash sale regulations. If you’re uncertain whether certain trades could trigger wash sale consequences, consult with a tax professional.

3. Avoiding Patterns: Steer clear of establishing regular patterns of selling and reacquiring identical options. Such practices increase the likelihood of your activities being flagged by the IRS.

Image: www.tradertaxcpa.com

Wash Sale Options Trading

Image: www.warriortrading.com

Conclusion: A Prudent Approach to Wash Sale Options Trading

Comprehending wash sale options trading unlocks the potential for savvy traders to exploit legal loopholes and reduce their tax burdens. By grasping the intricacies of the laws and carefully navigating loopholes, you can craft a strategy that maximizes gains while sidestepping IRS scrutiny. However, it is essential to exercise caution, maintain transparency, and seek professional advice if needed. With prudence as your guiding principle, wash sale options trading can enhance your financial acumen and drive trading success.